Talking Points

- Gold and Silver Downside Risks Remain Following Break Below Technical Barriers

- Copper and Crude Oil Suffer Ahead of Chinese September Manufacturing Figures

- Platinum Targets The 1,314 Floor Following A Slide Under The 1,360 Handle

The precious metals have extended Friday’s declines in Asian trading today with silver the worst performer of the group (currently weaker by 1.24 percent). Interestingly, the broad-based weakness for the metals has occurred alongside a dip for their pricing currency the US dollar index, as well as falls for major equity indices. This suggests the catalyst behind the alternative assets’ descent is a break of a key technicals, which may have triggered a cascade of sell orders.

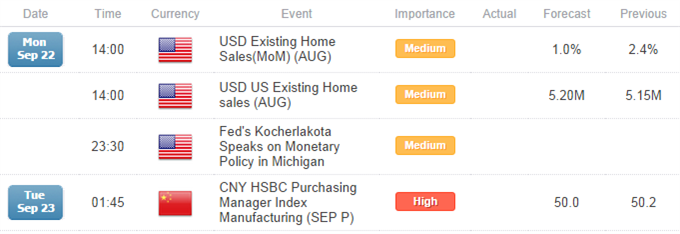

Looking to the US session; US Existing Home Sales data is the only medium-tier event on the horizon. The impact of the data on Fed policy bets and in turn the USD is questionable. Nonetheless, the tide has flowed in favor of the greenback over recent weeks, which may be difficult to turn unless incoming data dramatically deteriorates. In the absence of a severe correction for the reserve currency, the precious metals may be left searching elsewhere for their saving grace.

Finally copper (currently lower by -1.5 percent) and crude oil (WTI: -0.4 percent) have suffered further losses at the outset of the week. Pressure on the growth-sensitive commodities may be tied to anticipation over a deterioration in Chinese manufacturing figures due on Tuesday. A surprise slide into contractionary territory from the leading indicator would likely fan fears over a waning appetite for commodities from the Asian giant.

UPCOMING ECONOMIC DATA

CRUDE OIL TECHNICAL ANALYSIS

Crude is once again at a critical juncture as it teases at a push below the 91.20 barrier. Against a broader bearish backdrop a daily close below the noteworthy level would be seen as a fresh selling opportunity. At this stage reversal signals appear lacking, which casts some doubt on the potential for a recovery.

Crude Oil: Revisits 2014 Lows

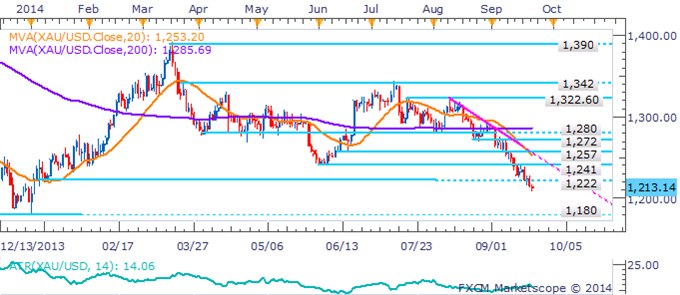

GOLD TECHNICAL ANALYSIS

Gold has edged out a daily close below former support-turned-resistance at 1,222. This has potentially opened the next leg lower towards the 1,180 mark with an absence of reversal signals in sight.

Gold: Break Below 1,222 Barrier Offers Fresh Short Entries

SILVER TECHNICAL ANALYSIS

Silver’s tumble has continued following a breach of the critical 18.50 mark. As noted in recent reports within the context of a sustained downtrend a push below the barrier would offer new short entries. Downside targets are offered by the July ’10 low at 17.30 and Late March ’10 low at 16.50.

Silver: Downside Risks Remain After Clearing Critical Barrier

COPPER TECHNICAL ANALYSIS

Copper has slid under the 3.08 floor, opening a knock on the next barrier at 3.01. A downtrend appears to be emerging for the base metal given the signals offered by the 20 SMA and Rate of Change indicator. However, recent price action has been relatively choppy, warning that a smooth ride lower may be difficult.

Copper: Price Compression Within Triangle Continues

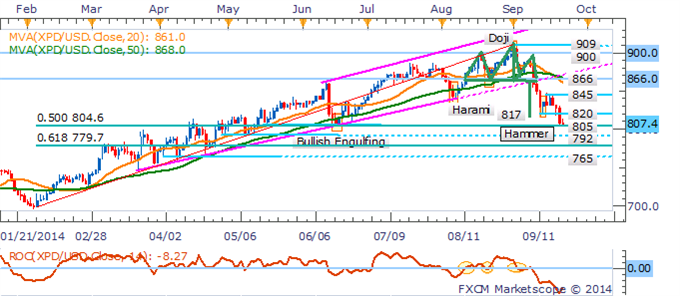

PALLADIUM TECHNICAL ANALYSIS

The presence of a short-term downtrend for Palladium warns of further weakness for the precious metal. A daily close below buying interest at the 50% Fib (805) would likely open the next leg lower to the 792 mark.

Palladium: Awaiting Push Past Buying Interest At Fib Level

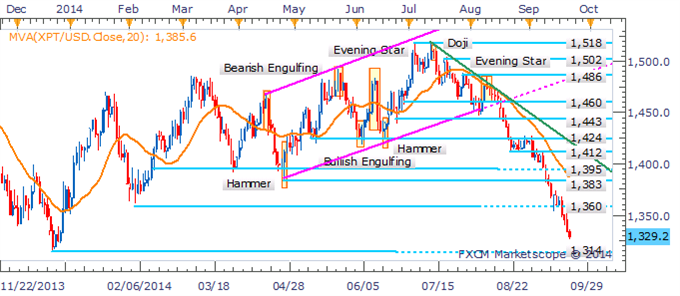

PLATINUM TECHNICAL ANALYSIS

Platinum’s woes have worsened in recent trade following the precious metal’s slide below the 1,360 floor. Against the backdrop of a core downtrend this casts the spotlight on the commodity’s 2013 lows at 1,314.

Platinum: May Extend Declines Amid Sustained Downtrend