Rising markets and a weakening US dollar are finding their momentum on Wednesday morning, driven by the impact of stimulus on the economy. Inflation expectations continue to increase, while a weak job market prevents the US from abandoning massive stimulus and the Fed from cutting on its bond purchases.

All this promises to push up the inflation rate. Inflation expectations are now at their highest in 7 years, but that is not yet a concern for the Fed. Richmond Federal Reserve President Thomas Barkin and Robert Steven Kaplan, president and CEO of the Federal Reserve Bank of Dallas made it clear earlier in the week that they are not worried about it.

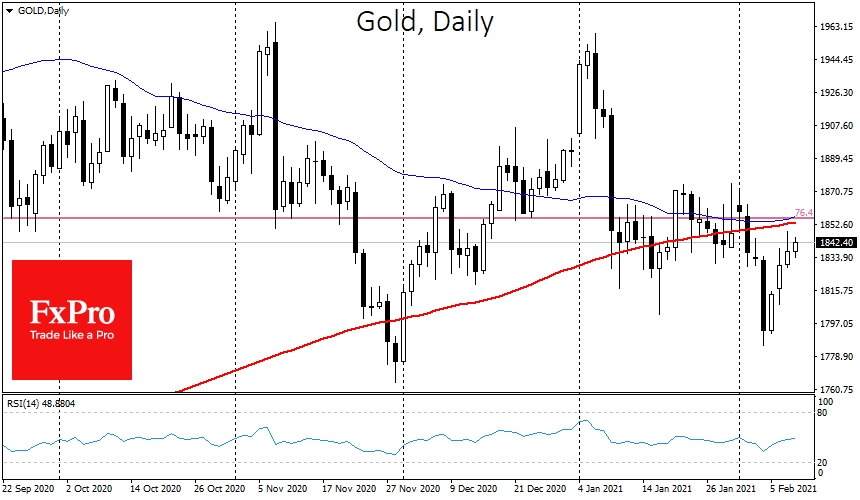

Against that backdrop, the markets have turned their attention back to instruments for a hedge against inflation, including gold.

Gold is trading at $1843, approaching the area where the 50 and 200 SMAs, which represent short- and medium-term trends, have almost converged. Going above those levels would signal that we have seen a "false" dip recently, and investors have started buying back the declines.

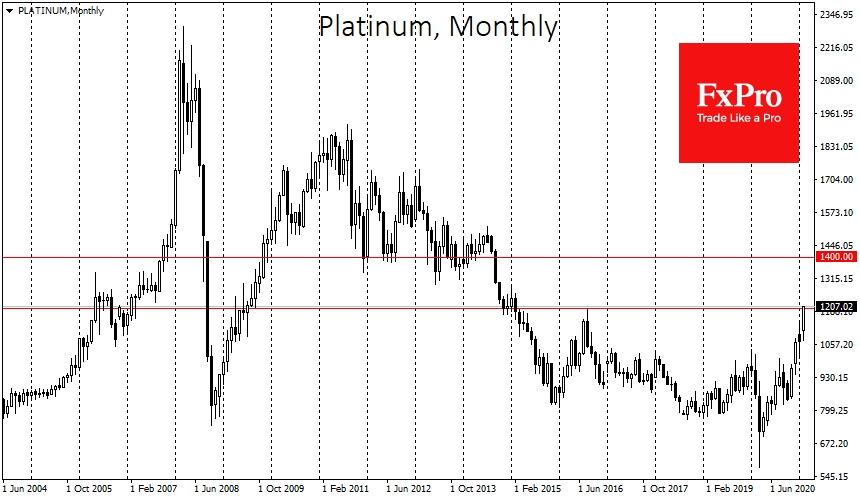

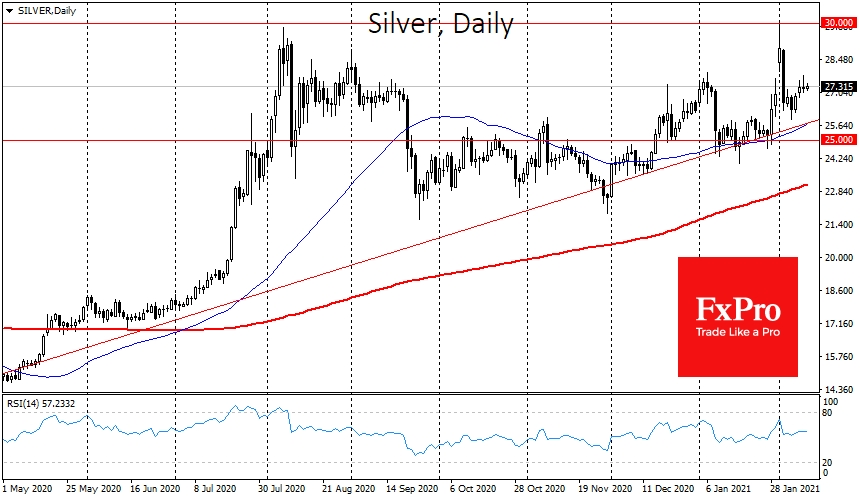

The positive outlook for gold is supported by the performance of the other precious metals. Silver and platinum have been attracting attention with sharp jumps and renewed highs.

This morning, the price of an ounce of platinum renewed its 6-year high, surpassing $1207. It then opens a straight path to the $1400 area, where Platinum was hovering from 2011 to 2014. The rise in its price is driven not by inflation expectations but by investors' bets on increased industrial demand for the metal, used to manufacture electric cars' components.

Silver has added for the fourth consecutive trading session, trading at $27.40. Although it is now below the highs at the start of trading in February, it is well within the long-term upward trend seen in March.

In all three metals, demand is driven by the stimulus' nature. The manufacturing and construction sectors are recovering at a faster rate, creating a rush for raw materials. And the fact that consumer welfare has not suffered during the crisis year sets the stage for accelerating inflation, from which households and corporate investors are actively seeking protection in metals and cryptocurrencies.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Precious Metals Resume Growth, Platinum At 6-year Highs

Published 02/10/2021, 05:09 AM

Precious Metals Resume Growth, Platinum At 6-year Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.