The anticipated gold rebound is under way, and my open long position is solidly profitable right now. In line with the case I've been making since the end of January, the tide has turned in the precious metals, and we are in a new bull upleg, which will become quite obvious to the bears.

Don't forget about my dollar observations made yesterday, as these are silently marking the turning point I called for:

(…) The weak nonfarm employment data certainly helped, sending the dollar bulls packing. It's my view that we're on the way to making another dollar top, after which much lower greenback values would follow. Given the currently still prevailing negative correlation between the fiat currency and its shiny nemesis, that would also take the short-term pressure of the monetary metal(s).

"What would you expect given the $1.9T stimulus bill, infrastructure plans of similar price tag, and the 2020 debt to GDP oh so solidly over 108%? Inflation is roaring – red hot copper, base metals, corn, soybeans, lumber and oil, and Treasury holders are demanding higher yields, especially on the long end (we‘re getting started here, too). Apart from the key currency ingredient, I‘ll present today more than a few good reasons for the precious metals bull to come roaring back with vengeance before too long."

So, let‘s dive into the charts (all courtesy of www.stockcharts.com).

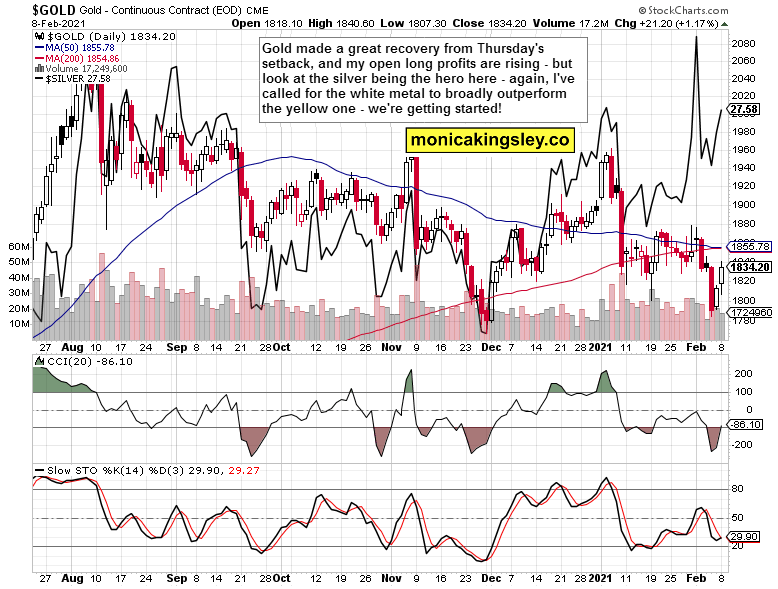

Gold And Silver

Let‘s overlay the gold chart with silver (black line). The disconnect since the November low should be pretty obvious, and interpreted the silver bullish way I‘ve been hammering for weeks already. Please also note that the white metal has been outperforming well before any silver squeeze caught everyone's attention.

Let‘s go on with gold and the miners (black line). See that January dip I called as fake? Where are we now? Miners are no longer underperforming, and the stage is set for a powerful rise.

Just check the gold miners to silver miners view to get an idea of how much the white metal's universe is leading everything gold. Another powerful testament to the nascent bull upleg in the precious metals.

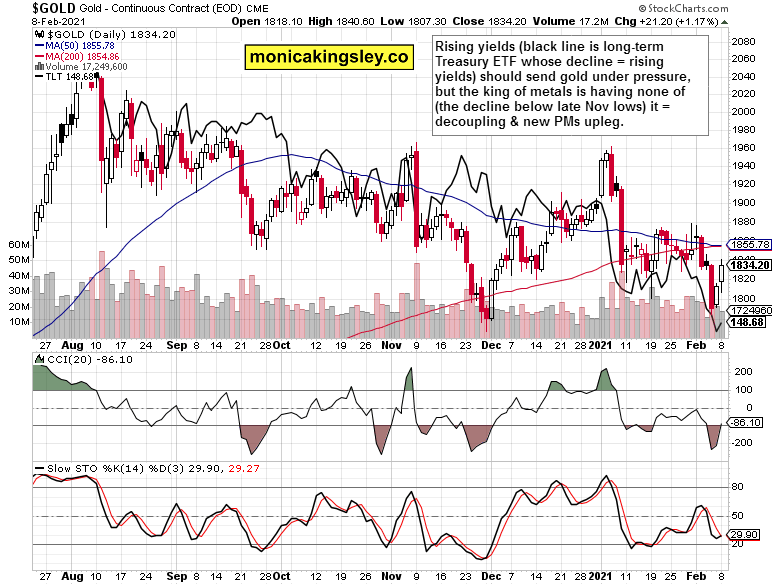

Continuing with gold and long-term Treasuries (black line), we see that the king of metals isn't giving in. Instead, its rising in the face plunging Treasuries that are offering higher yields now. No, the yellow metal is decoupling here, as the new precious metals upleg is getting under way.

The greenback is the culprit. The world reserve currency will indeed get under serious pressure and break down to new lows as the important local top is being made.

Summary

The gold and silver bulls are staging a return, as last week's price damage is being repaired. The signs of a precious metals bull, of a new upleg knocking on the door, abound. Patience will be rewarded with stellar gains.