The irony about the current gold market is that gold is actually slightly higher than it was two years ago in June 2013 when it made a crash low. But many gold market pundits and the financial media have maintained their bearishness on gold for two years, predicting another crash in gold. It simply hasn't come to pass.

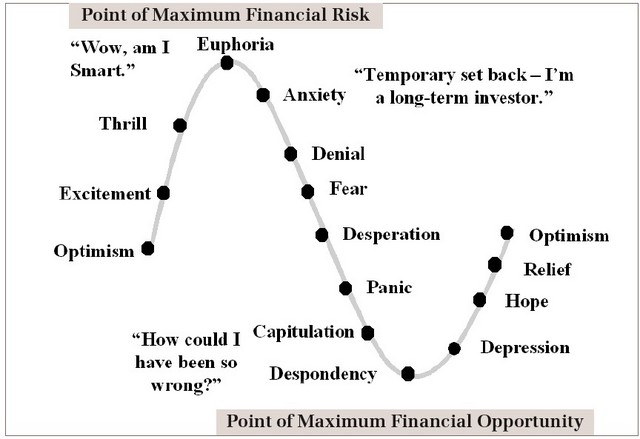

The reason they've maintained this popular bearish view is the gold market has been devoid of hope for years now because it's in the depression phase. This is where people give up hope at the bottom of a market.

What's interesting though, as the chart above points out, is that the "point of maximum financial opportunity" is also the point at which most people have given up on the investment. This is a key point to realize when looking for big long term trades. When people give up on or don't care anymore about an investment they are no longer bidding up its price. So when fundamentals eventually turn around for an investment that nobody is interested in it creates an explosive opportunity when demand kicks back in.

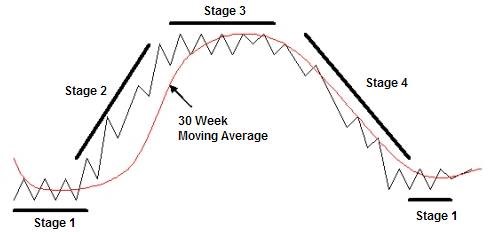

From a Stage Analysis perspective we can visualize the depression phase of an investment as a Stage 1 base. This is where hope is abandoned for an investment and supply and demand settle into balance at a low price, after a bear market Stage 4 decline.

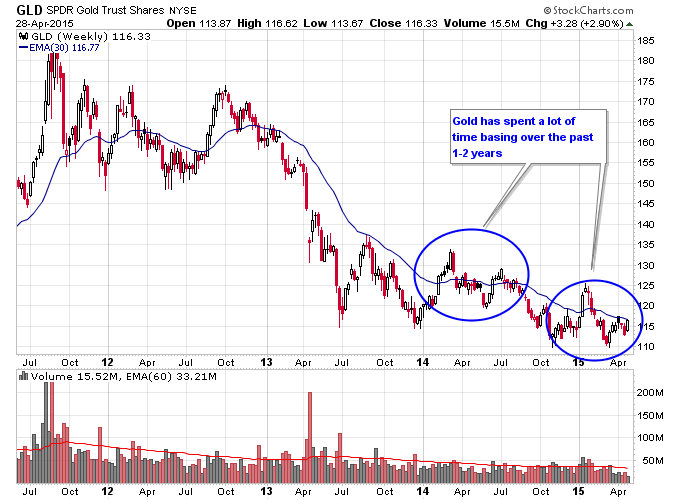

One thing that needs to be emphasized is that the Stage 1 basing phase can last for a long time, from months to multiple years. This is what has plagued some of those looking for a turnaround in gold over the last couple of years. In 2014 for instance gold attempted multiple times to breakout into a Stage 2 advance but each attempt failed and gold continued to drift. Each failed attempt disheartens the bulls and continues to plunge more and more investors into giving up which eventually is what causes a super buying opportunity when the real Stage 2 breakout finally materializes. This is why the "bigger the base", the higher the potential for a big trade because the bulls have been washed out of the investment.

You can see on the chart of teh SPDR Gold Shares ETF (ARCA:GLD) below that gold has spent a lot of time since 2013 in a basing phase, but each breakout in gold has failed so far. The parabolic advance in the U.S. dollar that started in mid-2014 actually plunged gold into another minor decline. But gold has re-established a Stage 1 base even with the dollar continuing to surge. Now gold is once again threatening the 30-week moving average with potential to move into a new Stage 2 advance.

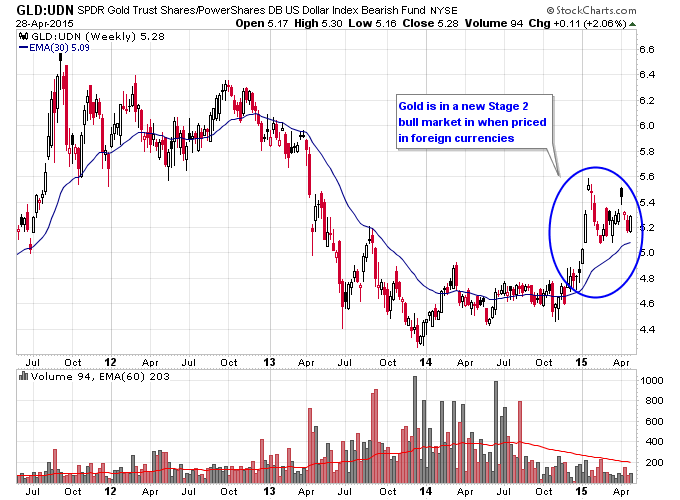

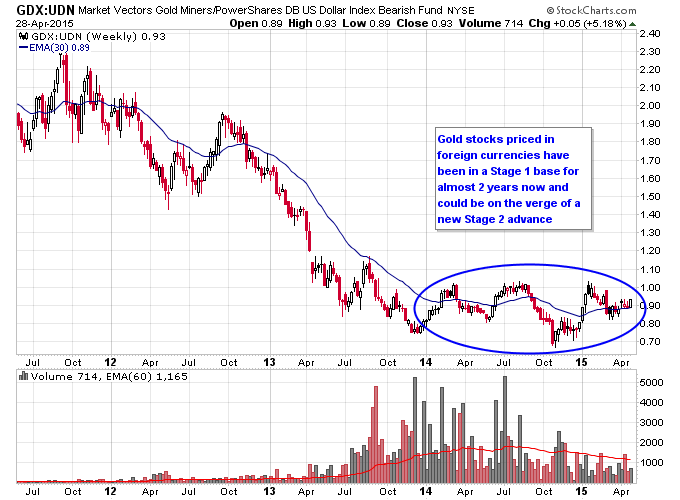

What lends support that this upcoming Stage 2 breakout in gold could be the "real deal" is that gold has broken out into a new Stage 2 bull market in foreign currencies. This underlying strength in gold has been masked by a mania in U.S. dollar, but foreign holders of gold are already experiencing a new bull trend.

Gold stocks priced in foreign currencies have established a massive Stage 1 base that has huge potential for a new bull market. Also if you take a look at gold mining stocks on the Canadian TSX exchange, many more have started new bull markets already then U.S. listed gold stocks, which speaks to the weak Canadian dollar and the breakout of gold in Canadian dollar terms.

One final thing to note is that the current Stage 1 base in the gold market is one of the biggest Stage 1 bases in the financial markets right now, and in fact it's one of the only Stage 1 bases. Which means that as far as trading opportunities go the gold market is in line to fire off a big opportunity at some point. And without other markets in Stage 1 bases transitioning into new bull markets to attract capital the gold market should gain a lot of attention.