Investing.com’s stocks of the week

With global growth returning, the U.S. economy surging to a 3% growth rate, U.S. rates on the rise, the U.S. dollar sinking, the return of inflation, commodities prices soaring, and the reflation trade in full force, it will result in the Fed to move off the sidelines and raises interest rates by 25 basis points in 2020.

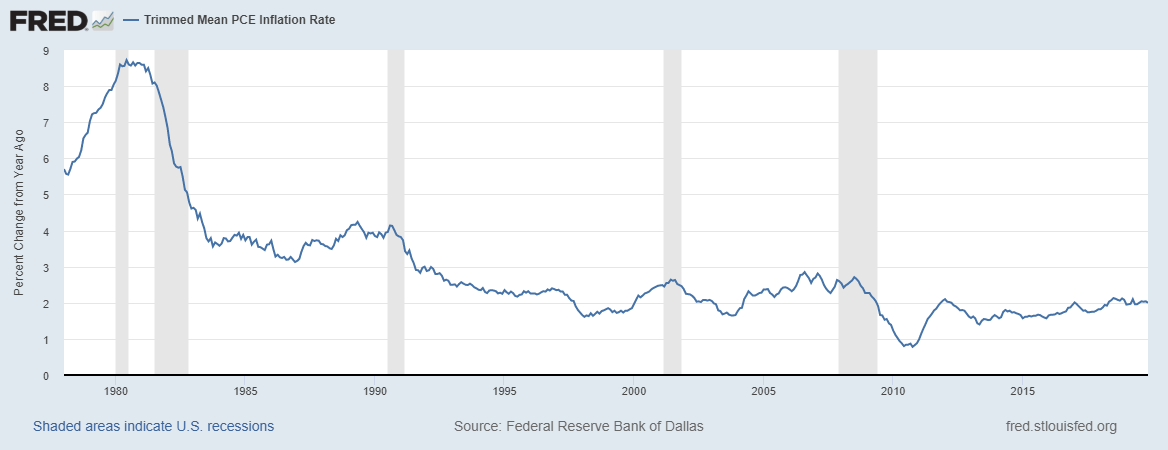

The Fed moved to the sidelines in 2019 after cutting rates three times. Now with the return of growth and inflation, the Fed will be forced to act. The Fed has noted it was willing to let the inflation rate run above its symmetric 2% target. However, with commodity prices on the rise and inflaton rates ticking up, the Fed will have no choice but to raise rates by 25 bps to a range of 1.75% to 2%.

But the Fed will not want to be the focal point during a Presidental election year, and so it will do what it must and hold-off from raising rates until after the election. That means the Fed will wait until its meeting at the end of December to push rates up.

It makes the Fed raising rates one-time in 2020 prediction 3.