Industrial gas producer and supplier Praxair Inc. (NYSE:PX) recently hiked the prices of industrial and medical gases for its bulk gas customers in the U.S. and its territories. The revised prices will be effective from Jul 15, 2016.

As revealed, prices of nitrogen, oxygen, argon, hydrogen, helium and carbon dioxide have been increased up to 15%.

Praxair cited the need to fund capital investments for improving in its production and distribution capabilities as the reason behind the rise in prices. Earlier, the company had increased its industrial and medical gas prices in Dec 2015 to support rising costs and higher investment needs.

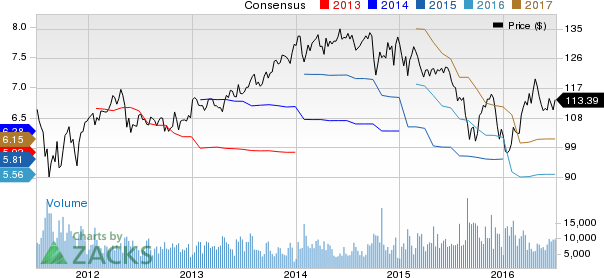

We believe Praxair’s profitability is highly dependent on costs of sales and expenses, as any unwarranted increase in these will lower the profitability and vice versa. However, increasing application has been raising the demand for industrial gases over time, proving beneficial for companies like Praxair. Exiting first-quarter 2016, the company had a solid backlog of $1.5 billion. In addition, Praxair boasts a diversified product portfolio and a large worldwide client base. Over the last 60 days, the Zacks Consensus Estimate for Praxair has remained stable at $1.35 per share for second-quarter 2016 and $5.56 for 2016, while the same has inched down 0.2% to $6.15 for 2017.

Despite the long-term positives, the company’s exposure to certain near-term headwinds has restricted its growth momentum. Currently, the stock has a market capitalization of $32.4 billion and carries a Zacks Rank #3 (Hold).

Some of Praxair’s prime competitors are performing well, having gained high investment rankings. These stocks include Albemarle Corporation (NYSE:ALB) , Axiall Corporation (NYSE:AXLL) and Innophos Holdings Inc (NASDAQ:IPHS) , each sporting a Zacks Rank #1 (Strong Buy).

PRAXAIR INC (PX): Free Stock Analysis Report

ALBEMARLE CORP (ALB): Free Stock Analysis Report

INNOPHOS HLDGS (IPHS): Free Stock Analysis Report

AXIALL CORP (AXLL): Free Stock Analysis Report

Original post

Zacks Investment Research