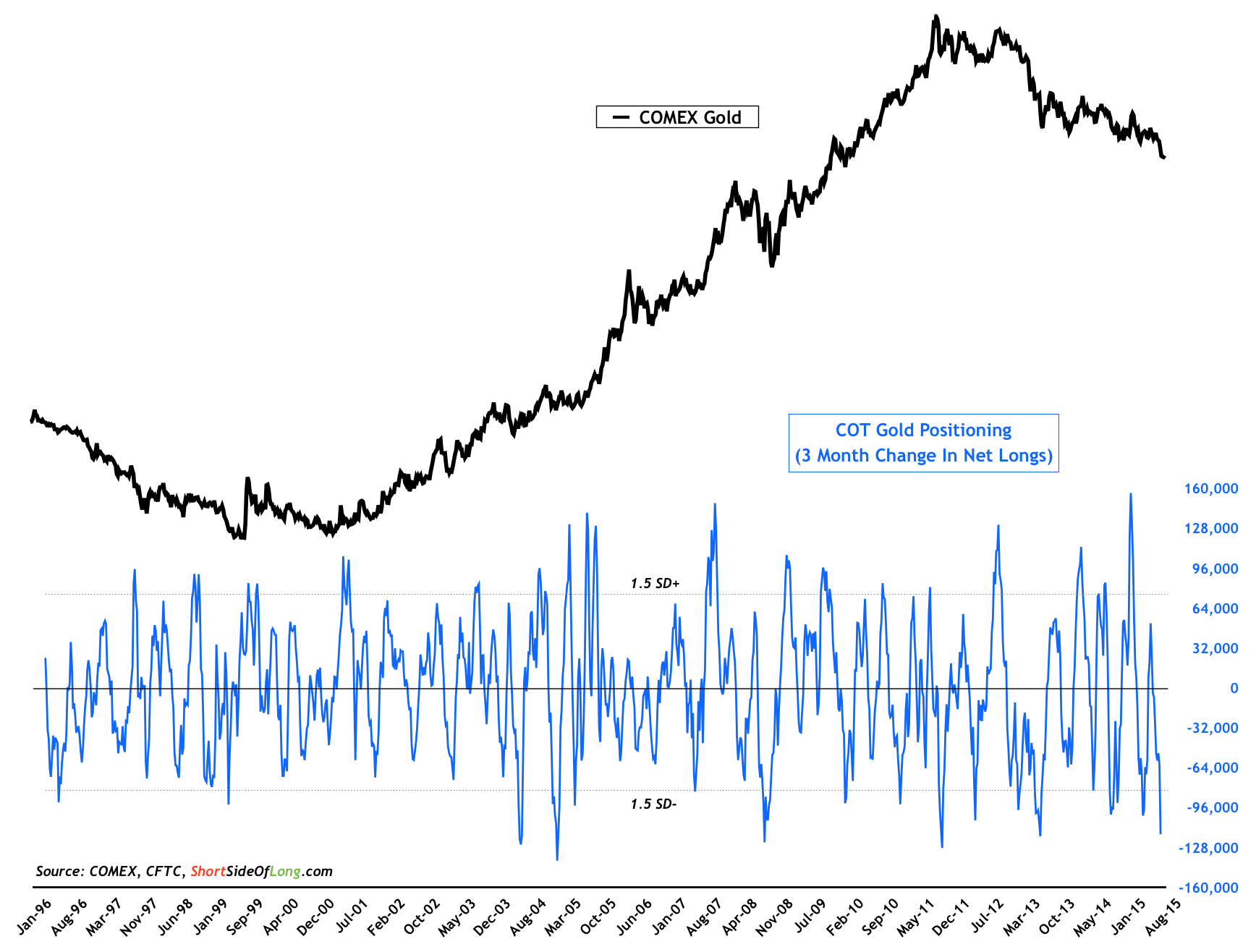

Hedge funds have cut bullish bets on Gold very swiftly over the last 3 months

Precious metal assets such as Gold, Silver and Platinum have been in a rally mode over the last several days. While most investors are wondering what the reason is for recent strength, the most likely scenario is market participants' positioning and overall sentiment. After falling for weeks, breaking to new lows and constantly being regarded as a useless asset (especially by Tom Kenee on Bloomberg Surveillance), hedge funds and other speculators have now completely left the sector.

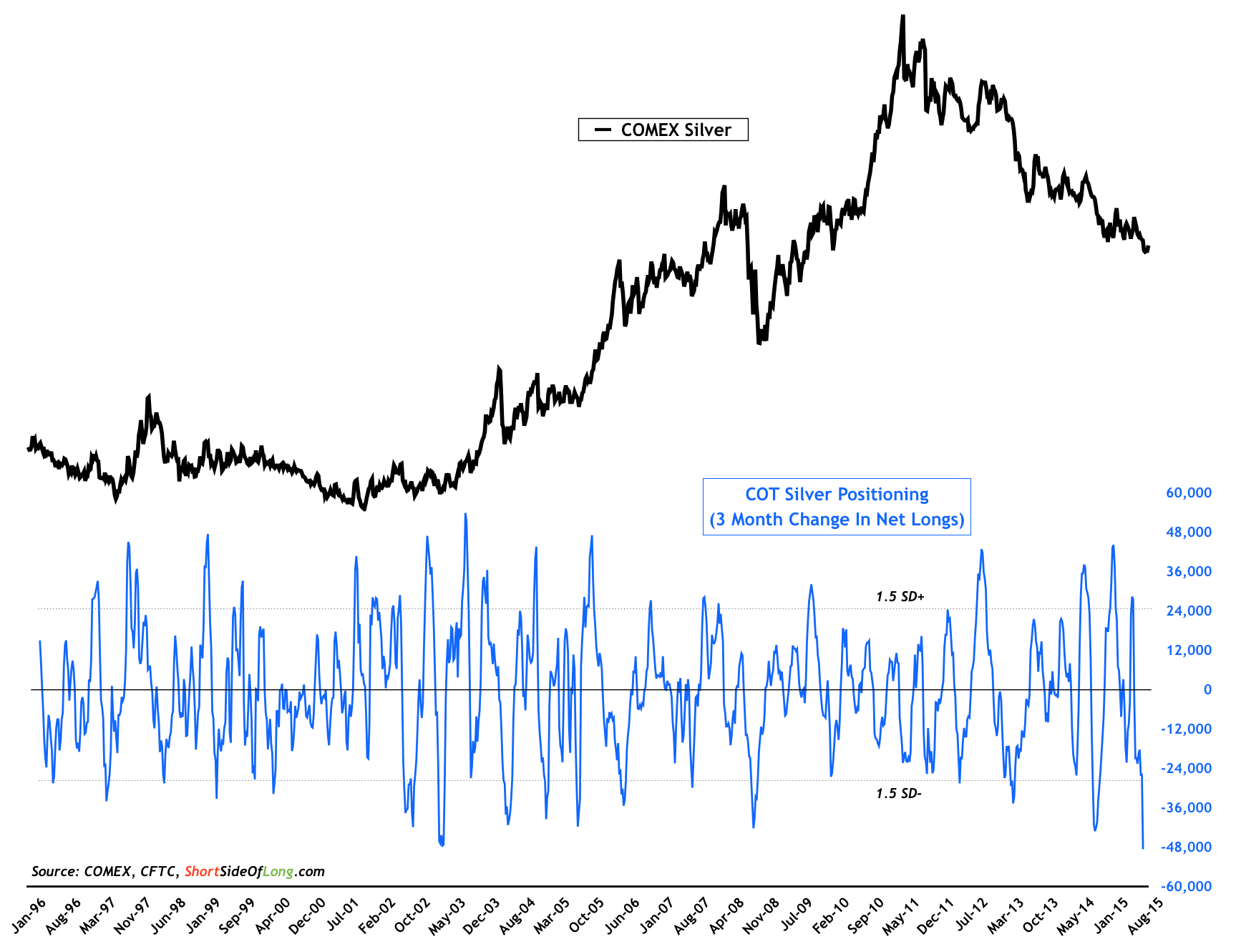

Speculators dramatic reduction in Silver net long contracts is one for the history books

Observing the two charts above, one linked to Gold COT and the other to Silver COT, we should be able to notice the dramatic reduction in net long positions. In the case of Silver, bullish bets were unwound so quickly and by such a large margin, that we have a 2.5 standard deviation event. Last time we saw behaviour like this was in early 2003 when Silver was starting a huge bull market rally that lasted for several years.

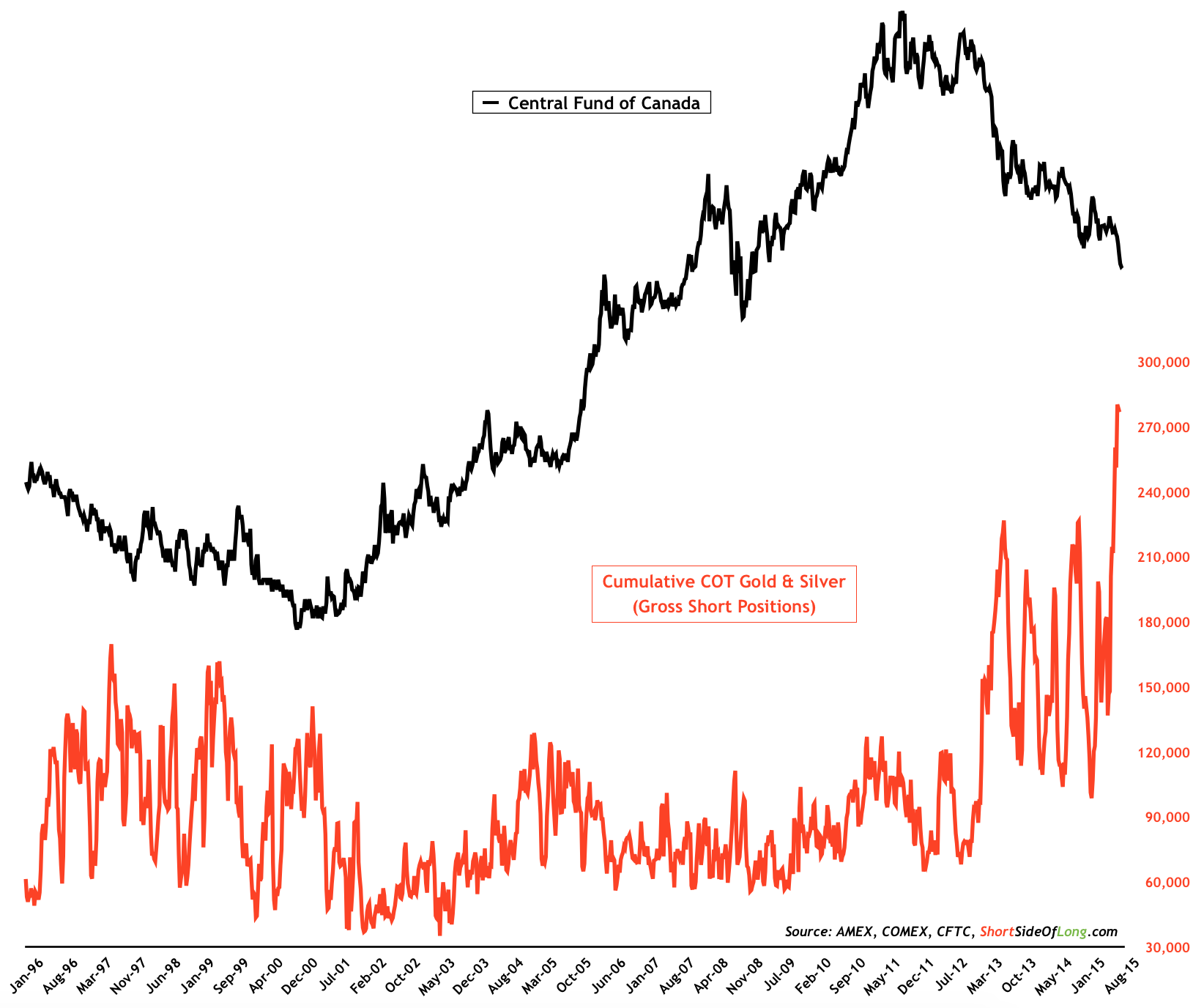

Currently, not only were overall positions cut sharply, but speculators also increased gross short interest on both Gold and Silver to yet another record high. Bearish bets climbed to over 280,000 gross futures contracts on Gold and Silver combined. In theory words, just above every man and his dog were expecting Gold to keep falling from here onward. Or even better, as Mr Tom Kenee said best: “Gold is classic textbook short.” Lucky for him, he has a job at Bloomberg Media and not as a trader who has to make a living from the markets.