President Trump’s State of the Union focused on defending American jobs, demand fair trade, rebuild revitalize nations infrastructure, reduce price of healthcare and drugs, create an immigration system that is safe and secure and to pursue a foreign policy that puts America’s interest first.

Industrials

He outlined his 2019 goal for American astronauts will go back to space with American rockets. Boeing (NYSE:BA), Lockheed Martin (NYSE:LMT) and Raytheon (NYSE:RTN) and Northrop Grumman (NYSE:NOC) may benefit if we see increased commitments on defense spending and aerospace travel.

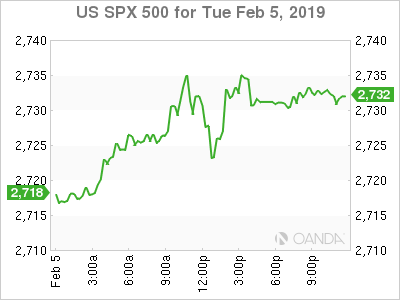

Trump delivered his standard remarks regarding the economy and strong labor market noting that it is growing twice as fast today as when he took office. He also highlighted that the he has cut more regulations in a short time than any other administration.

Regarding energy, he emphasized US dominance and stated that the first time in 65 years the US is net exporter of energy. Touting that America is now the number one producer of oil and natural gas in the world.

Discussing the deadline for border security funding, Trump did not budge and maintained his firm stance and announced he ordered another 3,760 troops to the southern border, abandoning the conciliatory tone he started off with. The President spent a good amount of time reviewing several examples that support his argument for the building his wall, he however did not spell out how he will reach a deal with Democrats or if he will end up using his emergency powers.

China Trade War

Trump smartly switched from talking about border security to the success women are having in the thriving economy. He then quickly transitioned to talking about China and the trade war.

Not much new on the trade front, just reiterating he will reduce the chronic trade deficit, end unfair trade practices, stealing American technology and subsidizing industries making it harder for American companies. He also celebrated billions he has already won from China.

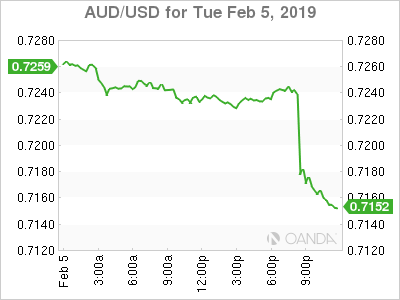

Note the Australian dollar fell after RBA Governor shifted to a neutral policy outlook, he noted that “Interest rate probabilities are now broadly equal.” Little reaction stemmed from Trump’s brief comments on the trade war update with China.

Healthcare

The next major priority for Trump is to lower the cost of healthcare. This will weigh on healthcare stocks today. Trump campaigned on ending the complex system of drug rebates, which is a key cause for high prices.

North Korea

President Trump also confirmed he will meet with Kim Jong-un at the end of the month in Vietnam.

On Venezuela, Trump provided nothing new, highlighting his support for opposition leader Juan Guaido and condemning socialistic views in Venezuela.

Takeaway

President Trump has ten months to get anything done before markets go into election mode and his State of the Union address did not provide much optimism that we will see bipartisanship action help deliver on most if not all of his initiatives.

While we could see potential constructive talks on the healthcare agenda, it is still an uphill battle as he may see some objections from Republicans. Current expectations are for this to fall short of passing so we could see limited downward pressure on healthcare stocks.

Defense and Aerospace stocks could see a boost on Trump’s agenda to protect American security and space travel.

Infrastructure stocks did see some gains last year on the prospects of an infrastructure deal, but he may have already missed the window in passing a deal. Trump only dedicated one paragraph and limited time on talking about infrastructure. The Democrats may support the idea but will likely choose to not give Trump the win.

Automakers may see some relief as the President chose not too announce tariffs on automobile imports.