Precious metals gave back some gains to varying degrees as the dollar corrected, but overall still paint a rosy picture.

Gold

Gold gave back most of its gains overnight to finish unchanged at 1311.00 from the previous day. Having spiked to 1326.00 yesterday on the North Korean headlines in early Asia trading, gold fell victim to the general recovery in the U.S. dollar. The New York session unwound the extreme short term positioning the headlines had generated earlier in the day.

Gold’s pullback looks corrective in nature from a technical perspective. In the bigger picture the yellow metal consolidated its gains around the 1311.00 mark well above the previous high at 1301.00. An overbought RSI and some heavy data days from the U.S. into Friday’s Non-Farm Payrolls may slow the charge for now, but overall the technical picture remains constructive.

Gold has resistance at the overnight highs of 1326.00 followed by 1337.00. Support rests at 1301.00 and 1296.00 followed by the ascending trend line, today at 1282.50.

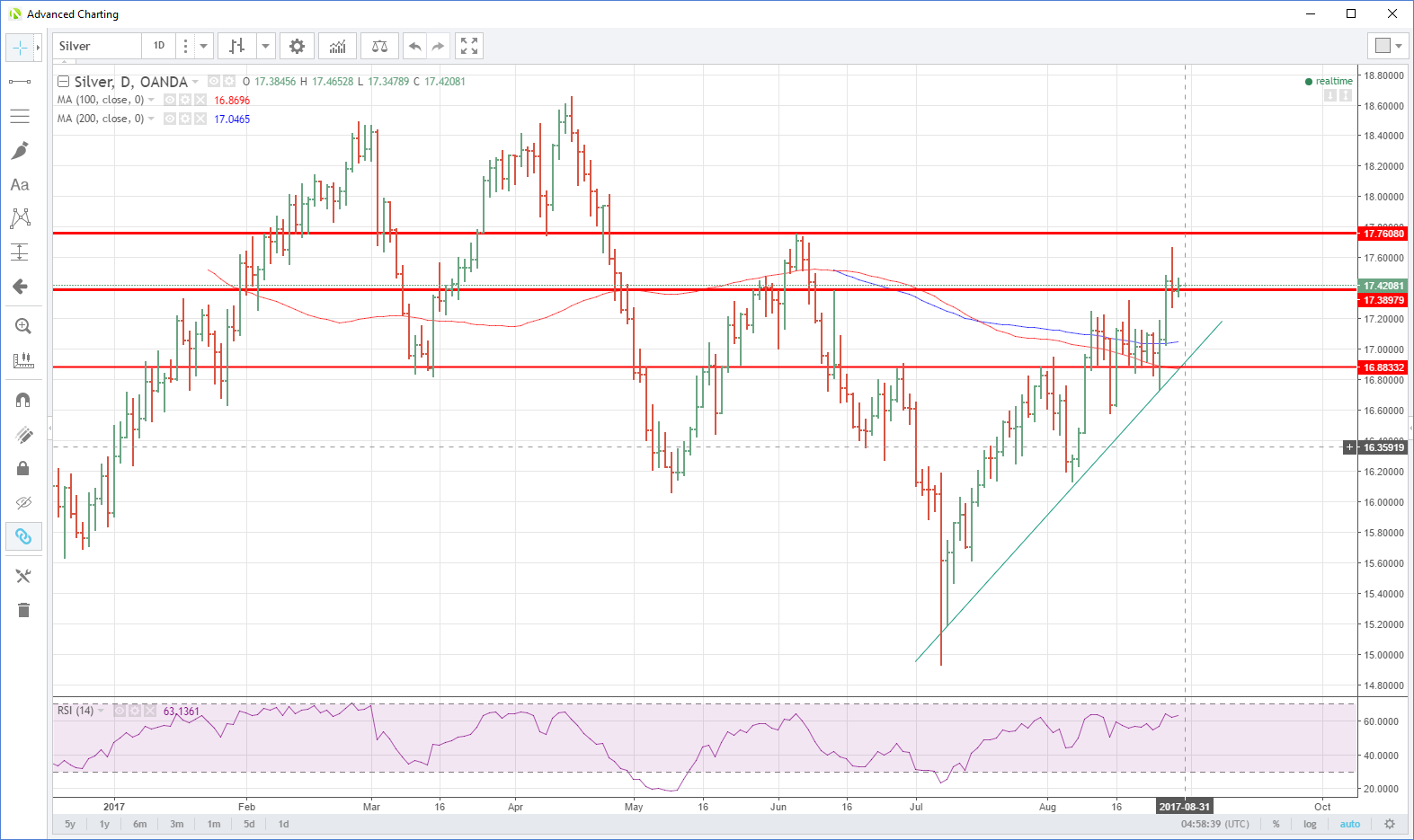

Silver

Silver too, gave up its overnight gains to finish just above support at 17.3900. It has managed a small rally in Asia though, climbing back to 17.4510 in early trading to level the technical picture still positive.

Key resistance still lies at 17.7600 with only a break of the ascending trend line support at 16.8830 casting doubt on the technical picture.

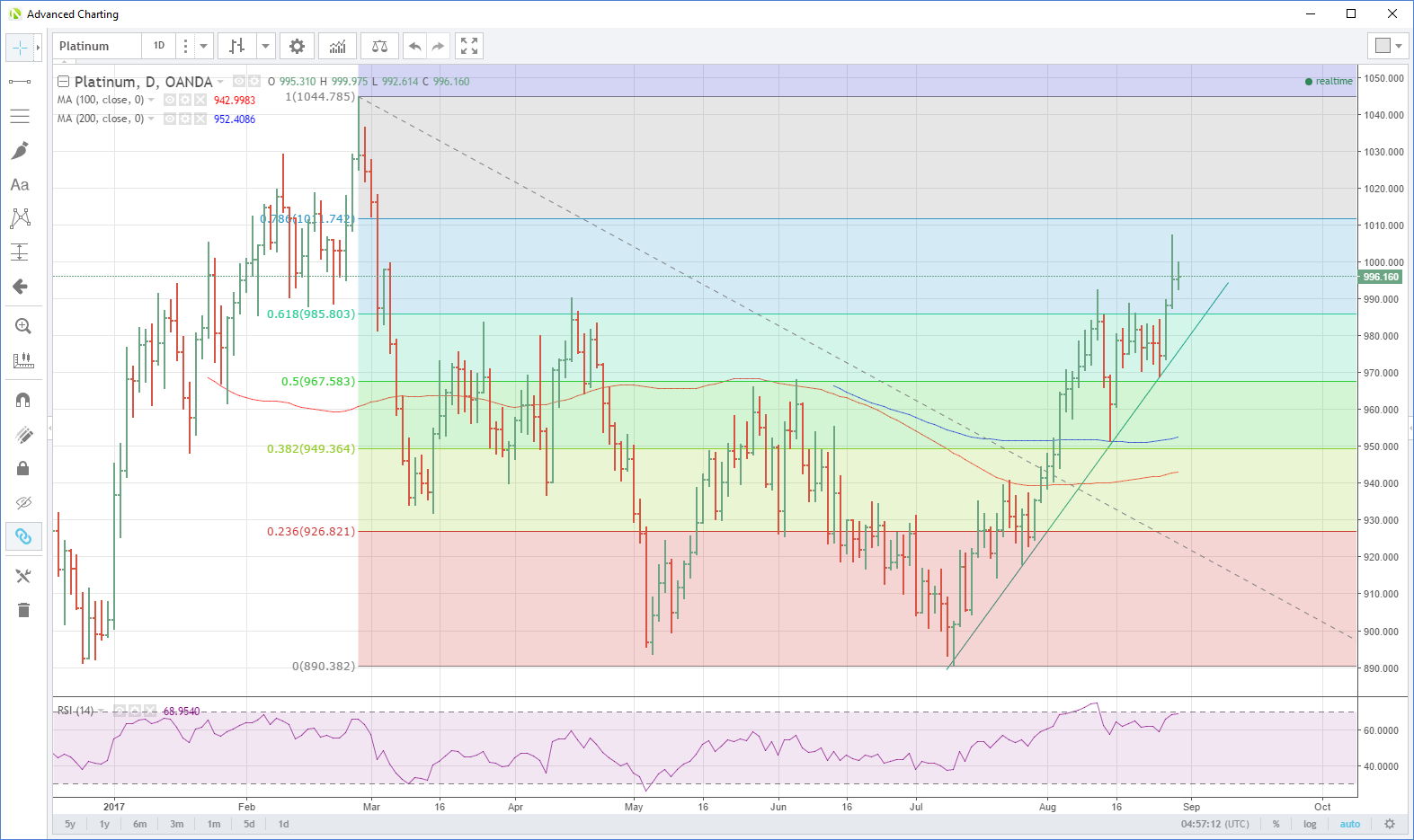

Platinum

Platinum carved through the psychological 1000.00 mark overnight and of the three metals, gave up the least of its gains, finishing comfortably above its opening to close at 995.00.

Platinum has continued to push higher in early Asia trading, up five dollars to 1000.00. Initial resistance is at the overnight high of 1007.00 followed by the more formidable 76.80% Fibonacci at 1012.00.

Supports appears initially at 989.00 followed by the rising trendline support today at 976.00.

Palladium

Palladium shrugged of the dollar correction and marched higher, as it has wanted to do for most of the year. Among the precious metals, palladium hardly flinched yesterday, finishing at 945.00 just off its highs of 950.00 and first resistance level. Support appears at 941.00 followed by the 919.00 breakout. Although the RSI is approaching overbought territory, any correction will likely be a shallow one looking at the technical picture.