Fourth-quarter 2015 GDP growth for the U.S. was just revised up to 1.4 percent annualized from an initial reading of 0.7 percent. That brings growth for the year as a whole to 2.4 percent -- not stellar, but respectable, and in line with the moderate growth that we expect in 2016 as well.

The revision illustrates the danger of relying too much on initial data, especially data tracking huge and abstract economic aggregates such as GDP. Even when the first official data release comes, we take it with a grain of salt, having seen how often it is enthusiastically embraced by pessimists who are eager for the data to show what they want the data to show -- and earlier this year, that was an economy at risk for recession.

Now, though, in the world of economic tracking, we have seen a new metric grabbing more headlines: a “live” number produced by the Federal Reserve Bank of Atlanta called “GDPNow.” GDPNow has existed since 2011, and we have occasionally consulted it, but it was not until perhaps the past year that we noticed GDPNow grabbing headlines and the attention of brokers and financial commentators. The Atlanta Fed tracks a wide variety of metrics and feeds them into a model, which then produces a live current GDP estimate, frequently updated.

It makes for engaging news-bites. Earlier this week, financial journalists and brokers were fixating on the latest GDPNow read: “0.6 percent growth for the first quarter of 2016! Everything is going from bad to worse!”

The trouble is that GDPNow is basically useless as an indicator of what a quarter’s growth will really turn out to have been. Of course the staff at the Atlanta Fed are completely transparent about this fact; it’s not they who make much ado about the metrics, but others who are happy to have a news item to talk about.

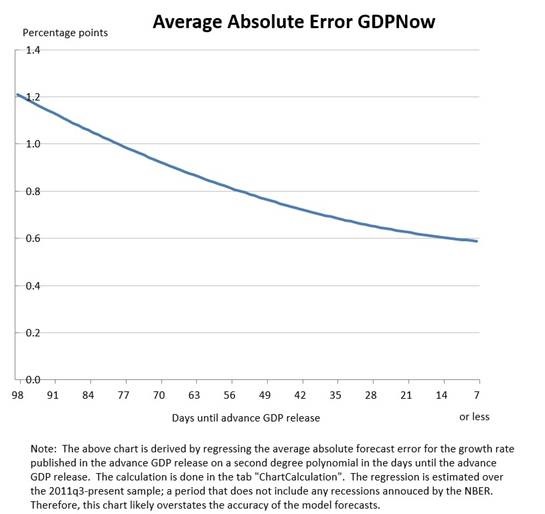

Below is a graph that shows the average absolute error of the GDPNow forecast:

Source: Federal Reserve Bank of Atlanta

In short, three months out from the first official GDP release, the average error of GDPNow according to its historical track record is a little under 1.2 percentage points. This is a large enough margin of error that GDPNow is simply meaningless as a piece of economic data. When the official release is a week or less away, GDPNow’s average error falls to 0.6 percentage points -- still large enough that no serious researcher could make much use of it. The GDPNow measure also varies wildly during the period leading up to the official release. And as the Atlanta Fed notes, the fact that it is only drawing on five years of estimates, a period which does not include any recessions, means that this analysis likely overstates the model’s accuracy!

Thirty days out as we are from the first official Q1 2016 GDP release, the current GDPNow reading of 0.6 percent, judging from history, could mean almost anything. Given GDPNow’s average accuracy, the initial formal release will likely fall somewhere between -0.1 percent and 1.3 percent.

And that’s the initial release; a few months later, the official release will be revised. Most recently, as we noted above, Q4 2015 growth was revised up from 0.7 percent to 1.4 percent. So without any stretch of the imagination, this week’s dismal 0.6 percent GDPNow reading could turn out to have been for a quarter where growth was actually above 2 percent.

Generating More Fear Than Insight

Who uses GDPNow? In our experience, outside of economics professionals who might consult the model for their own purposes, it’s mostly a news generator for brokers and financial journalists who want something dramatic, eye-catching, and “current” to say -- whether or not what’s being said is rooted in sober and reliable data. Still, it is worth watching GDPNow for that odd reason that makes it worthwhile to watch a host of other unreliable indicators as well -- because we know others are watching them, taking them seriously, and reacting to them, so they are contributing to market psychology.

Perhaps in the end we should not be ungrateful to market participants who take GDPNow seriously. The more who do, the more opportunity it affords to those who observe the unreliable data and choose to base their strategy on something more sound.

Investment implications: A host of talking heads, from financial journalists to brokers, are looking for dramatic news bites that will create fear and agitation in their readers and clients. The Atlanta Fed’s “GDPNow” tracker provides a ready stream of such news. As a reliable indicator of actual GDP growth, it is useless, as its own track record attests. It is a case study of how investors should make use of such questionable data sources -- disregarding them as indicators of underlying economic reality, but paying attention to them insofar as they reveal something about the psychology of other market participants. But most importantly, investors should not let such sensationalistic news flows cloud their judgment, or make them anxious and agitated. Our investment advice: the U.S. economy is growing modestly; keep calm and ignore flawed data.