A few weeks ago we wrote that precious metals were at risk of a correction. First, they powered higher. But last week they ran into technical resistance levels that date back well beyond only a few years.

This is true for Gold, Silver as well as the miner ETFs: VanEck Vectors Gold Miners (NYSE:GDX) and VanEck Vectors Junior Gold Miners (NYSE:GDXJ).

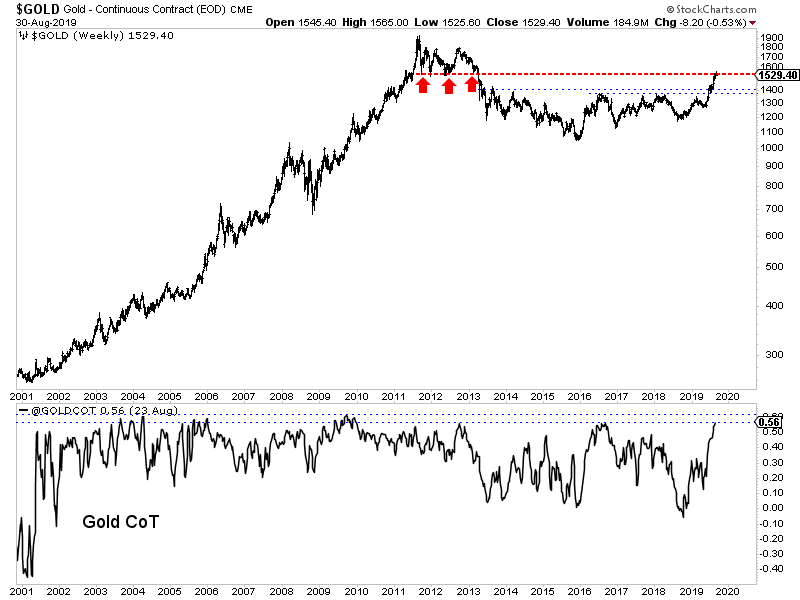

Starting with Gold, we can see that it has struggled to get through $1550/oz. That’s not a surprise as we pointed out this level as resistance since Gold surpassed $1370/oz.

The combination of multi-year resistance at $1550/oz and the current high net speculative position could force Gold down to a retest of $1400/oz.

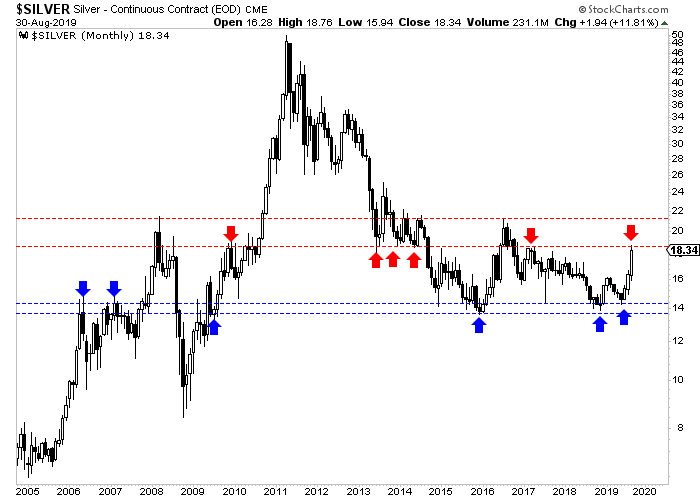

Meanwhile, Silver has been the strongest component of the sector in the short-term.

It closed the month of August right at major resistance in the mid $18s, which as you can see, has been a key level for the last 11 years. A monthly close above $18.50 would be significant but it may not happen until October or November.

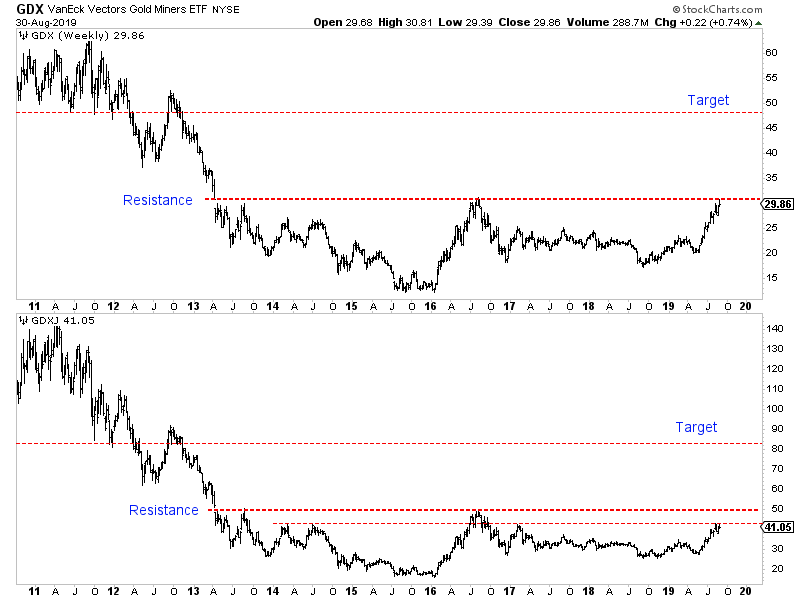

Turning to the stocks, we see that GDX (NYSE:GDX) has reached its 2016 high and 6-year resistance. A correction or consolidation for weeks or even a few months would be perfectly normal.

GDXJ has lagged, much like Silver, as it has yet to reach its 2016 high near $50. However, it is dealing with important resistance at $42 which dates back to 2014.

As summer winds down, the excitement in precious metals is building. The retail crowd is looking to jump back in for the first time in years and the same can be said for many institutions.

In the big picture, this is the time to jump back in. You do want to get in before the sector makes its next break higher and before GDX (NYSE:GDX) and GDXJ surpass multi-year resistance.

However, the immediate risk appears to be to the downside.

Gold, Silver and gold stock ETFs all are at multi-year resistance levels. A correction and consolidation is perfectly normal and should be expected here.

If you missed the recent run, don’t panic. It’s best to exercise patience and wait for weakness. Better value and new opportunities will emerge.