For years, many Gold Bugs (investors who’ve been advocating buying Gold and Silver at low prices as a hedge against future global economic risks) were shunned as conspiracy theorists and nuts. How could these people believe Gold and Silver were solid investments when the global equities markets were rallying 5% a year consistently – what could go wrong?

Over the past two weeks, I have personally received multiple phone calls and emails from friends and associates asking how these people can suddenly ”buy physical metals.” In one case, this individual was purchasing Airline and Food Services stocks in late February thinking this move would be short-lived and telling me how the airlines would recover quickly after this is all over. Now, that person wants to know my secret contacts for buying physical metals.

Yes, the prices have begun to skyrocket a bit – Silver especially. What’s going to happen over the next few weeks is that more and more average people are suddenly going to realize they should have been buying metals as security against risk. Paper metals are going to explode as well, but physical metals will demand a premium that is much higher than paper/spot price. Right now, one ounce of Silver is going for about $21 to $25 per ounce in physical form (depending on my sources). The current SPOT price of silver is $14.50. That means the premium for physical Silver is between +45% to +75% right now in the open market.

Daily Gold Chart

This Daily Gold chart highlights the upside Fibonacci price targets using our Adaptive Fibonacci Price Modeling system. We believe the next upside price target for Gold is $1825. A higher upside price target is visible on this chart near $1950 and we believe Gold prices will reach this level eventually. But we believe the current $1825 level is the immediate target. This would represent an immediate +10 upside price advance and would establish NEW HIGH prices for the past 9 years.

Silver Daily Chart

This Silver Daily chart also highlights our Adaptive Fibonacci Price Modeling system and shows an upside price target of $17.25. Remember, the current physical demand for Gold and Silver has skyrocketed over the past 2+ weeks. The Spot price is really not indicative of the open market price of physical at the moment. If Spot Silver moves to $17.25 as we predict, that would be a +19% upside price advance. If Silver advances to $18.25, that would be a +26% upside price advance.

You should also take a look at our silver chart from 1999 and what happened then, and should happen again now as well.

Silver Bugs are loving the setup right now because they know the pattern that sets up in the Metals market when a crisis hits. First, Gold begins to rally faster than Silver and the Gold to Silver ratio spikes higher. Then, once the shock-wave of the market crisis subsides, the metals begin a fairly usual price advance where both Gold and Silver advance – in unequal forms. This is when the real fun for Gold and Silver Bugs begins.

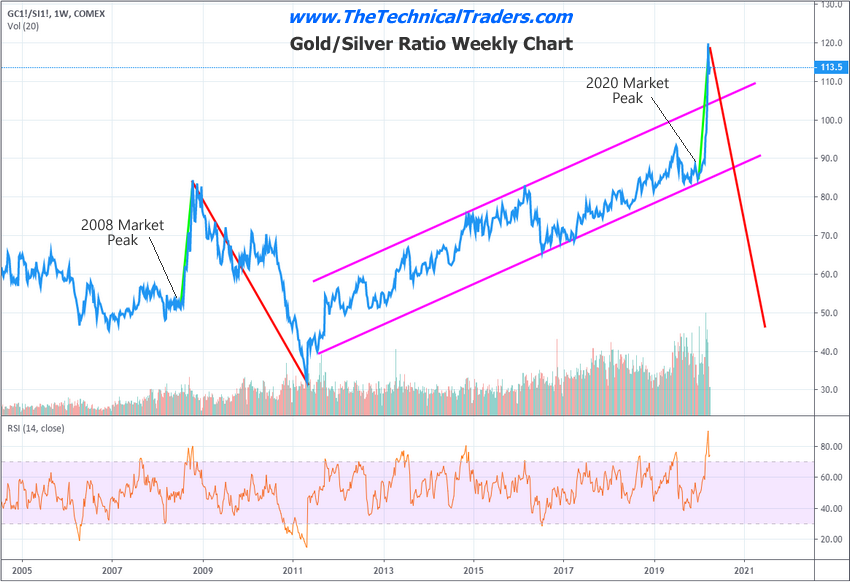

Gold to Silver Weekly Ratio Chart

THE SILVER LINING

Take a look at this Gold to Silver Weekly Ratio chart. This chart measures how much one ounce of silver it takes to purchase one ounce of gold at current prices. Notice that spike in the ratio back in 2008? That was the spike in gold prices relative to silver prices as the top formed in 2008 and the “shock wave” struck global investors. What happened? Everyone tried to pile into the Gold trade and ignored Silver for about 6+ weeks.

Then what happened to the Gold to Silver Ratio? It COLLAPSED from levels near 85 to a bottom hear 31. That means the price of Silver advance almost 3x faster than the price of Gold over that span. In order for the ratio to fall from near 90 to levels near 30, that indicates a very expansive price increase in the price of Silver.

Now, take a look at what has happened just recently in the Gold to Silver Ratio… another massive price spike. This time, the spike reached levels near 120 (Yikes). Can you guess why Gold and Silver Bugs are so excited right now? If another price advance takes place in precious metals which is similar to the 2008~2011 rally, Gold may see a 300% to 500% rally and Silver may see a 450% to 900% rally over the next 2 to 3 years.

This is no joke. Physical metals are why Gold and Silver Bugs believe the value of having it in your hands is much better than owning an IOU from a broker or bank.

Get ready for some incredible price moves in the metals markets and congrats to all the Gold and Silver bugs out there. Our analysis says our patience and accumulation of physical metals will soon pay off in a big way.