Graphics processing units maker NVIDIA (NASDAQ:NVDA) is scheduled to report first-quarter earnings after tomorrow's close. The stock has been in a long-term uptrend, and earlier topped out at a record high. Given NVDA's history of positive earnings reactions, the security could be in store for even more upside tomorrow, with the options market pricing-in a big swing in either direction.

Data from Trade-Alert pegs Nvidia's implied daily earnings move at 10% -- though this is slightly lower than the 11% single-day post-earnings move the stock has averaged over the last two years. In those eight quarters, the equity has closed higher the next day six times, including the two most recent.

Sentiment toward NVDA is hardly enthusiastic ahead of earnings. The weekly 5/11 260-strike call has seen the biggest rise in open interest over the past 10 days. Data from the major options exchanges shows mostly sell-to-open activity here. While it's likely that these call writers expect $260 to serve as a ceiling through Friday's close, it's also possible they're hoping to profit from a volatility crush after earnings.

Elsewhere, 10 of 25 analysts maintain a "hold" or "strong sell" rating on the stock, while the average 12-month price target of $251.75 is right in line with current trading levels. Another post-earnings upside move could have these brokerages following in the footsteps of Barclays (LON:BARC), which may create even bigger tailwinds.

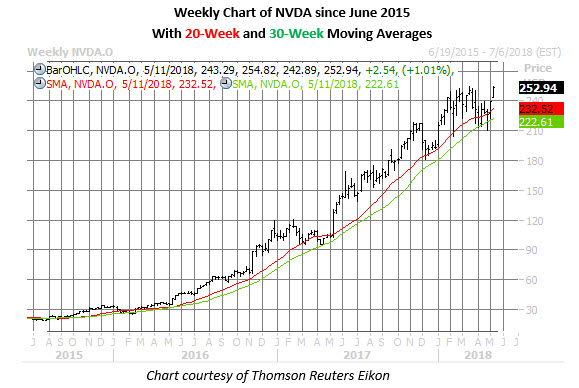

Looking at the charts, the shares of have been guided higher by their 30-week moving average for nearly three years. More recently, this trendline, along with its 20-week counterpart, has boosted the chip stock 146% in the last 12 months. Today, NVDA is up 1.2% to trade at $253.34, fresh off an all-time peak of $254.82 and on track for its fifth straight gain -- its longest daily win streak since early January.