The US Dollar Index declined yesterday, while the precious metals market moved higher, possibly due to the relatively “turbulent” pre-election debate in the U.S. But still, did anything actually change regarding the outlook?

Not really.

As we have stated in our previous analyses, while gold and the rest of the precious metals market will probably decline significantly in the following weeks, and that a short-term correction would not be surprising at all. The same holds true for the USD Index, except that the direction of any possible moves could be considered the opposite.

Regarding the USD Index’s short-term chart, we’ve indicated the following:

Last week, the USD Index was just starting to break above the declining resistance line. We wrote that the situation doesn’t become crystal-bullish unless we see a confirmation of the breakout in the form of either a significant move above the resistance (it’s not significant so far), or three consecutive daily closes above it.

That’s exactly what we saw. The breakout is more than confirmed. We didn’t see a corrective decline, but rather, we’ve witnessed a pause. So, will we see a pullback soon? That’s quite possible, but definitely not inevitable. Such a decline could trigger a rally in gold, but we don’t think that any of these moves would be significant.

As it turns out, that’s precisely what we’ve witnessed this week.

The USDX moved a bit lower, while gold, silver and mining stocks moved slightly higher. However, the sizes of these moves were not particularly significant.

In the chart above, we see that the USDX has barely moved to the August highs, and then moved back up again (in today’s pre-market trading) – above these highs. What does that mean? It means that the pullback might already be over.

At the moment of writing, we can see that gold erased most of yesterday’s upswing (during the pre-market trading), which would support the theory above about the corrective move being over.

If we take the intraday prices into account, gold moved slightly above its August low, but that would not be the case if we consider the daily closing prices. In the latter case, we could even speak of a breakdown’s verification below the August low.

Silver corrected based on a relatively weak support level created by the local August lows. We’ve predicted that this move is not likely to be anything significant, and indeed, it wasn’t. Silver corrected a smaller part of the downswing, and it didn’t even manage to move back to the rising support line that it had broken earlier this month. Therefore, the outlook remains bearish.

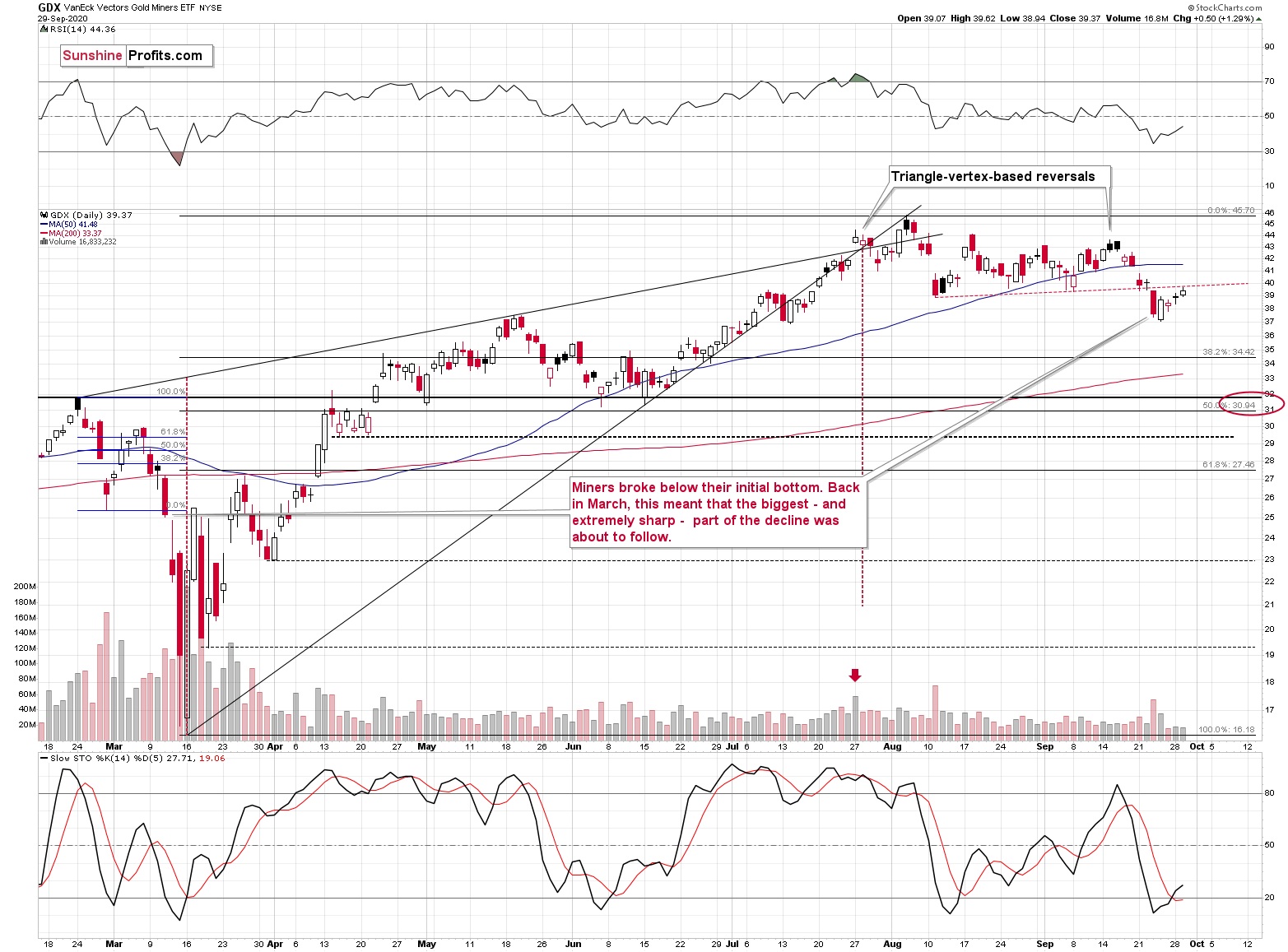

But, did it become bullish in the case of the mining stocks? After all, they just closed above their August low.

In short, we’re not buying the bullish narrative because of the following three reasons:

- It doesn’t fit the indications from the USD Index, gold or silver.

- GDX (NYSE:GDX) corrected to the rising resistance line, based on the previous lows (red, dashed line) without breaking it.

- Gold is already back to where it was 24 hours earlier, and since miners closed above their August low for just one day, it seems that this was somewhat accidental and that they will follow gold’s bearish lead that we’ve already detected in the pre-market trading.

In other words, practically everything that I wrote yesterday and in Monday’s extensive analysis still applies – the outlook for the precious metals market remains bearish for the next several weeks.