The Gold Futures contract gained 0.81% on Monday, as it retraced its Friday's decline. So gold is still trading within a consolidation along $1,950-2,000. The market retraced most of the decline from September 1 local high of $2,001.20 on Thursday, before going back below $1,950 recently. Gold price is trading within an over month-long consolidation, as we can see on the daily chart:

Gold is 0.7% higher this morning, as it is extending Monday's advance. What about the other precious metals? Silver gained 1.85% on Monday and today it is 1.4% higher. Platinum gained 2.01% and today it is 1.1% higher. Palladium lost 0.27% on Monday and today it's 1.5% higher. So precious metals are extending their yesterday's advance this morning.

Yesterday we didn't get any important economic data releases. Today there will be the Empire State Manufacturing Index release at 8:30 a.m. and then at 9:15 a.m. we will get the Industrial Production and Capacity Utilization Rate numbers. But markets will be waiting for Wednesday's FOMC Statement release.

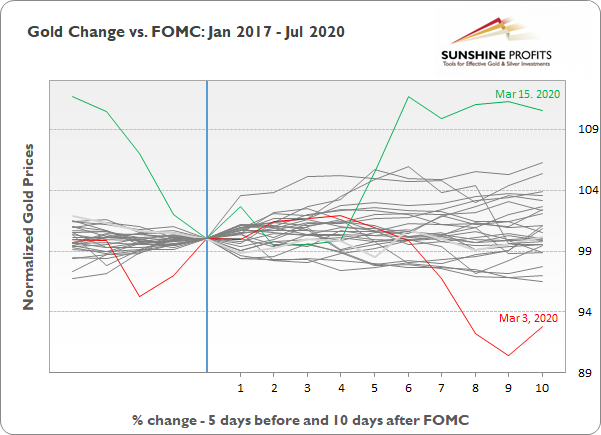

Let's focus on tomorrow's Fed announcement. Where would the price of gold go following the news release? We've compiled the data since January of 2017, a 43-month-long period of time that contains of thirty FOMC releases. The first chart shows price paths 5 days before and 10 days after the FOMC release. We can see that the biggest 10-day advance after the NFP day was +10.5% after March 15, 2020 release and the biggest decline was -7.2% after March 3, 2020 release. However, we've had an increased volatility following coronavirus fear then.

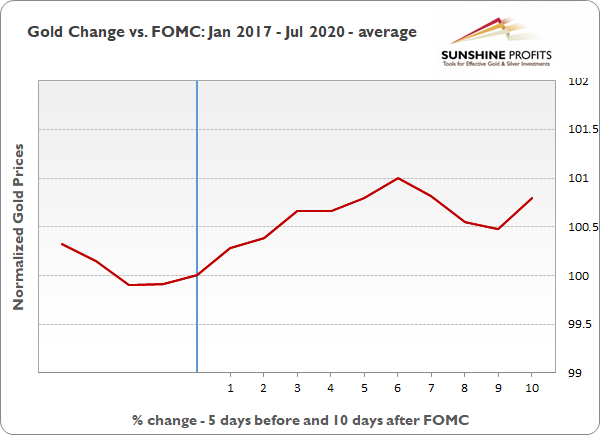

The following chart shows average gold price path before and after the FOMC releases for the past 43 months and 30 releases. The market was usually declining ahead of the FOMC day. Then it was going up for a week-long period. We can see that on average, gold price was 0.8% higher 10 days after the FOMC Statement announcement.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, September 15

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- 8:30 a.m. U.S. - Empire State Manufacturing Index, Import Prices m/m

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

Wednesday, September 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 10:00 a.m. U.S. - Business Inventories m/m, NAHB Housing Market Index

- 2:00 a.m. U.S. - FOMC Statement, FOMC Economic Projections, Federal Funds Rate

- 2:30 p.m. U.S. - FOMC Press Conference

- Tentative, Japan - Monetary Policy Statement, BOJ Policy Rate