The Euro currency is still looking like it might be in for a rough ride. After beating back the demons of southern Europe and the debt crisis, coupled with massive unemployment, it seems that a new threat is starting to appear on the scene.

Overnight saw the release of CPI data which pointed to the threat of deflation, further compounding the situation in the Euro-zone, which has recently pulled itself out of recession. The threat of deflation is a serious one, as has been seen in Japan over their last ‘forgotten’ decade. And stagnating inflation or deflation can seriously harm the progress of economies, especially ones that are so heavily indebted as they are in the south of Europe.

The data overnight was bad though, as it showed a 1.1% decrease over last month when it came to consumer pricing. Such a heavy decrease has not been seen since recordings began for the Euro. The most concerning part was that the yearly forecast is a lowly 0.8%, which is well below the current mandate of the ECB, which is to maintain inflation at around 2%.

This in turn has led to calls from the former ECB president, commenting that we may indeed see some sort of stimulus enacted in order to help boost inflation in the Euro-zone. Markets have since reacted accordingly in preparation for the March ECB meeting, which is expected to be show action on the part of the ECB and their efforts to help boost inflation in the Euro-Zone. The attention will now likely shift to comments from Mario Draghi in the coming months, and what he has to say on the dangers of deflation and the Euro.

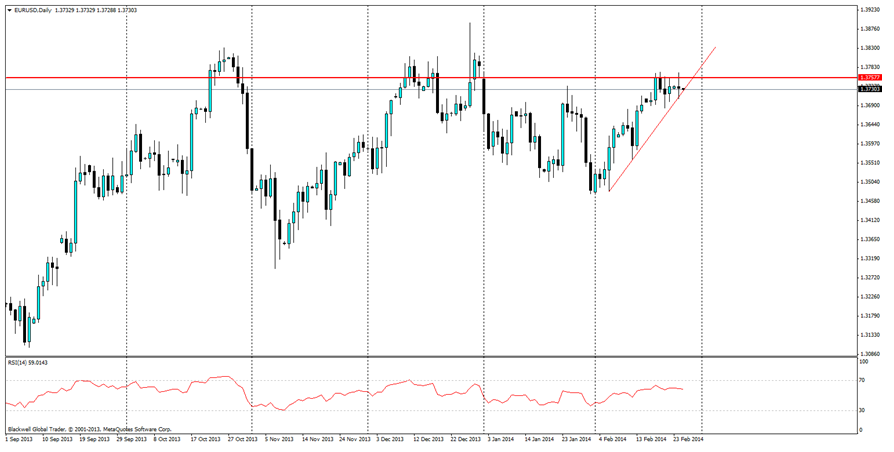

Market movements on the charts have been strong, with the Euro closing down after last night's announcement. The most likely scenario now looks to be that the resistance level at 1.3757 will likely hold in the coming weeks, until we can see further action from the ECB; or more talk at least about action. However, markets will now shift to watch the steep trend line in play, and if the candles can close down through it over the next two days, signalling a breakthrough, and that the bears may have taken control in the volatile market.

EUR/USD Daily" title="EUR/USD Daily" height="242" width="474">

EUR/USD Daily" title="EUR/USD Daily" height="242" width="474">

Personally, after this announcement, I think it's clear that we may see further falls up until the ECB conference, but I also believe it’s a little too early to be shorting the Euro heavily. My reasoning behind this is that yes, the ECB has a problem on its hands, but we all know now that when the ECB commits to a problem, it actually commits and backs up tough talking with action. Back when Greece nearly imploded and Spain was on the cusp of collapse, we saw markets hammer the Euro. Now, the threat is there, but the ECB has shown itself to be more than capable and it will certainly act in order to increase inflation. So for now I believe there will be an opportunity to short the market, but we should certainly not expect the massive falls we have seen before.