2016 is going to be a big year for media companies.

On screens both big and small, we’ve become addicted to heroes and villains - real and imaginary. As a result, media empires are profiting in very big ways.

In 2015, box office records were toppled. Tens of millions of viewers tuned into the GOP debates, generating huge profits for networks and advertisers. This will all bleed over into the new year.

Maybe you hate Trump. Maybe you love him. Maybe you’re sick and tired of superhero movies. Regardless, they can’t be ignored.

But before we get into divisiveness and meanness - and all of the money to be made there - let’s start with something that is universally loved... Star Wars.

Disney Dominates the Big Screen

In mere weeks, Star Wars: The Force Awakens has become the fastest movie to gross $1 billion in history. It took just 12 days. It was also the first film ever to score a $300-million plus opening weekend.

But here’s the real kicker... The Force Awakens hasn’t opened in China yet.

China is the world’s second-largest movie market behind the United States. When the newest entry in the Star Wars franchise premieres there on January 9, a heap of international records will likely be shattered.

These days, Walt Disney Company (N:DIS) is basically minting money with the Star Wars and Marvel franchises. (And just think, at this very moment, there’s less than 354 days until the next Star Wars movie is released...)

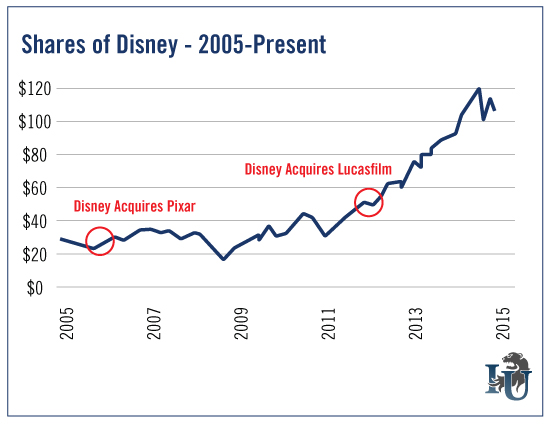

In 2015, shares of Disney performed okay, gaining a little more than 13%. That was enough to outpace the broader markets. But shares were really hammered to finish out the year, falling from $120 on November 20 to $107 at the end of December. That’s a decline of more than 10%.

It’s a potentially explosive setup, especially with The Force Awakens opening in China soon. And let’s not overlook Disney’s massive licensing agreements with a variety of toymakers and retailers.

Think about this for a second...

Frozen toys were at the top of Christmas lists this year. So were Stars Wars toys, which reportedly set a Christmas record. Sales were estimated to be somewhere between $3 billion and $5 billion. (Side note: Roughly a quarter of those Storm Troopers and Jedi Knights were purchased for adults.)

Star Wars is such a coveted franchise that Hasbro (Nasdaq: O:HAS) coughed up $225 million in 2013 to be the primary toy partner with Disney until 2020. That included $75 million upfront with the rest due as sequels are released.

We all know that the more than $1 billion Star Wars has made so far doesn’t go straight into Disney’s coffers. Theaters have to get their share of the ticket sales as well.

Since 2008, the average split is that a studio takes 53% and the remainder goes to theater operators. For Star Wars: The Force Awakens, however, Disney was able to negotiate a take of more than 60%. So, the company holds a much bigger than normal piece of the pie. It was also able to demand that the movie stay in theaters for four weeks, as opposed to the typical three.

So, we have a huge movie franchise... with huge box office draw... and massive merchandising appeal... all owned by Disney.

In November, the company reported full-year results for fiscal 2015. Revenue increased 7% to $52.5 billion, while studio revenue for the fourth quarter was flat. Keep in mind that studio revenue isn’t always going to be comparable because of release schedules.

But Disney is on an absolute tear at the box office...

Since its fourth quarter ended in October, it’s already released Bridge of Spies, The Good Dinosaur and Star Wars: The Force Awakens.

Bridge of Spies made $138 million at the box office on a $40 million budget. The Good Dinosaur scored $214 million, basically breaking even. And, as we’ve covered, Star Wars: The Force Awakens has already brought in over $1 billion on a budget of roughly $200 million.

Disney will release two more Marvel movies in 2016: Captain America: Civil War and Doctor Strange. The last two Marvel movies released in 2015 brought in roughly $2 billion at the box office combined. The company will also release the sequel to Finding Nemo, called Finding Dory. The next Star Wars movie, Star Wars Anthology: Rogue One, will drop just in time for Christmas 2016.

From now until July 2017, Disney has 17 movies slated to hit the theaters. That’s an extremely ambitious schedule. In fact, Disney is planning to release a new Star Wars movie every year until 2020. That’s on top of a Marvel superhero movie basically every other quarter.

Shares of Disney have doubled since the company purchased Lucasfilm in October 2012. And the stock is up more than 300% since the company bought Pixar in January 2006.

For all of those reasons, Disney is one of the stocks I’ll be watching closely in 2016.

Now, let’s talk about the other media circus that’s cascading down upon us...

Politicians Take Over the Small Screen

In case you didn’t know, 2016 is a presidential election year. And elections are one of the biggest moneymaking businesses for media outlets.

First, let’s talk about the debates... well, at least the Republican debates.

In 2008, the most-watched GOP debate was on ABC, drawing 7.35 million viewers. In 2012, the most-watched GOP debate also aired on ABC, drawing 7.63 million viewers.

The first GOP debate of this election season on Fox News was viewed by 24 million people.

It became Fox News’ most-watched program ever. It was also the highest-rated nonsports cable program of all time and the highest-rated cable news program of all time.

The Republican debates have been breaking ratings records for every network they appear on.

Adding to that, in recent years, presidential elections have been getting progressively more expensive...

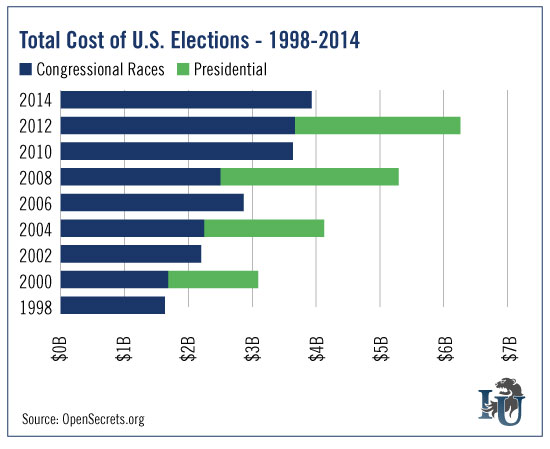

The 2012 election cycle topped 2008 as the most expensive in U.S. history with more than $6 billion spent.

During the mid-term elections in 2014, some $4 billion was spent, making it the most expensive mid-term election in history.

The Koch brothers earlier this year said they budgeted $889 million to spend on the 2016 election... more than double what they spent during the 2012 elections.

So, the stage is set for the 2016 race to be the most costly in U.S. history.

Earlier this year, it was estimated that total television ad spending for the upcoming election will reach $4.4 billion.

Where will all this money go?

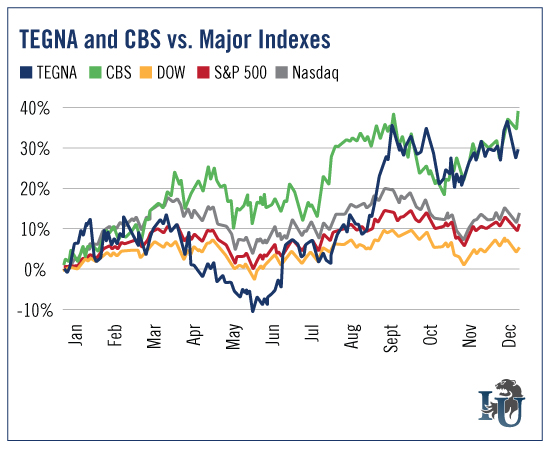

In the third quarter of 2014, Tegna Inc (N:TGNA)- then known as Gannett - reported record revenue from its broadcasting segment, which had increased 105%. This was largely thanks to political advertising. In the fourth quarter of 2014, the company reported record revenue again from this segment, up 117%.

In 2012, during the last presidential election, shares gained 30.4%.

At the same time, CBS Corp. (NYSE: N:CBS) turned in a record year, as well as a record fourth quarter. Like TEGNA, the growth was mainly driven by political advertisements.

Shares of CBS gained nearly 40% in 2012.

Both companies, as you can see, greatly outperformed the market that year. They sat back and collected record revenue, driven by political ad spending.

Since the 1990s, tribalism has taken hold in this country - Red versus Blue; Us versus Them. You might say that’s unfortunate. But over the past couple of decades, one thing has become increasingly clear...

This division is extremely profitable.

And now that there’s no cap on what campaigns and their supporters can spend to spread their messages, certain media companies - and their investors - should be in for a blockbuster year in 2016.