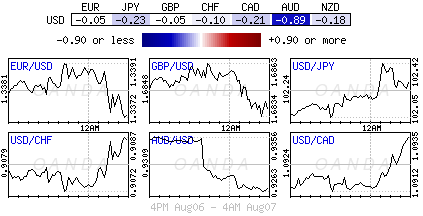

Summer holidays; what summer holidays? It near impossible to take your eyes off the trading screens, in doing so, one may misinterpret the next event or geopolitical risk that has been thrown at capital markets in the most unique of times. Market dynamics are shifting, albeit regional, political and economical. For dealers and investors, that provides asset price movement and a host of trading opportunities amongst the varying asset classes - bonds, equities, FX and commodities.

Tension between Russia and the West, combined with the knock-on effect it's having on European growth continues to drive financial markets. Euro-bourses are extending their declines while safe-haven government bonds continue to linger near their record price highs. The benchmark Germany 10-Year bond yield has fallen to a record low this morning (+1.08%), while its 2-year compatriot trades negatively -- investors pay the German government to harbor cash. The current and future economic fallout of Western sanctions, along with the potential Russian retaliatory actions has capital markets continuing to trade risk off. For investors, they will be looking for hints from ECB's Draghi on the likely response if Euro economic growth continues to disappoint.

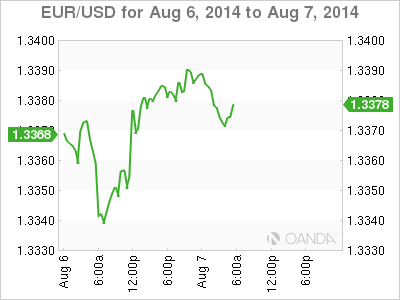

The bigger picture for forex has been dominated by Central Banks low rate monetary policy. To date, it has managed to handcuff investors to a low volatile and volume-trading environment, a scenario that brings with it limiting trading opportunities. This morning the market gets to see two of the biggies - the Bank of England and the ECB.

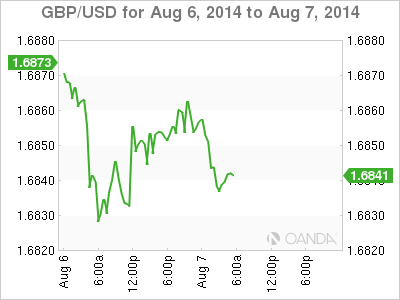

BoE to stand 'pat'

There is no pressure for Governor Carney to do anything. The market expects another unchanged monetary policy announcement from the BoE when its two-day Monetary Policy Committee meeting concludes. For the U.K., its key economic data release this week was July's service sector purchasing managers’ index on Tuesday. It managed to print its highest level for the year - 59.1 versus 57.7. Amongst those details and what could be supporting a Bank of England tightening cycle later this year is the indication of "capacity pressures" as the backlog of work rose at a "marked and accelerated pace. The only possible change may come later this morning is in tone as stronger fundamental reports increase the scope for dissent amongst MPC members.

ECB has its work cut out

With Euro inflation anchored close to zero, renowned weak growth, softer German manufacturing data and rising geopolitical concerns certainly makes for a depressing backdrop for Draghi's highly anticipated press conference. The ECB is expected to remain on hold with rates and other policy action later today. President Mario Draghi is likely to emphasize the long-term refinancing operation that will start in September, and the completion of the bank's asset-quality review in October. In respect to inflation, he is likely to downplay the Eurozone's recent drop to +0.4% in July from +0.5% in June, while highlighting lower energy prices and higher core inflation. He is expected to reiterate the ECB's commitment to implement further easing measures should the Europe's situation worsen in H2. The only possible surprise from the post-meeting press conference will be if Draghi does not make further "dovish" noises. His problem is that the ECB is almost out of ammo and vague promises will be punished.

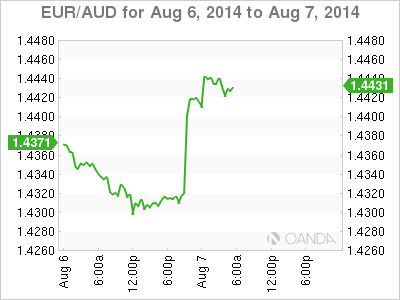

RBA does not need to 'jawbone'

To date, Governor Stevens at the RBA has been overtly critical of the high value of his AUD. Earlier this week, the RBA kept rates anchored at a 12-month low (+2.5%) despite mining investments cooling and a stubbornly strong Aussie. A percentage of the market was probably expecting more direct jawboning from Stevens, but he admitted that the outlook for the Aussie economy looks challenging and refrained from talking the Aussie down from lofty heights. That work has been left up to the overnight's disappointing Aussie employment report.

The AUD currently trades straddling its two-month low (AUD$0.9270). The jobless rate rose to a 12-year high of +6.4% - the first time above that of the US since 2007 - while employment change were a slight net negative against an expected rise of +13k. Digging deeper, the full-time component gained +14.5k, however total hours worked fell for the first time in 3-months with a -14.8m decline. The participation rate rose to +64.8%, a 4-month high. However, one mixed or contradictory data point does not initiate a trend, nevertheless, despite insufficient evidence for an RBA cut, it does up the ante for no rate hikes for the remainder of this year.

The net gainer in a low rate environment is the 'carry trade,' and in particular, antipodean currencies funded by cheaper EUR's (EUR/AUD and EUR/NZD). This has certainly been a coveted trade this year and is experiencing some 'overcrowding.' If US yields do happen to climb, those positions will get squeezed, especially if Draghi utters, "whatever it takes."