As the carnage in the energy sector continues, the butcher’s bill of dividend casualties is starting to grow.

Back in March, I explained how Seadrill Limited (NYSE:SDRL) had the weakest financial position of all the offshore drillers. And in early November, I asserted that dividend cuts were coming.

Now, we’re already starting to see the “deluge” I warned about.

Seadrill and Trilogy Energy (TO:TET) have suspended their dividends altogether. Baytex Energy (NYSE:BTE) and Canadian Oil Sands (TO:COS) slashed their payouts by 58% and 43%, respectively.

Income investors want to know where the next axe will fall.

Well, I’m issuing a major warning for specific stocks across the energy sector.

The Cash Flow Deficit

One of the best ways to assess a dividend’s sustainability is to examine the company’s free cash flow (FCF), which is operating cash flow minus capital expenditures.

Unfortunately, a large percentage of the companies in the energy sector have low or even negative FCF due to the capital-intensive nature of the oil and gas industries. As a result, FCF is insufficient to cover dividend payouts in many cases. The company essentially has to issue debt or equity to finance the distribution.

By subtracting the total cash dividend distribution amount from FCF, we arrive at a cash flow surplus/deficit figure (let’s focus solely on the companies with a deficit for this exercise).

Then, by standardizing this cash flow deficit – comparing it to the overall size of the company – we can attempt to quantitatively approximate the sustainability of the payout, based on the last four quarters of data.

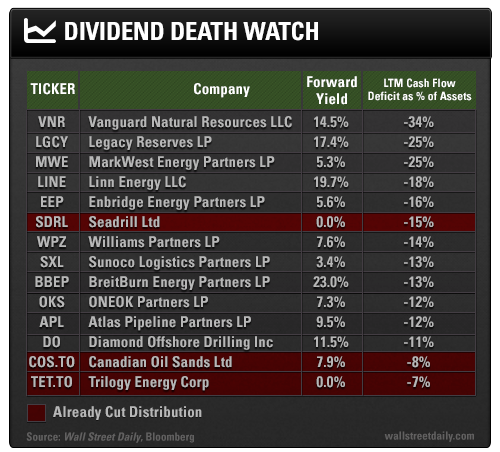

Using this metric, I’ve compiled a list of companies with exceptionally low dividend payout sustainability. You’ve heard of return on assets (ROA) as a profitability measure… Well, think of this new metric as shortfall on assets (SOA).

Ladies and gentlemen, I present to you the Dividend Death Watch:

I’ve included three companies that have already cut their distributions, so you can see how the rest stack up against them.

This list is certainly not comprehensive, although it’s littered with master limited partnerships (MLPs), a type of pass-through entity.

Vanguard Natural Resources LLC (NASDAQ:VNR), Legacy Reserves LP (NASDAQ:LGCY), Linn Energy LLC (NASDAQ:LINE) and BreitBurn Energy Partners LP (NASDAQ:BBEP) can be categorized as “upstream” MLPs, which are involved in oil and gas exploration and production.

These upstream MLP shares have already gotten mauled. For example, LINE is down over 35% (net of dividend payment) since my November warning.

The “midstream” MLPs, which focus on oil and natural gas storage and transmission, have held up relatively better.

That said, firms such as MarkWest Energy Partners, Enbridge Energy Partners LP (NYSE:EEP), Williams Partners, Sunoco Logistics Partners LP (NYSE:SXL), Oneok Partners (NYSE:OKS) and Atlas Pipeline Partners LP (NYSE:APL) look to have significant dividend sustainability issues, as well.

You’ll also notice that Diamond Offshore Drilling (NYSE:DO) seems to be the next most vulnerable offshore driller after Seadrill, at least based on this cash flow shortfall metric.

Sure, capital expenditure budgets for these companies can be cut to delay a distribution cut. However, reduced investment will impair future revenue and operating cash flow potential. In the case of Williams Partners, revenue already peaked and is down nearly 15% since 2011.

Basically, these companies are on an unsustainable path.

The great energy massacre will claim more victims, and I believe the vast majority – if not all – of the companies on the above list will have to significantly cut their dividends or MLP distributions before it’s all said and done.

A few of the most highly indebted members of the Dividend Death Watch list may even see their shares go to zero. Leverage kills.

Safe (and high-yield) investing,

Alan Gula, CFA