One of my favorite mottos is: "It is better to be lucky than good." No matter you good you are at what you are doing - the unforeseen and unpredictable can occur spoiling your efforts.

Follow up:

An incoming USA President is given an economy. Certain elements in an economy (such as employment) lag around six months. Some economic improvement can be almost immediate - like those triggered by lowering taxes (especially when withholding or other payments are reduced). Economic improvement triggered by regulatory relief can be swift or can lag by years - depending on the relief.

As an example, President-elect Obama was given an economy in recession in January 2009 - and that recession ended in June 2009. How much credit should President Obama be given for ending the recession?

My position is little to nothing.

The previous Congress and President Bush had already put in place TARP (including rescue of General Motors Company (NYSE:GM) and Fiat Chrysler Automobiles NV Pref (NYSE:FCAM)), In his first 100 days in office - the only real anti-recession legislation was the stimulus - American Recovery and Reinvestment Act of 2009 - which added only $114 billion to the economy in ALL of 2009 - and likely next to nothing by June 2009.

In reality, President Bush and the previous Congress got the USA into the recession - and set the stage to get the USA out of the recession.

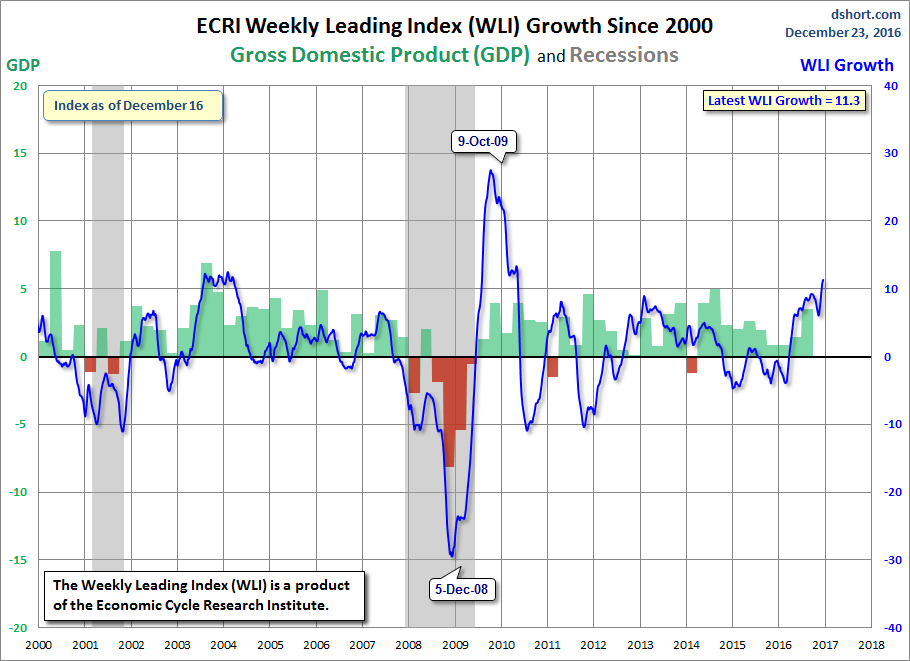

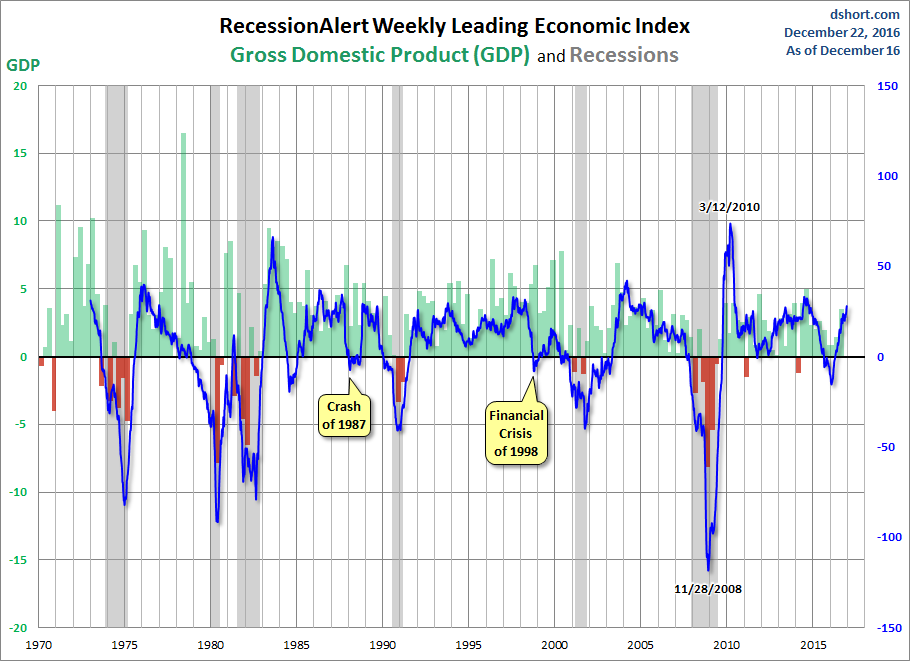

President-elect Trump is more than likely to be handed an economy where the underlying dynamics are already accelerating. Two leading indicators ECRI Weekly Leading Index and RecessionAlert's Weekly leading Index are both accelerating and their values are at levels consistent with strong economic growth.

Ok, I would not take any forecasting indicator as gospel - but since 2000 there has been reasonable correlation between GDP and these leading indicators.

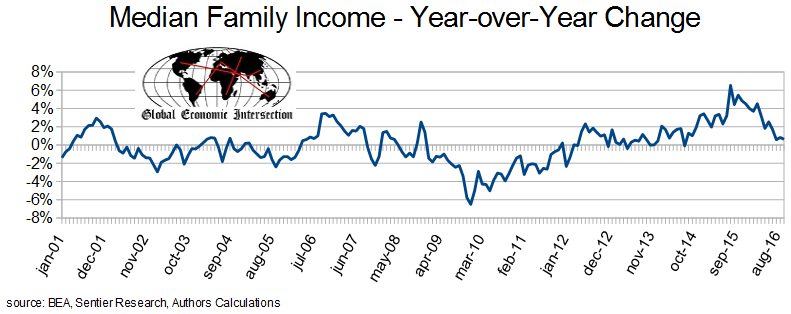

But by now everyone should know that GDP is not a good indicator of what the median person is experiencing. After accelerating growth in median family income for five years, beginning in September 2015 median family income growth rate has been decelerating.

In the case of median family income, we can partially blame Congress and President Obama for delivering a slow growing family income situation - of course much of the economy is outside the control of government.

It seems President-elect Trump will be lucky on the economy as measured by GDP - but will the average Joe and Jane see an improvement in their financial situation?

When you tinker with the economy, there will be unwelcome side affects. In addition, there will be unanticipated international and domestic events. I wish President-elect Trump luck.

Other Economic News this Week:

The Econintersect Economic Index for January 2017 again insignificantly improved with the economic outlook for weak growth. The index remains marginally above the lowest value since the end of the Great Recession. But there are indications of better dynamics in our index in the future. Six month employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: none

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: