It’s Friday in the Wall Street Daily Nation. For the neophytes in our ranks, that means it’s time to break free from our regular routine.

Instead of just flapping our gums ad nauseam, we’re employing a handful of graphics to help convey some important insights.

Specifically, I’m serving up two of the hottest technology trends in 2017 — along with hints on how to profit from each.

So without further ado…

Gettin’ Chatty With It

The next major tech revolution (and wealth bonanza) is about to be unleashed.

Frankly, it’s been hiding in plain sight. It’s been dominating the headlines coming out of two major technology conventions this year: the Consumer Electronics Show in Las Vegas and Mobile World Congress in Barcelona.

However, many investors still don’t see it coming. Mainly because the interface is literally invisible.

I’m, of course, talking about voice interfaces.

Look no further than Amazon.com Inc (NASDAQ:AMZN)'s virtual assistant, Alexa, for proof why voice is about to take over the technology world.

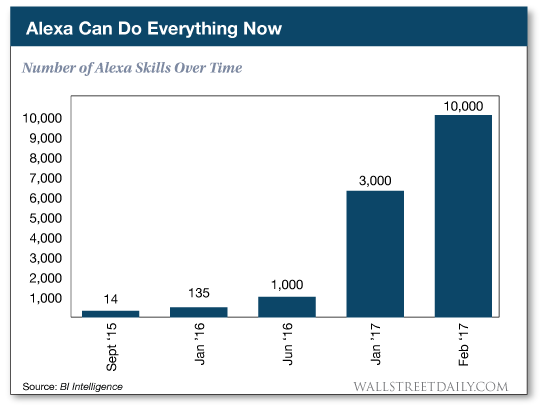

When Alexa launched a mere two years ago, it was only able to complete 14 tasks. Now it can achieve over 10,000.

“We’ve made huge progress in teaching Alexa to better understand you,” says Rohit Prasad, Amazon’s head scientist. I’ll say!

It goes without saying that when a technology can reliably do more — cheaply — more people are destined to use it.

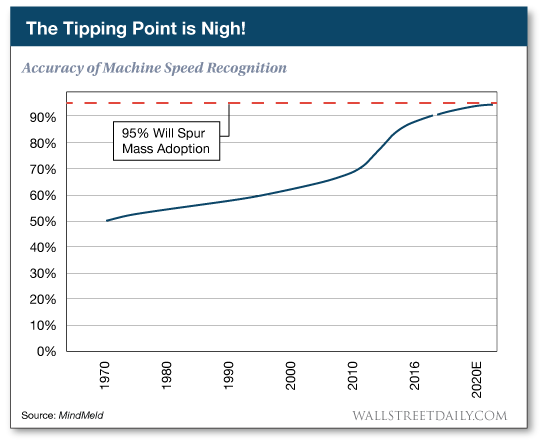

Industry insiders agree that for voice interfaces to go mainstream, voice recognition technology — the ability for computers to understand human speech — would need to achieve a 95% accuracy rate.

Well, guess what? We’re mere decimal points away. A research paper completed in October 2016 by engineers at Microsoft (NASDAQ:MSFT) revealed that they achieved an accuracy rate of 94.1%. Even for the most complicated languages, like Mandarin Chinese.

Then, this month, IBM’s speech recognition team achieved a new record high at 94.5%.

As Shawn DuBravac, chief economist for the Consumer Technology Association (CTA), says, “We’ve seen more progress in this technology in the last 30 months than we saw in the last thirty years.”

Translation: In a matter of months, we’ll breach the tipping point for mass adoption.

Follow the Smart Money Into AI

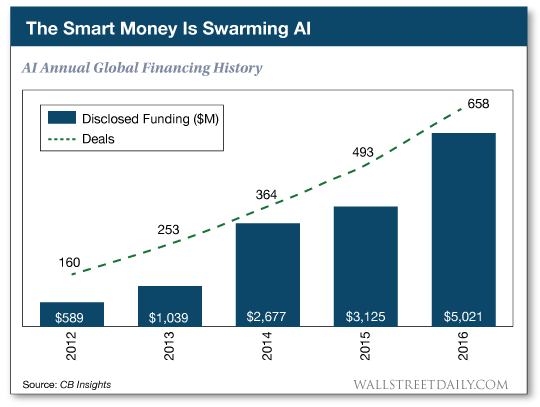

Venture capital money flows are a telltale indicator of timely profit opportunities. And there’s no mistaking this trend.

Last year, a record 658 artificial intelligence (AI) startups received venture funding, up from 160 in 2012, according to CB Insights.

The trend is far from letting up. Case in point: Forrester Research predicts that AI investments will increase more than 300% in 2017.

Clearly, we’ve reached an inflection point.

It’s not just venture capitalists that are hot on AI, though. As a recent article in Forbes proclaimed, “Virtually every major power in chips is suddenly chasing the AI dream.”

Truth be told, it’s not just the chip players getting positioned. Recently, Uber launched an AI research lab… Apple (NASDAQ:AAPL) announced plans to collaborate with the AI community… and Ford Motor Company (NYSE:F) formalized a $1 billion investment over the next five years in a startup called Argo AI.

So capital is flooding into AI from all corners of the market. And the momentum is building.

The obvious and overcrowded play in the space is NVIDIA Corporation (NASDAQ:NVDA). Once again, we’ve identified an under-the-radar small cap perfectly positioned to profit from the AI boom.