Gold (NYMEX)

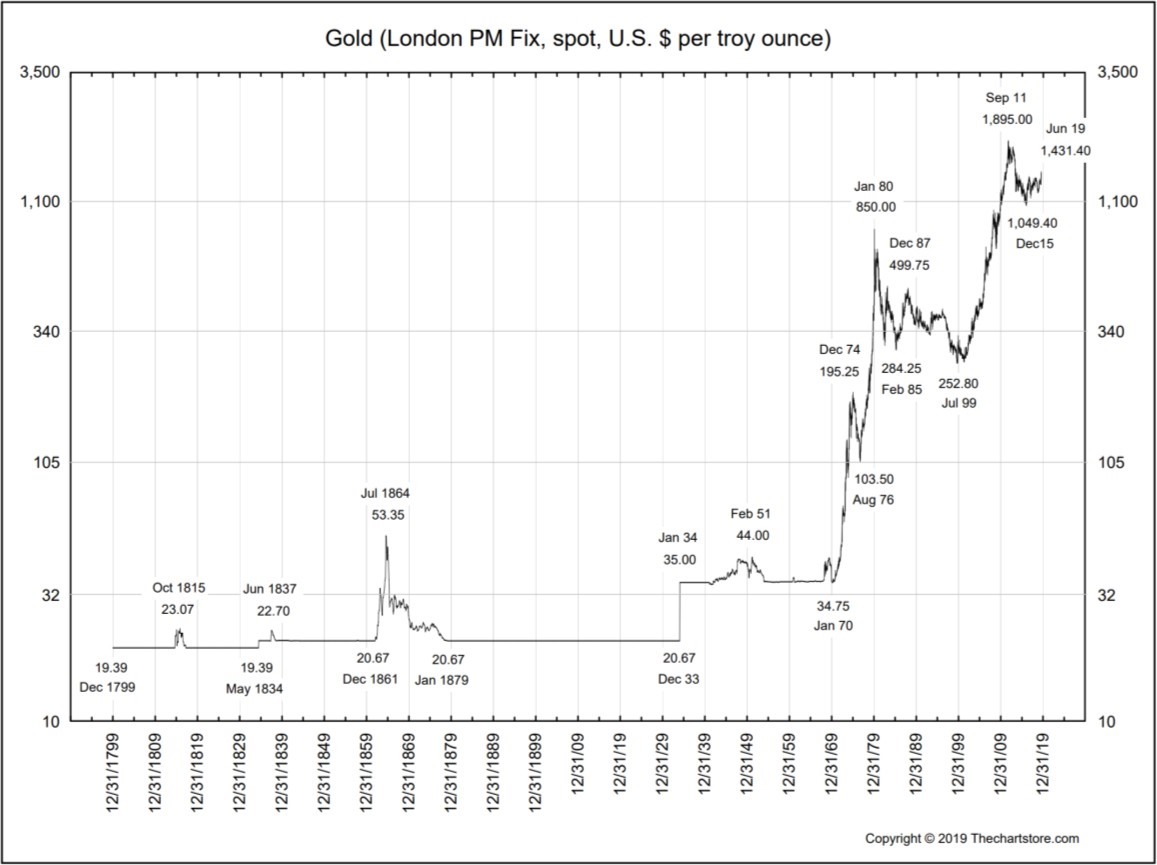

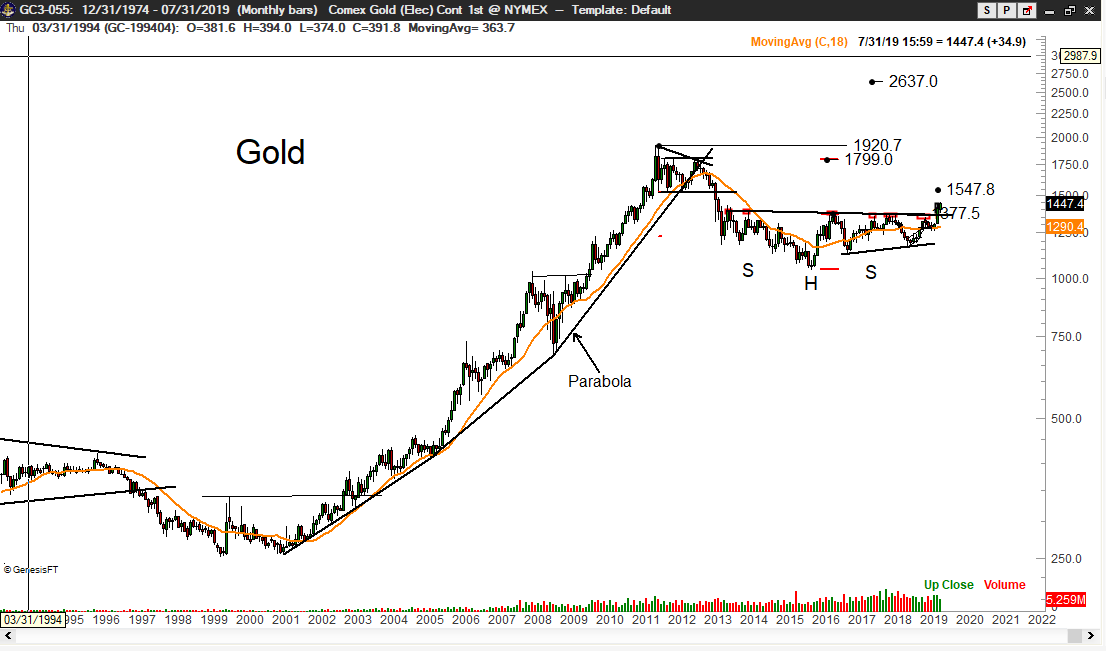

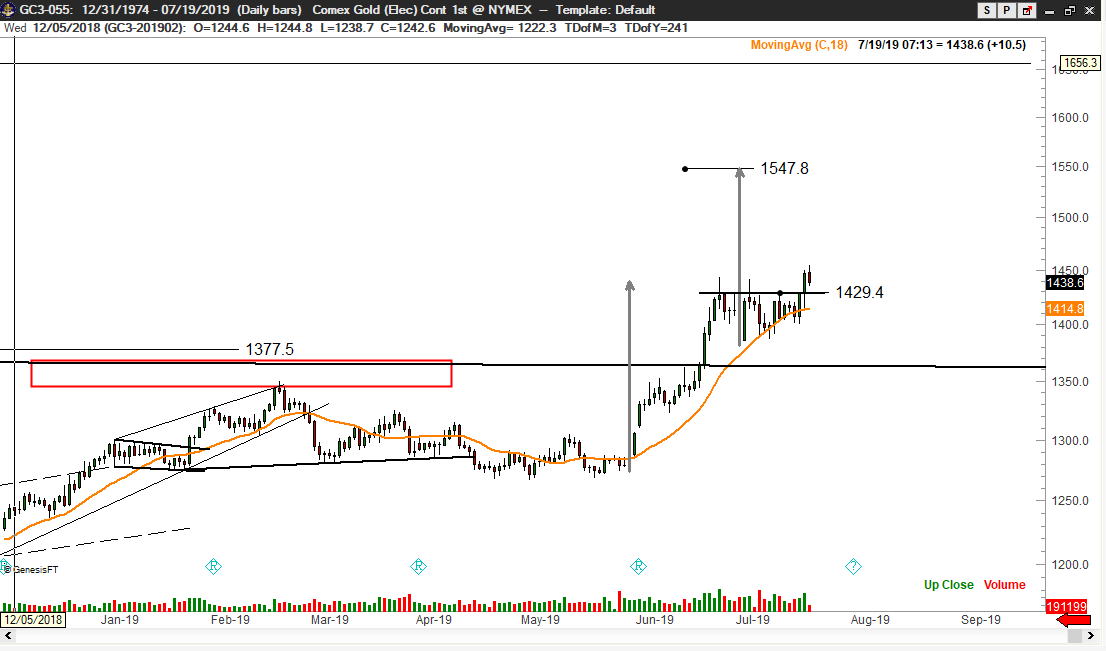

Perhaps we are finally involved in trade with a proper follow-through. Time will tell. The dominant chart construction in Gold is the completion of a 6-year inverted H&S bottom pattern wherein the right shoulder is a 3-year symmetrical triangle, as shown on the closing price chart.

This continuation H&S pattern can be seen as part of a historic bull trend as seen on the yearly line and monthly candlestick charts. This pattern has a target of 1800, although a retest of the ATH at 1920 is logical. A further P&F target exists at 2637.

The advance on Thursday completed a possible 3-week continuation pennant. If this is a half-mast pattern, the target is 1547, as shown with the grey arrows. I am interested in buying a retest of the pennant if it occurs within the next couple of trading days.

Silver (NYMEX)

The advance this past week completed a possible 13- month “W” or double bottom on the Silver weekly chart.

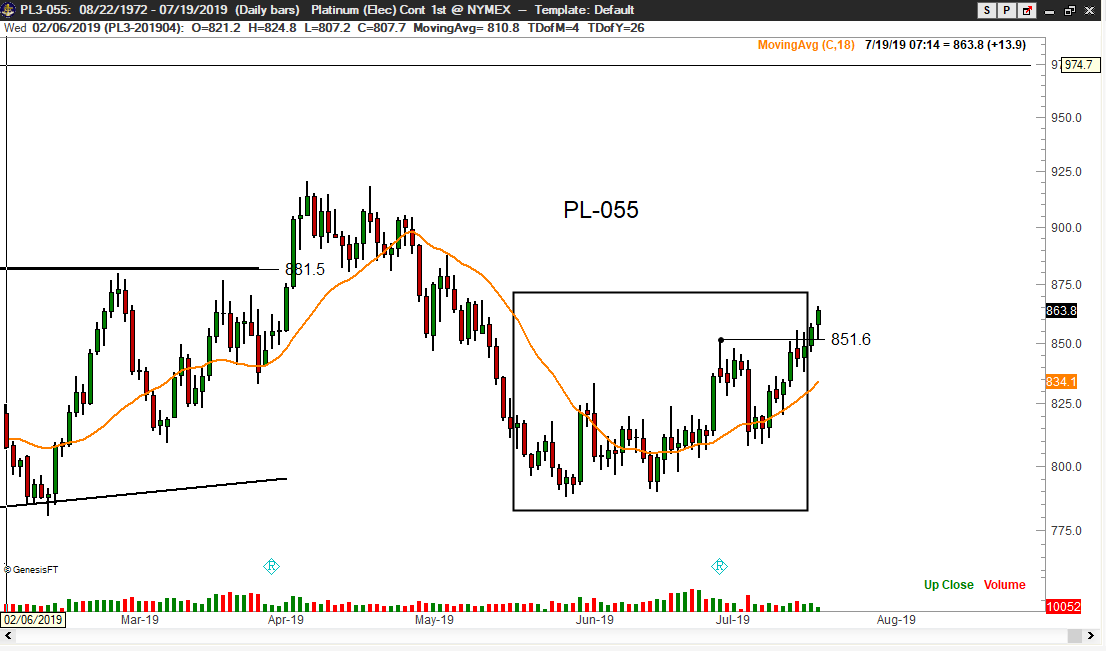

Platinum (NYMEX)

A 9-week horn bottom has been completed on the daily chart of the Oct Platinum futures contract.