A 40% rise in the Molins PLC (MLIN.L) share price, shows belated recognition of action taken by management to restructure several struggling businesses. This is now a lean group with sound growth prospects and a strong balance sheet. More significantly, there is the added bonus of a rapidly growing laboratory business, while acquisitions are also moving up the agenda. The potential is still not fully recognised.

Profits up by 9%

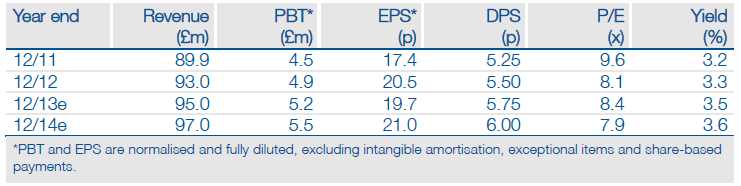

After a lower first half of the year when underlying pre-tax profits came back from £1.7m to £0.8m, management delivered the indicated strong second half, easily making up the shortfall with a full-year figure of £4.9m, 9% above the previous year and comfortably above City expectations of unchanged profits. The incidence of contract completions, which tends to favour the second six months, was more marked than usual, while the planned reversal in Scientific Services following the heavy investment during the first half duly materialised.

Momentum continues to build

The new testing regime for tobacco products in the US is coming on stream slower than we had hoped. However, momentum remains strongly in the right direction. The two manufacturing divisions are working on their growth strategies, with several opportunities emerging despite the challenging global trading climate. We have lifted our profit target for 2013 by 6%, and believe these revised figures could prove conservative. We expressed increasing confidence about the medium-term outlook in our report published last August – we retain this view.

Strong balance sheet

The Molins PLC (MLIN.L) balance sheet remains strong, with net cash balances raised by £0.3m to £7.4m over the year, despite a major investment in new laboratory facilities in the US. Our current estimates indicate continuing cash-generative trading. The triennial pension revaluation is due to be published in mid-2013; while a rise in contributions is possible, the underlying position appears under firm control.

Valuation: Still undervalued

The Molins PLC (MLIN.L) share price has advanced by 40% over the past six months. While this is well ahead of the market, the prospective rating of 8.4x 2013 earnings is still less than half that of larger UK-based global capital goods manufacturers. Even if the shares pause for breath in the short term, the group still looks undervalued.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Preliminary Results For Molins PLC (MLIN.L)

Published 03/04/2013, 07:19 AM

Updated 07/09/2023, 06:31 AM

Preliminary Results For Molins PLC (MLIN.L)

Ahead of expectations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.