Investing.com’s stocks of the week

Growth concerns about China and Europe have stung markets again this morning – pushing the dollar back up towards 80 on the USDX and hurting precious metals. The gold price has fallen below support at $1,650, though it should encounter increased bids around $1,630. The silver price has unsurprisingly fallen harder and faster than gold, and is now under $32. Platinum is now cheaper than gold again – a sure sign of “risk off” moves by traders.

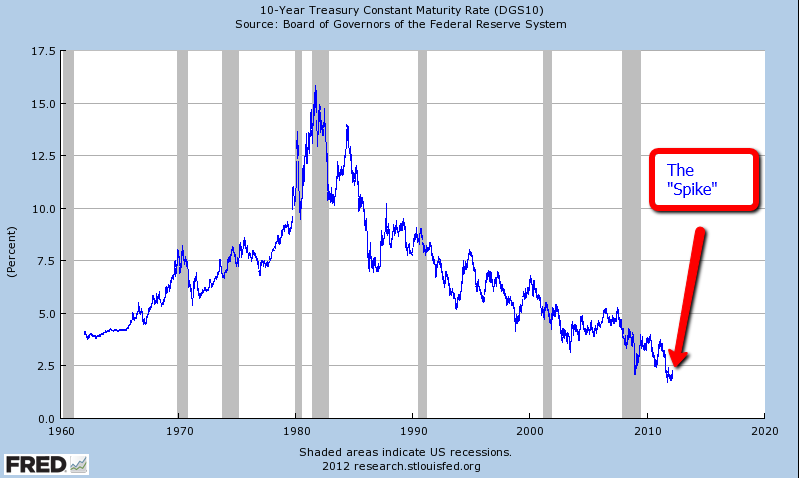

Commodities were also weak yesterday, though WTI crude oil proved the exception, bolstered by reports of a surprise drop in US oil inventories. The cautious mood in equities and commodities has gone hand-in-hand with gains for US Treasuries, with the yield on the 10-year note falling to 2.29% this morning. TheArmoTrader puts the recent spike in Treasury yields in perspective with the chart below.

This yield will have to get above 4.0% at least before we can start talking about the end of this bull market. That said, nobody should doubt the seriously bearish fundamentals as far as the US bond market is concerned, something discussed by Frederick Sheehan in an insightful article at TheBigPicture.

Sheehan notes the importance of falling Chinese and Japanese demand for Treasuries – something we noted in a recent Gold Research article. The age of thrifty Asians subsidising western consumption is drawing to a close.