The Gold Futures contract lost 1.73% on Wednesday, as it retraced its recent advance following bouncing off $2,000 price level. Gold reversed from its new record high of $2,089.20 a month ago after much better than expected Nonfarm Payrolls release, among other factors. The following upward correction reached local high of $2,024.60 on August 18. Since then gold has been fluctuating, as we can see on the daily chart:

Gold is 0.39% lower this morning, as it is extending yesterday's decline. What about the other precious metals? Silver lost 4.36% on Wednesday and today it is 0.91% lower. Platinum lost 5.10% and today it is 0.08% lower. Palladium lost 1.89% on Wednesday and today it's 3.6% higher. So precious metals are generally going down this morning, as U.S. dollar strengthens.

Yesterday's ADP Non-Farm Employment Change release has been worse than expected at +428,000. Today we will get the Unemployment Claims number at 8:30 a.m. and the ISM Non-Manufacturing PMI release at 10:00 a.m.

The financial markets will be waiting for tomorrow's monthly jobs data release.

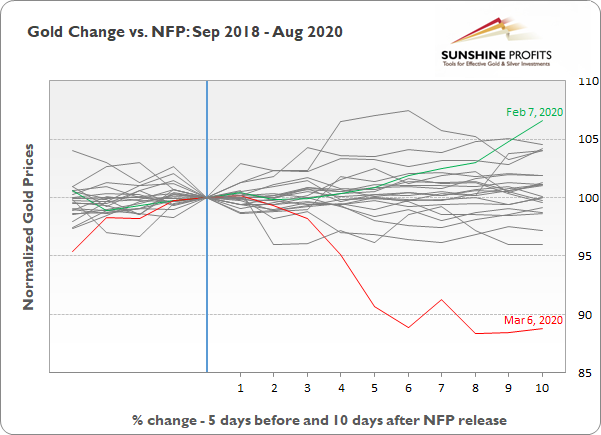

Let's focus on the Friday's Nonfarm Payrolls number release. Where would the price of gold go following that news release? We've compiled the data since September of 2018, a 24-month-long period of time that contains of twenty four NFP releases. The first chart shows price paths 5 days before and 10 days after the NFP release. We can see that the biggest 10-day advance after the NFP day was +6.6% in February of 2020 and the biggest decline was -12.7% in March of 2020. However, we've had an increased volatility following coronavirus fear then.

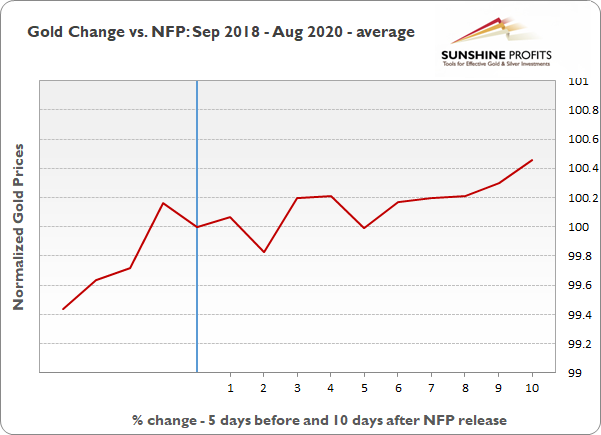

The following chart shows the average gold price path before and after the NFP releases for the past 24 months. The market was usually fluctuating for a week before advancing and closing 0.5% higher on the 10th day after the monthly Nonfarm Payrolls release.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, September 3

- 8:30 a.m. U.S. - Unemployment Claims, Revised Nonfarm Productivity q/q, Revised Unit Labor Costs q/q, Trade Balance

- 9:45 a.m. U.S. - Final Services PMI

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

Friday, September 4

- 8:30 a.m. U.S. - Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings m/m

- 8:30 a.m. Canada - Employment Change, Unemployment Rate