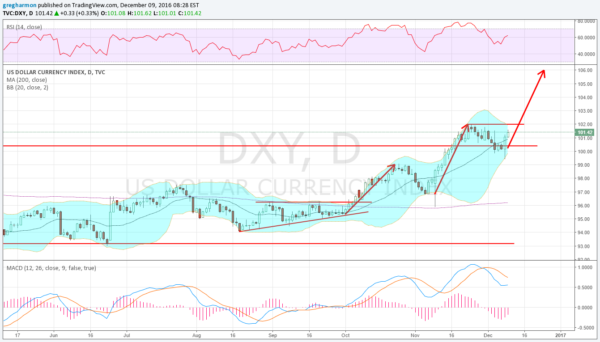

The US Dollar Index took off to the upside following the election last month. The move took it out of its 2-year broad consolidation and to a new 14-year high. But then it stalled. With a small pullback it retested the breakout area and has held up. Thursday, following the ECB decision, it briefly dipped and was quickly bought up. It closed higher on the day and off of the support zone. As of Friday morning, USD continued higher.

So what's next? It looks like a third drive higher.

Target

The chart below paints the picture. The US Dollar Index started a Three Drives Pattern at the beginning of October as it lifted out of an ascending triangle. It retraced about half of that move before a second impulse to the upside that started after the election. The move-up off of support Thursday needs to get over 102, the mid November high, to confirm the 3rd Drive of the pattern. That would then give a target to 106 or more.

The current Bollinger-Band® squeeze supports the timing. These bands often squeeze in just before a move. And momentum is favorable as is supportive. The RSI is moving back higher in the bullish zone after a holdup on a pullback. The MACD is also turning back up after a hold in positive territory during its pullback.

It looks like it's time to buckle up for another ride higher.