“The bad news is, time flies. The good news is, you’re the pilot.” – Michael Altshuler

A few stocks are acting nice, especially in the mining sector, but for the most part we are rangebound.

I was stopped out my heavy Twilio Inc (NYSE:TWLO) positions while I was on the road Wednesday but I am holding my miners still, for as long as they continue to move higher.

The presidential debate isn’t really having any effect on stocks and at this rate we may not see much movement until after the election so I’m trading a few with a cautious stance using tight stops.

Netflix Inc (NASDAQ:NFLX) continues to act very strongly after earnings so if a few more of the big boys report well we may see everything turn higher as so often happens.

Time will tell.

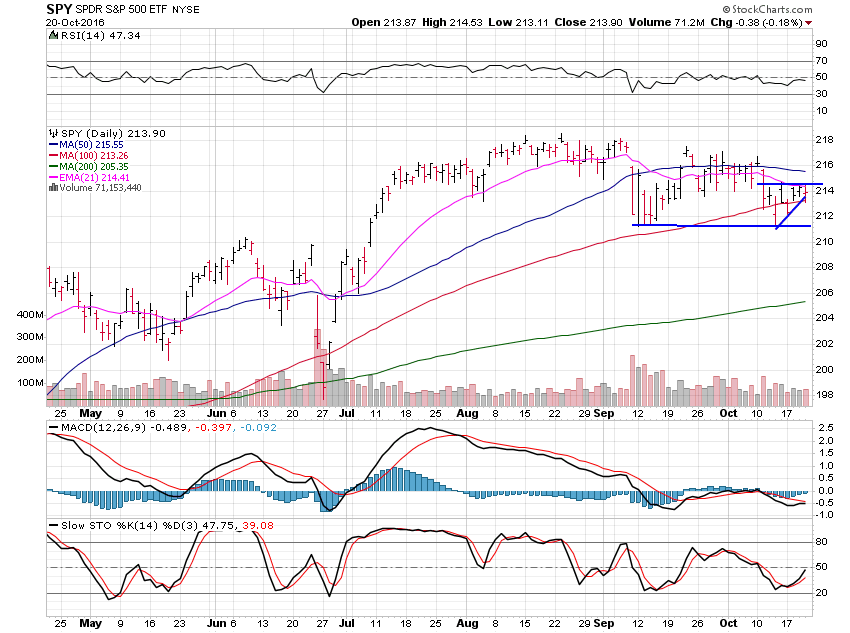

SPDR S&P 500 (NYSE:SPY) isn’t doing much here as it trades between the 21 and 100 day moving averages.

Above the 21 day at 214.41 is positive while a move under the 100 day at 213.26 is negative.

The chart is sloppy here with a potential double bottom in place, or you could make the case for a loose bear flag as well.

The most troubling pattern I see in the chart is a large head and shoulders top.

I will trade whatever pattern is confirmed.