The gold futures contract lost 0.35% on Thursday, as it slightly extended its Wednesday's decline of over 1.7%. Precious metals went lower following U.S dollar's advance. The stock market's rout didn't trigger any significant move in gold yesterday.

Last month yellow metal has reversed from its new record high of $2,089.20 after much better than expected Nonfarm Payrolls release. The following upward correction reached local high of $2,024.60 on August 18. Since then gold has been fluctuating, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is retracing some of yesterday's decline. What about the other precious metals? Silver lost 1.90% on Thursday and today it is 1.0% higher. Platinum lost 1.60% and today it is 2.2% higher. Palladium gained 2.39% on Thursday and today it's 1.1% lower. So precious metals are mixed this morning.

Yesterday's ISM Non-Manufacturing PMI release has been as expected and the Unemployment Claims number has been slightly better (lower) than expected at 881,000.

The financial markets are waiting for today's monthly jobs data release. The Nonfarm Payrolls number is expected to drop to +1,375 million from last month's +1,763 million.

Let's focus on today's Nonfarm Payrolls number release. Where would the price of gold go following that news release?

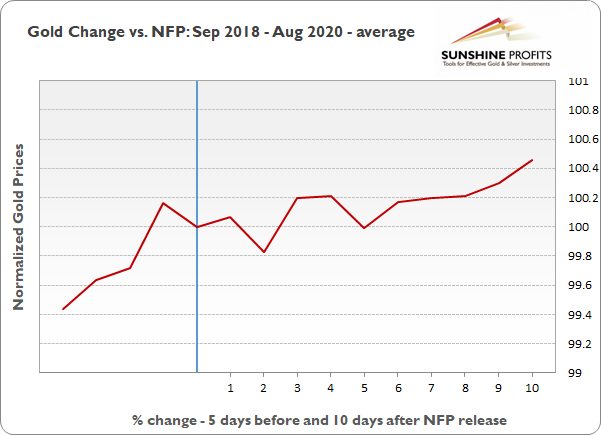

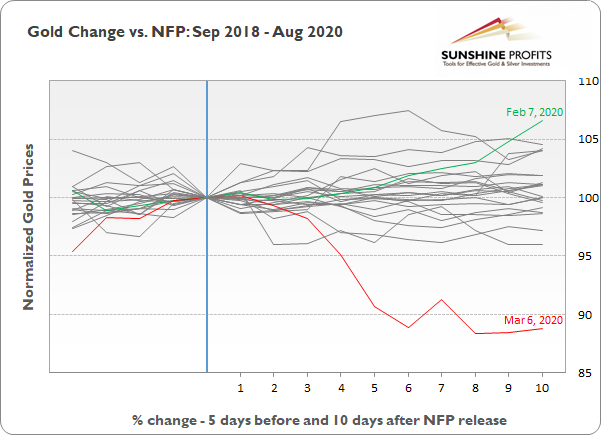

We've compiled the data since September of 2018, a 24-month-long period of time that contains of twenty four NFP releases. The first chart shows price paths 5 days before and 10 days after the NFP release.

We can see that the biggest 10-day advance after the NFP day was +6.6% in February of 2020 and the biggest decline was -12.7% in March of 2020. However, we've had an increased volatility following coronavirus fear then.

The following chart shows the average gold price path before and after the NFP releases for the past 24 months. The market was usually fluctuating for a week before advancing and closing 0.5% higher on the 10th day after the monthly Nonfarm Payrolls release.