Two names today that report after the close tonight Amgen Inc (NASDAQ:AMGN), and United Rentals Inc (NYSE:URI).

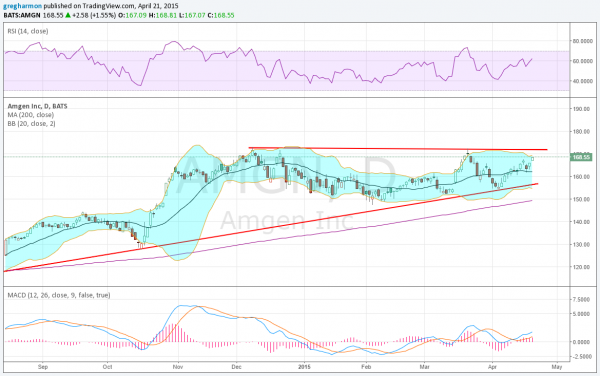

Amgen, has been slowly trending higher, making higher lows. Since December those have met resistance at 172 and consolidated. Heading into earnings it is pushing towards the top of the range with the RSI in the bullish range and rising, while the MACD is also rising. There is support lower at 162 and 155 followed by 149.50. There is no resistance above 172 but a Measured Move to 214. The reaction to the last 6 earnings reports has been a move of about 3.48% on average or $5.90 making for an expected range of 161.75 to 173.75. The at-the money weekly April Straddles suggest a smaller $5.20 move by Expiry with Implied Volatility at 39% above the May at 25%. Short interest is low at 1.4%. Open interest is focused here between the 165 and 170 Strikes.

Trade Idea 1: Buy the April 167.5/170 Call Spread for $1.30.

Trade Idea 2: Buy the April 167.5/170 1×2 Call Spread for a $0.30 credit.

Trade Idea 3: Sell the April 162.5/172.5 Strangle for a $1.65 credit.

Trade Idea 4: Buy the April/May 172.5 Call Calendar ($1.44) and sell the May 155 Put (90 cent credit) for 54 cents.

#1, and #2 give the short term upside, with #2 using margin. #3 gives a good range with it profitable from 160.85 to 174.15. #4 gives the longer term upside and uses leverage to lower the cost. I prefer #3 or #4.

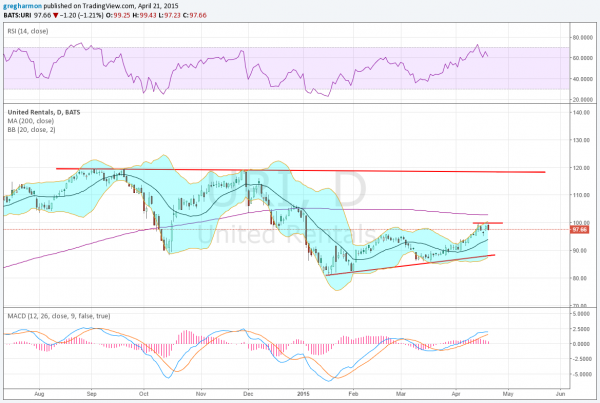

United Rentals, made a double top in November and pulled back. Since then it has been trending higher with consecutive higher lows. The short term consolidation into earnings is occurring at the same time spread as the last short term top and same distance measured higher. The RSI is bullish but pulling back while the MACD is leveling. There is support lower at 95.40 and 86.70 followed by 82. There is resistance higher at 99.70 and 105.50 followed by 114 and 119. The reaction to the last 6 earnings reports has been a move of about 3.05% on average or $3.00 making for an expected range of 94.75 to 101. The at-the money weekly April Straddles suggest a larger $5.25 move by Expiry with Implied Volatility at 66% above the May at 33%. Short interest is high at over 10%. Open interest favors the 95 Strike should it fall and the 100 to 105 range if it rises.

Trade Idea 1: Buy the April 97.5/95 Put Spread for $1.20

Trade Idea 2: Buy the April 97.5/95 1×2 Put Spread for a 30 cent credit.

Trade Idea 3: Buy the May 95/100 Call Spread for $3.00.

Trade Idea 4: Buy the May 95/100 Call Spread and sell the May 95 Puts for 65 cents.

Trade Idea 5: Buy the May 97.5/100 Call Spread and sell the April/May 95 Put Calendars for 50 cents

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.