It was not logical to blame President Obama for the Great Recession. On the other hand, President Obama does have varying levels complicity in the extremely weak recovery - and the current zombie economy.

Follow up:

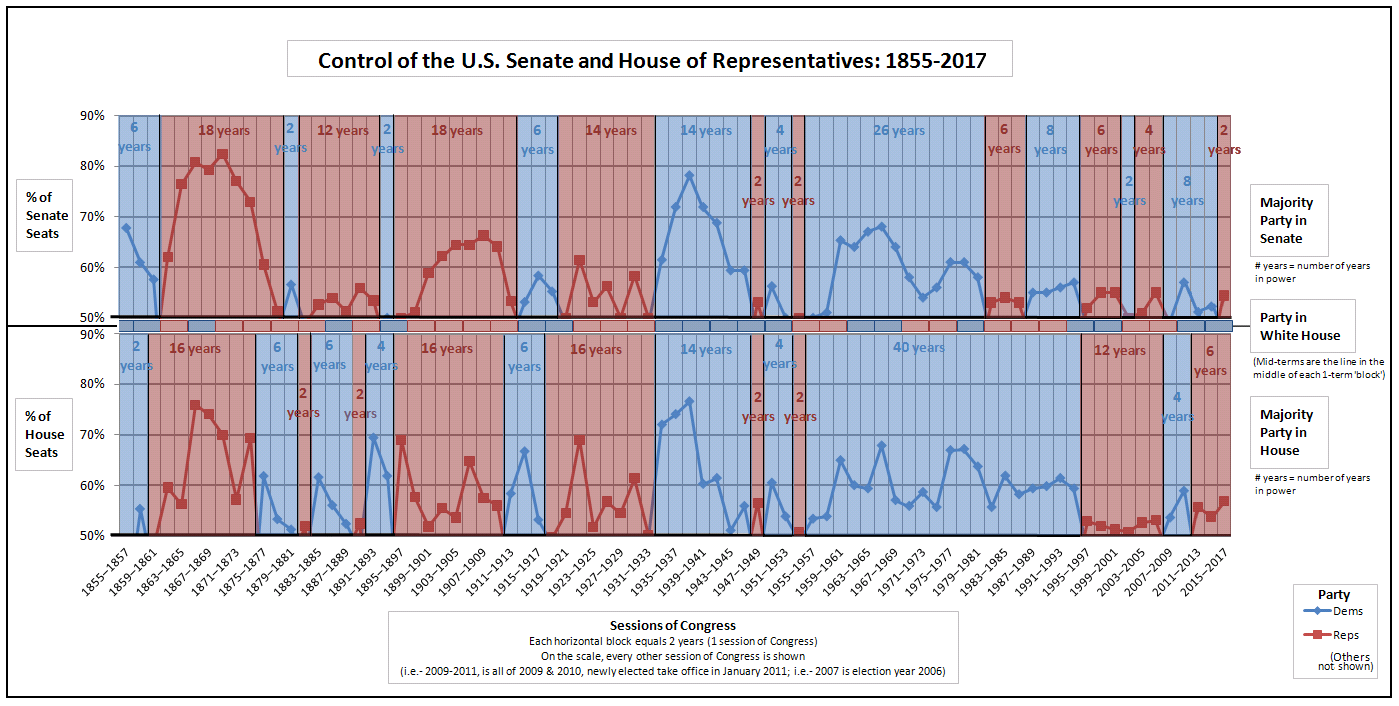

In all events, the purse strings are held by Congress, and that body holds most of the authority to create laws. And in the last eight years, Congress was willing to create laws without reading what is in the law (see Obamacare). I would argue the USA in the last eight years went through the most ineffective Congressional period since its founding.

Just like the first years of the Obama administration, Trump will enjoy a Congress controlled by his party. This is a "get out of jail free" card (where his agenda can be implemented) - and will disappear when the population sees that the "change" delivered is not what the the population expected. From Wikipedia:

Say the newly elected President Trump implemented his promised changes - how soon would this change become noticeable to the group of people who voted for him?

Not for years. The economy takes time to react. The stock markets may rise, and the upper end of the economy could immediately benefit if investors see opportunity based on Trump's actual agenda. But the lower end of the economy depends on jobs which take time to percolate. Jobs is a lagging indicator, and Econintersect has been fairly accurate at predicting jobs growth based on economic growth that occurred 6 months previous.

All things being equal - a noticeable jump in jobs growth would barely be evident for the next congressional election cycle in two years.

In many ways, Trump's economic plans need luck as a recession is also possible.

It depends on which data sets I select - but I could make a case for the economy recessing, expanding or remaining in the current zombie state. My current belief is the zombie economy will continue for the next six months.

Overlay on top of a zombie economy, the realization that it takes time for change to become noticeable to Joe Sixpack. Based on all the exit polls I saw, Trump won because he promised jobs. This is a tall order which is hard to achieve in a short period of time - if it is possible in an age of increasing automation.

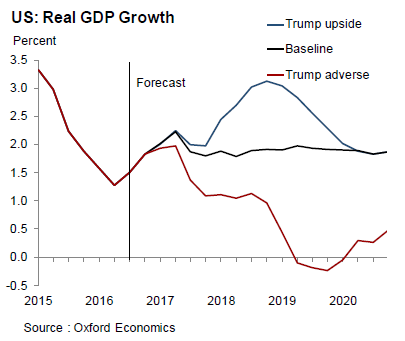

I think it is interesting that some economists see rather quick economic change under a President Trump. From Oxford Economics:

Markets appear to have adopted a glass half-full view of the recent election outcome. We caution, however, that while lower taxes, more infrastructure spending and reduced regulation may be positives for businesses, increased policy uncertainty, more trade protectionism, congressional fiscal orthodoxy and stricter immigration are important constraints.

One of the main characteristics of a Trump presidency will be the unusually elevated degree of policy and political uncertainty. While we know the name of the president and the composition of Congress, we have little information about the likely administration, which policies will be passed and when these may be implemented.

- Our baseline view assumes a compromise between President Trump and Congress contains a modestly expansionary fiscal package and targeted trade protectionist measures. While private sector activity benefits from lower taxes and increased infrastructure investment in the near term, trade protectionism and elevated policy uncertainty constrain growth to just 2% in 2017 and 1.8% in 2018. The Fed still raises rates in December, but only proceeds with one rate hike in 2017.

- Our upside scenario assumes tax reductions are twice as large as in the baseline (worth $1tn over the next decade) and much more inclusive for low-income families, and the government implements a larger infrastructure investment program. Trump negotiates a relaxation of fiscal orthodoxy in exchange for a less protectionist trade stance than he campaigned on. Growth accelerates to 3% in 2018, and the economy is 2% larger than in the baseline by the end of 2020, creating 2 million more jobs.

- Our downside scenario assumes that, after a brief honeymoon period, President Trump reverts to his highly protectionist and isolationist stance. His refusal to negotiate with Congress means Republicans refuse any increase in the deficit. Global aversion to the US combines with heightened domestic policy uncertainty. Real GDP growth slows and the economy enters a recession by late 2018. By the end of his term, the economy is 5% smaller than in the baseline and counts 4 million fewer jobs.

I strongly disagree that President Trump can noticeably change the economy positively in his first year. Most probably the baked-in economic dynamics will govern for the first year. However, certain stupid moves can slow the economy especially ones which trigger inflation in a zombie economic state (stagflation). From a post by the St. Louis Fed President James Bullard which echoes my sentiment:

In terms of the macroeconomic outlook, “the near-term St. Louis Fed forecast remains unchanged as of today,” Bullard said, adding, “our outlook for monetary policy is also unchanged.” He noted that U.S. unemployment is effectively at the FOMC’s estimate of its long-run level, while U.S. inflation is low but close to the FOMC’s 2 percent target and rising. In addition, safe real rates of return are low and are not expected to change.

“A single policy rate increase, possibly in December, may be sufficient to move monetary policy to a neutral setting,” Bullard said.

Potential Medium-Term Impact of an All-Republican Lineup

In addition to a Republican White House, the outcome of the Nov. 8 election also means that the Republican Party will maintain control of the House of Representatives and the Senate. “This means that the legislative and executive branches will be in one party’s control, opening a greater possibility of legislative action,” Bullard said.

He discussed two areas of possible legislative action that may affect medium-term U.S. growth prospects. “One is a fiscal package emphasizing government spending on infrastructure, possibly accompanied by tax reform. Another is changes to the regulatory environment,” he said.

Bullard noted that the FOMC takes fiscal policy into account when calibrating its monetary policy decisions, and that a key problem in the U.S. in recent years has been low productivity growth that has hampered real GDP growth. “A targeted fiscal infrastructure package aimed at increasing U.S. productivity growth may help to increase U.S. real GDP growth in the medium term,” Bullard explained. “Similarly, tax reform that allows repatriation of corporate profits earned abroad may enhance investment in the U.S.”

Turning to regulation, Bullard noted that the U.S. re-regulated the economy in the aftermath of the 2007-2009 recession, but that it appears the pendulum may now swing back the other way ...

.... Bullard concluded with a look at some potential policy changes that could have a macroeconomic impact over the longer term. In particular, he briefly discussed trade and immigration. While trade negotiations tend to be slow-moving relative to monetary policy, “trade arrangements can have important macroeconomic effects, but over the longer term,” he said. “Similarly, immigration reform would likely have important effects on the macroeconomy, but perhaps over a longer horizon.”

I also strongly disagree that increased spending on the military or infrastructure will create many jobs [note my background is management of mega-infrastructure projects]. Infrastructure projects take time to ramp up (design, budgeting, mobilizing) - and in all events longer than one year. Further, construction creates only relatively few jobs per dollar spent - and the employment is only temporary until the project is complete. Military spending and infrastructure will improve GDP but not the plight of Joe Sixpack.

Americans are in for a very interesting 2017 - let us hope economically better than 2016.

Other Economic News this Week:

The Econintersect Economic Index for November 2016 declined with the economic outlook remaining weak. The index remains near the lowest value since the end of the Great Recession. Some sectors of the economy continue to give recession warning flags. Six-month employment growth forecast indicates minor slowing in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: American Apparel (f/k/a Endeavor Acquisition and Viva Radio), CHC Group, Sable Natural Resources (f/k/a NYTEX Energy Holdings), Xtera Communications

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: