The question on everyone’s mind is: When is it a good time to buy some gold or silver after they bottom? The answer to that question is simple: When key triggers are met. Count-trend rallies in gold or silver don’t mean that they have enough energy and momentum to keep climbing. Miners also don’t have enough strength to lead the way in a fresh climb upwards for the precious metals, so everything we see now only speaks of corrective action.

Gold moved higher yesterday (Dec 8), while silver and mining stocks went in the opposite direction. It seems that the latter moved in tune with the trend, while the move in the former was rather accidental.

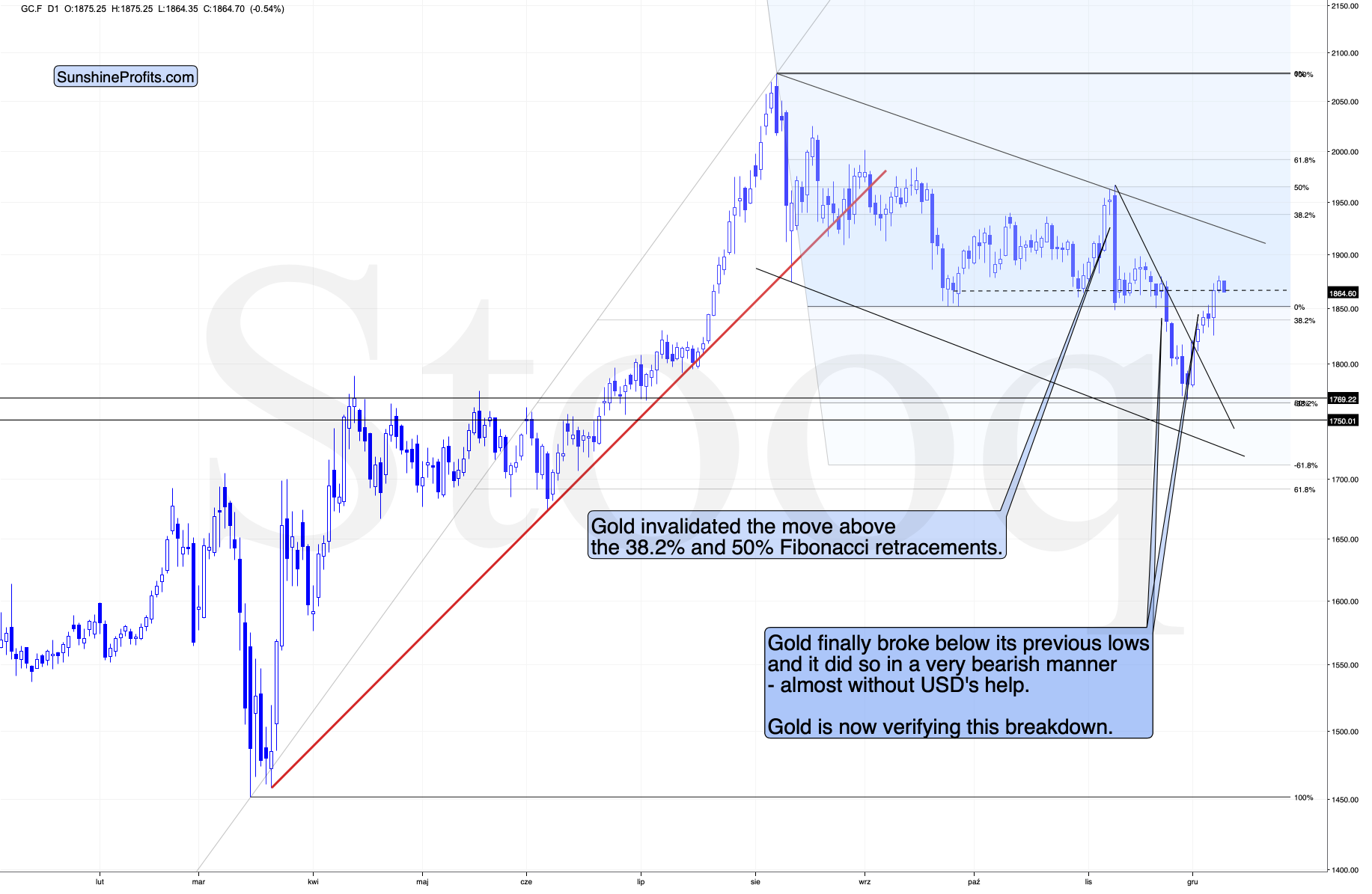

Why? Because gold already invalidated yesterday’s daily rally at the moment of writing these words (in the overnight trading). Yes, the closing prices matter the most, but if gold was really after an important breakout, it wouldn’t have wiped out the previous day’s entire rally just several hours after the closing bell.

I previously wrote that it had been quite possible for gold to rally up to its September lows, and the low in gold futures in terms of the closing prices was $1,866.30. Monday’s closing price for gold futures had been exactly $1,866, and yesterday, gold closed at $1,874.90. At the moment of writing these words, it’s trading at $1,864.60.

So, did anything particularly bullish happen on the gold market yesterday? Not really.

But can gold move even higher from here? As discouraging (or encouraging, depending on one’s perspective) as this answer may be, it’s a “yes”. The U.S. Dollar Index is currently trading at about 90.8, and its downside target is at about 90, so there is room for another short-term slide. Such a slide would be likely to trigger a rally in the yellow metal. How high could the rally go during this final part of the counter-trend corrective upswing?

Perhaps to the mid-November high of about $1,900. Even though gold might theoretically rally all the way up to the early-November high, I don’t see this as being likely.

Meanwhile, silver formed a tiny reversal yesterday and it’s moving lower today.

Silver reversed after touching the declining resistance line, which is also the upper border of the triangle pattern. Did we just see a top in silver? That’s quite likely, but not certain. I wouldn’t be surprised if silver took one final attempt to break higher and rally and topped close to the early November high. After all, silver is known for its fake breakouts.

Moreover, please note that silver has a triangle-vertex-based reversal point in the final part of the month, which could imply that this is where silver forms a final, or temporary bottom. This could have implications also for the rest of the precious metals sector, as its parts tend to move together in the short and medium term.

Given the bearish post-Thanksgiving seasonality in the case of precious metals and the tendency for them to form local bottoms in the middle or second half of December, it seems likely that the above is likely to be some kind of bottom.

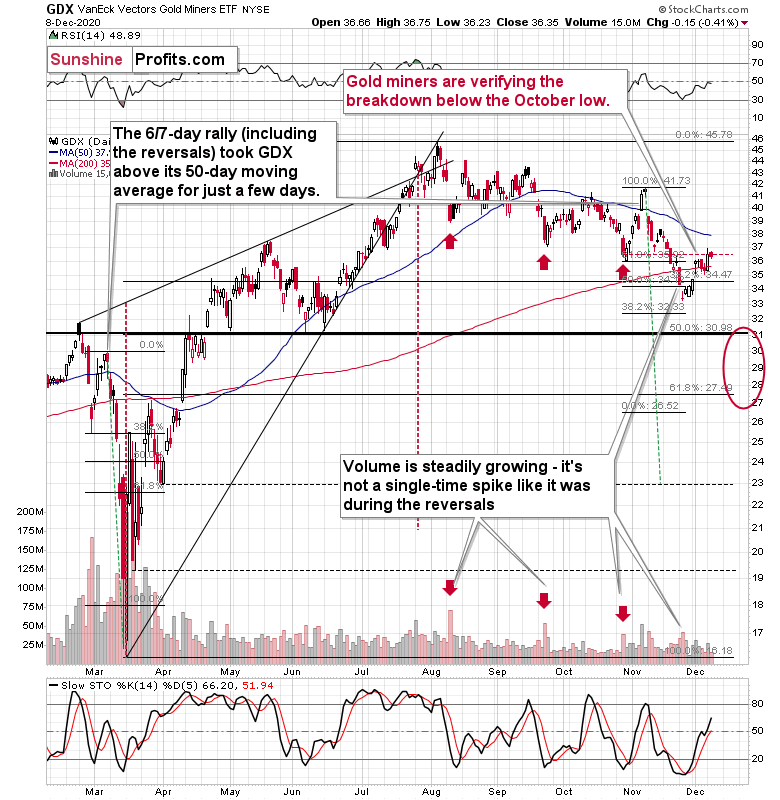

Mining stocks moved 0.41% lower yesterday, despite a higher close in gold futures and the GLD (NYSE:GLD) ETF. The general stock market moved slightly higher yesterday, so it wasn’t the reason behind miners’ weakness. This lack of strength confirms the points that I made yesterday and further validates the bearish picture:

What we see in the precious metals is just a correction, not the start of a new, powerful upleg. If it was, miners would have been leading the way higher. We currently see the opposite.

Over a week ago, I wrote that miners could move to the previous lows and by moving to them, they could verify them as resistance . The previous – October – low is at $36.01 in intraday terms and at $36.52 in terms of the daily closing prices. Yesterday, miners closed at $36.50.

So, while gold closed at its September low (in terms of the daily closing prices), gold miners closed at their October low.

If the USD Index declines one more time before bottoming, and gold rallies, miners could also move temporarily higher. How high could they move? I think that the mid-November high of about $38 (intraday high: $38.35, daily close: $38.01) would provide the kind of strong resistance that miners might not be able to breach.

Still, this upside is based on two big IFs.

The first “if” is if the USD Index declines to 90 or slightly lower – it’s extremely oversold, and the CoT reports confirm it.

The second “if” is if the precious metals sector really reacts to USD’s decline with a visible rally. In the past few weeks, gold shrugged off quite a few USDX declines. And miners shrugged off even more positive news.

Consequently, it seems that trying to take a profit from the possible, but not very likely, immediate-term upswing is not the best idea from the risk to reward point of view.