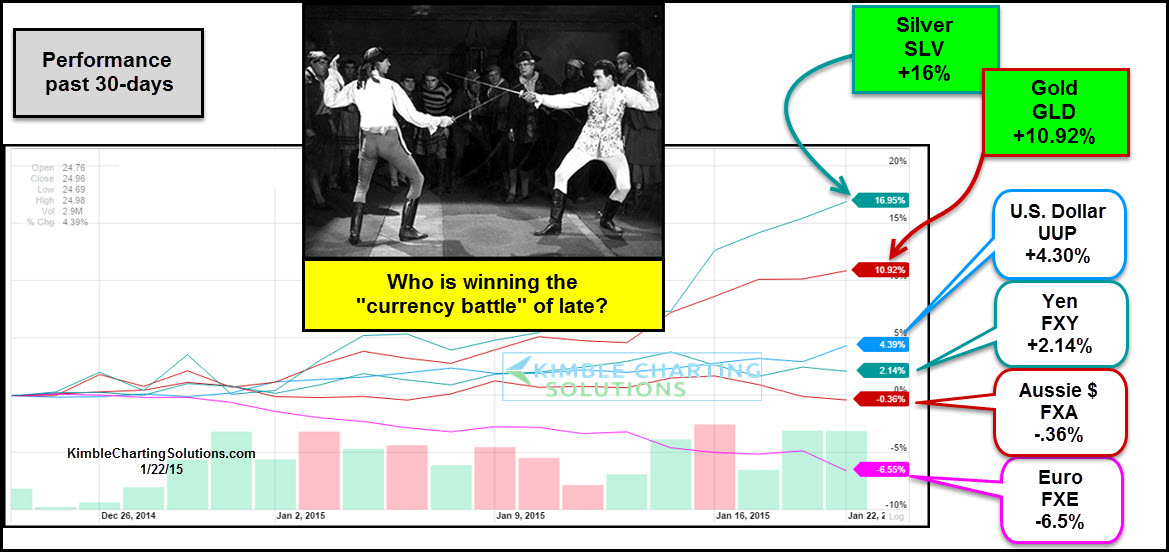

When you look at a few of the leading currencies around the world over the past 30 days, no doubt the US dollar is acting pretty strong, especially against the euro.

If you add gold and silver to the currency battle, the dollar doesn't look so strong.

When you compare the U.S. dollar to gold and silver over the past 30 days, the clear winner in the currency battle is not the USD, despite it's recent strength. As you can see from the chart above, the dollar has lost around 6% against gold and around 10% vs. silver.

The Power of the Pattern shared a couple of days ago that the gold/dollar ratio was turning up, despite recent strength in the dollar. (see post here).

Silver ETF (ARCA:SLV) is facing a trio of resistance at (1) above. If it can break above, flows toward silver could really pick up and keep the metal as the leader vis-a-vis the currency battles.

Full disclosure...Members are long the metals complex due to this strength and gold/silver breaking above channel resistance last week.