The S&P 500 (SPY) will likely rise on Friday, finishing off a volatile and crazy week of political crisis, financial crisis, and a new S&P 500 (SPY) record. The Dow Jones Industrial Average (DIA) lost .01% yesterday and the NASDAQ 100 (NASDAQ:QQQ) added .62% yesterday, likely on excellent Google (GOOG) earnings.

I was wrong for the fourth day in a row yesterday and hopefully I will be right today. Investors still seem to be breathing huge sighs of relief and hope and I expect this trend to continue into the weekend. With the debt ceiling raised and the government re-opened, it will likely take a few days for investors and markets to consolidate themselves before we get a new stock market picture. So for now, I am predicting that the S&P 500 (SPY) will rise again for Friday to finish out the week.

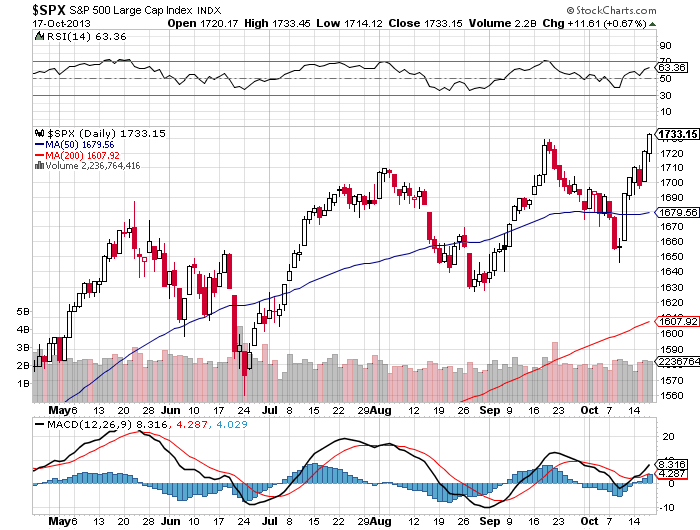

From a technical perspective, the S&P 500 (SPY) remains extremely bullish, with a near overbought RSI of 63.36 and a robust 4.029 MACD Indicator. Yesterday was also a new record for the S&P 500 (SPY), so the bulls will likely be on a tear for a while to play out the charge. In any case, momentum appears to be on our side, so we might as well run with it again:

Chart courtesy of stockcharts

International markets are a flat and mixed bag, with the Nikkei in positive territory and the Hang Seng in negative territory at the time of this writing. European markets finished on the negative side on Thursday, with the FTSE finishing .07% into the green and the DAX losing .38% and the CAC losing .10%.

US Futures markets are currently trading 3-4 tenths into the green at the time of this writing, suggesting further positive investor sentiment.

The VIX Index (VXX) also suggests a higher S&P 500 (SPY) today, after the VIX lost an additional 8.36% to close at 13.48, well below its 50 and 200 moving day averages. Investors do not appear to be scared any longer, at least for now.

Friday should bring us the Leading Indicators report, but it is still delayed because of the now open US Government. Yesterday’s Jobless claims report plus a slew of other helpful US economic reports were delayed as well. Earnings reports are making the news however, with Google (GOOG) tearing up the charts yesterday and pushing the NASDAQ way into the green. Tomorrow brings more earnings reports from market bigwigs Morgan Stanley (MS) and General Electric (GE).

And, for our fun fact of the day: According to MarketWatch, Women trade and invest better than Men do. In fact, Women trade on average 2.3% better than Men do. Why? Women are generally more rational and less emotional when its comes to stock market trading.

Bottom Line: I predict an S&P 500 (SPY) rise for Friday, based on current trends of relief, hope, and new S&P 500 (SPY) records. Next week could be a different story.