Canadian Solar Inc (NASDAQ:CSIQ) was able to snap an ugly streak of post-earnings performances back in March, when the shares gained 7.2% after the alternative energy company reported a better-than-expected fourth-quarter profit. The stock will try to carry this momentum into the next earnings release, scheduled for before the open tomorrow, while options traders have been targeting calls ahead of the event.

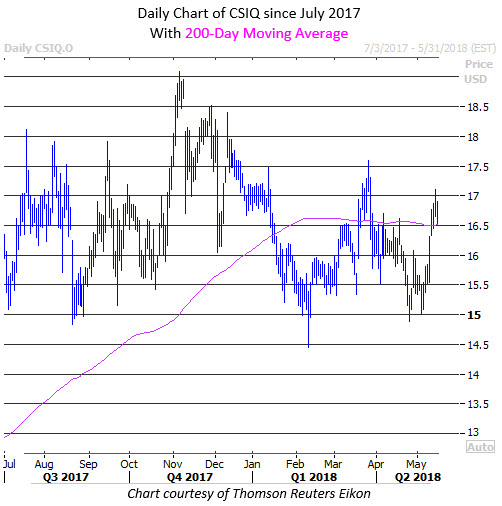

But taking a quick step back, CSIQ has also benefited from California's recent decision to mandate solar panels on new homes, helping the equity extend its bounce from the $15 region that's provided solid support since last July. This rally has the shares back stop the 200-day moving average, which acted as a floor earlier today, with the security, last quoted at $16.78, now battling its year-to-date breakeven point.

As alluded to earlier, CSIQ options traders have been focusing on calls in recent weeks, according to data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). More than 1,000 long calls were opened across these exchanges in the past two weeks, compared to fewer than 300 puts. Looking closer, the in-the-money July 16 call saw the largest increase in open interest during this time frame.

This heavy call activity is continuing today, with volume nearly double that on the put side. Glancing at some of the most popular options, new positions are being opened at the weekly 5/25 17.50-strike call, which could mean bulls are betting on more upside through the end of next week, when the contracts expire.

Overall, Canadian Solar stock has averaged a one-day swing of 8.7% the day after earnings, going back two years. The options market is expecting a similar move this time around, too, with implied volatility data pricing in a 8.5% move for tomorrow's session.