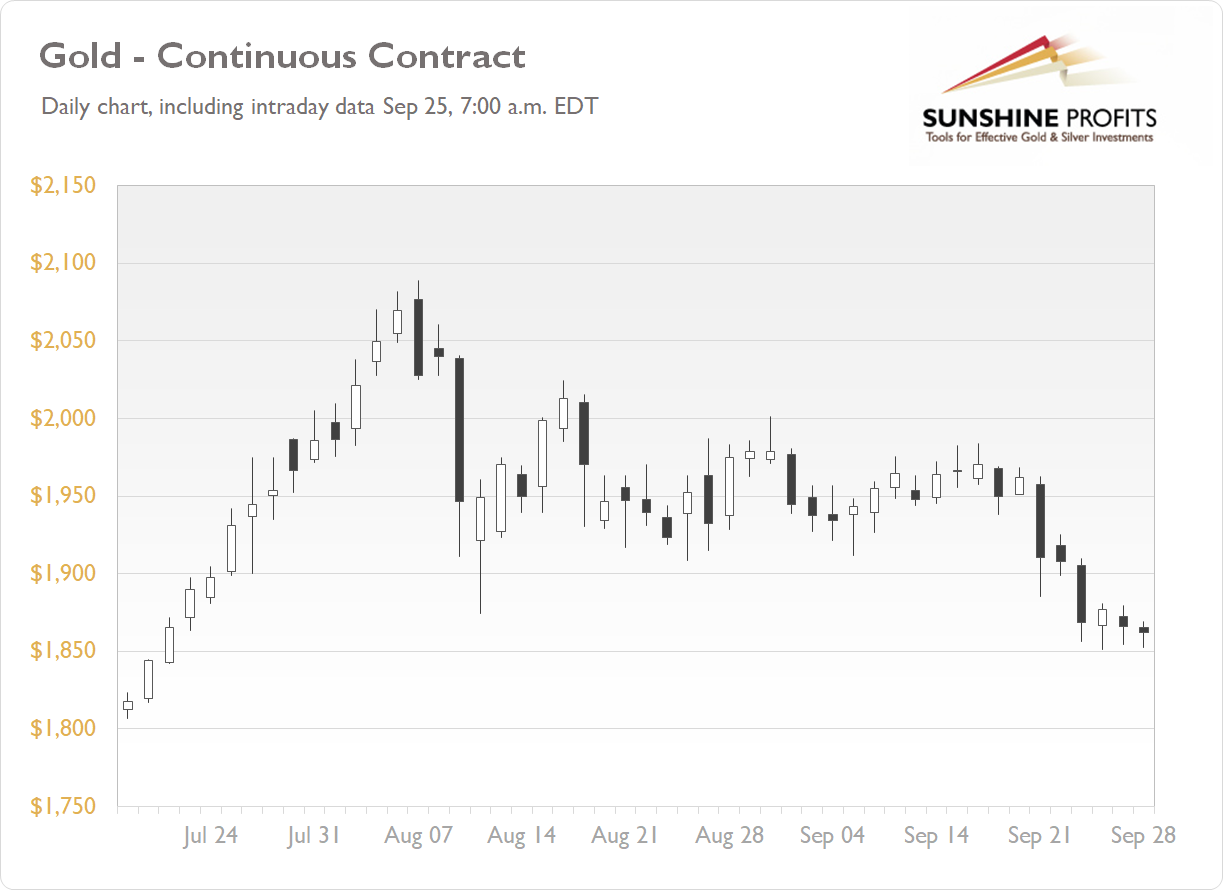

The gold futures contract lost 0.56% on Friday, as it extended a short-term consolidation following the decline after breaking below the price level of $1,900. The market reached the lowest since late July last week.

Gold keeps retracing its rally from around $1,800 to Aug. 7 record high of $2,089.20 in reaction to U.S. dollar rally, among other factors. Gold also broke below its mid-August local low, as we can see on the daily chart (the chart includes today's intraday data):

Gold is 0.1% lower this morning, as it is trading along Friday's daily closing price. What about the other precious metals? Silver lost 0.4% on Friday and today it is 1.44% higher. Platinum gained 0.48% and today it is 2.9% higher. Palladium lost 0.21% on Friday and today it's 1.8% higher. So precious metals are mixed this morning.

Friday's Durable Goods Orders release was worse than expected. Today we won't get any important data releases. However, there will be a lot of Fed and ECB talk this week. We will also have the important monthly jobs data release on Friday.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, September 28

Tuesday, September 29

- 8:30 a.m. U.S. - Preliminary Wholesale Inventories m/m, Goods Trade Balance

- 9:15 a.m. U.S. - FOMC Member Williams Speech

- 9:30 a.m. U.S. - FOMC Member Harker Speech

- 10:00 a.m. U.S. - CB Consumer Confidence

- 11:40 a.m. U.S. - FOMC Member Clarida Speech

- 1:00 p.m. U.S. - FOMC Member Quarles Speech

- 9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

- 9:45 a.m. China - Caixin Manufacturing PMI