Over three weeks ago, OPEC joined Russia’s 500,000 barrels per day decrease and announced significant oil production cuts of its own. The Organization of the Petroleum Exporting Countries, led by Saudi Arabia, has now reduced its daily output by 3.66 million bpd since October, 2022. Following that news, crude oil understandably opened with a gap to the upside on Monday, April 3rd.

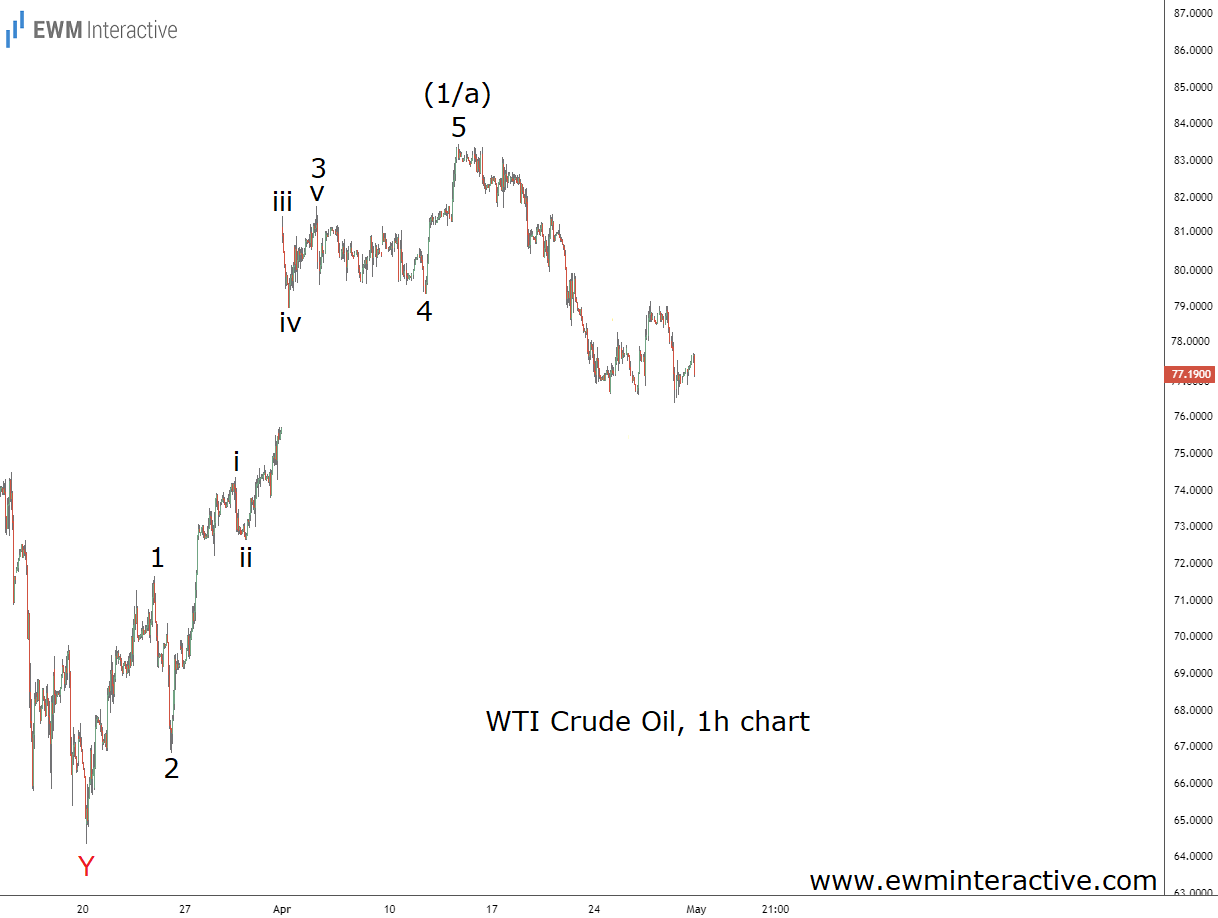

Despite that initial pop, however, the cuts have so far failed to ignite a sustained rally in the price of oil. In fact, WTI crude oil plunged sharply, from $82.58 to $76.43 a barrel in less than two weeks. Given the promising economic revival of China, the recent drop is all the more baffling. True, in early May, the Fed is expected to add another 25 bps to its string of interest rate hikes. This might cause a recession further down the road. But the US economy is showing surprising resiliency so far, and inflation is decelerating already.

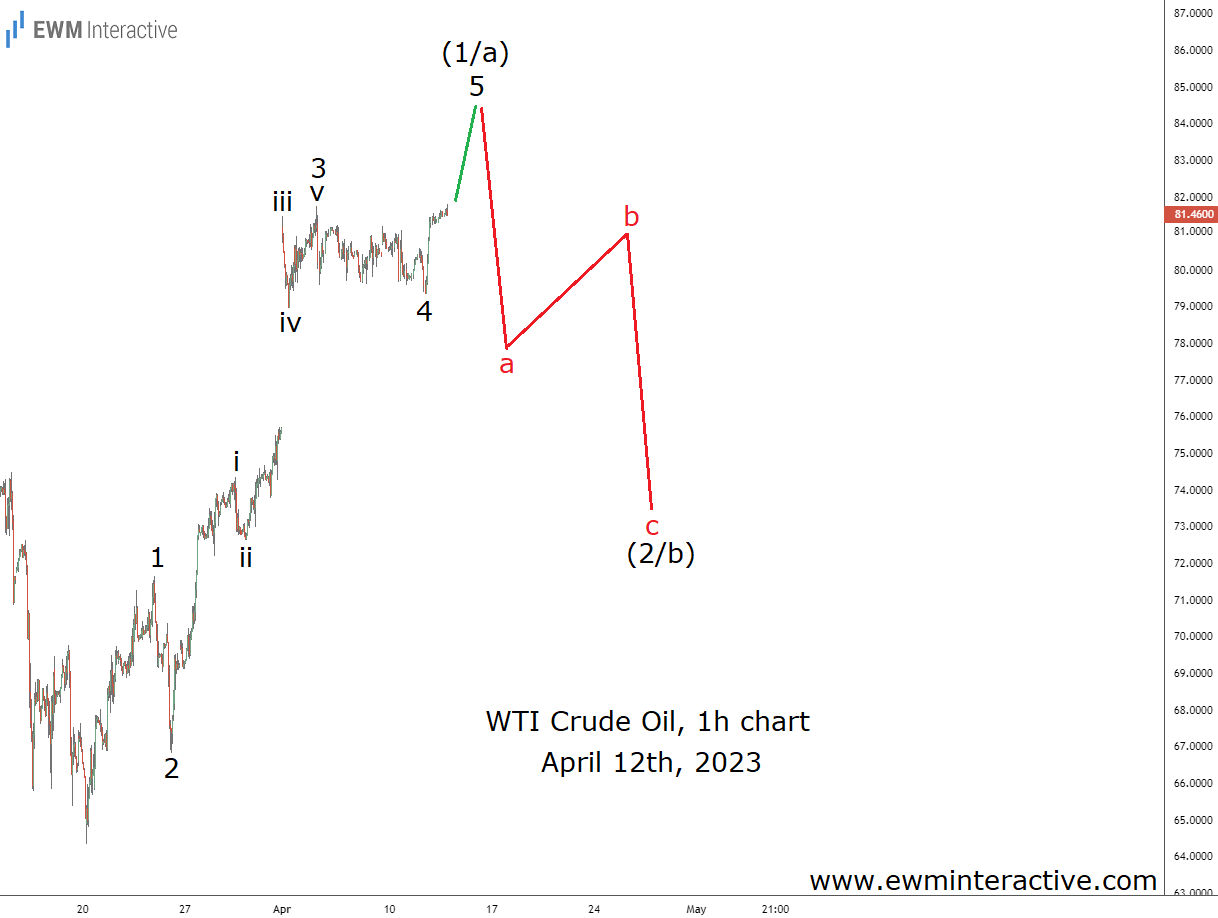

So how do we explain the WTI tumble when all the fundamental macro factors are bullish? Fortunately, we don’t have to bother with such after-the-fact explanations because Elliott Wave analysis actually helped us predict the plunge in advance. The chart below, shared with our Elliott Wave Pro subscribers on April 12th, shows how.

The hourly chart reveals that the upside gap following OPEC‘s production cut announcement fits in the position of wave iii of 3 of a five-wave impulse. The pattern had been in progress from the bottom at $64.33 and was already approaching its end by April 12th. We’d labeled it 1-2-3-4-5, where the five sub-waves of wave 3 were also visible.

A new swing high was supposed to occur in wave 5. Instead of accelerating further to the north, however, WTI crude oil was likely to form a bearish reversal. That’s because, according to the Elliott Wave theory, a three-wave correction follows every impulse. This is how a single chart and an eye for patterns prepared us for a decline, despite the OPEC cuts and China’s economic recovery.

The bulls made it to $83.37 in wave 5 the same day. Less than three weeks later, WTI fell below $76.50, in a drop that seemed totally illogical to everyone except those familiar with Elliott Wave analysis. And while traders await the Fed’s next rate decision on May 3rd, the charts are giving us a hint already.