Industrial gas producer and supplier Praxair Inc. (NYSE:PX) reported impressive bottom-line results for second-quarter 2017. Adjusted earnings came in at $1.46 per share, surpassing the Zacks Consensus Estimate by 2.1%.

Also, the bottom line increased 5% from the year-ago quarter’s tally of $1.39 on the back of revenue growth. However, rise in cost of sales played spoilsport in the quarter.

Revenues totaled $2.834 billion, roughly in line with the Zacks Consensus Estimate of $2.83 billion. Compared with the year-ago quarter’s tally, the top line grew 6.3%. The year-over-year improvement was driven by 3% gain from volume growth, 1% from favorable pricing and 2% cost pass-through. Businesses in electronics, chemicals, metals, energy and food and beverage end markets were strong.

Backlog was $1.4 billion at the quarter end.

Segmental Revenues

Praxair operates through five business segments. Their top-line results for the quarter are briefed below:

Revenues generated in North America increased 6.7% year over year to $1,505 million. The segment’s revenues represented 53.1% of total revenue.

Revenues in the Europe, representing 13.5% of total revenue, increased 7.9% to $383 million.

In Asia, revenues increased 7.4% to $422 million and represented 14.9% of total revenue.

Surface Technologies revenues were $151 million, slightly above $148 million in the year-ago quarter. The segment’s revenues represented 5.3% of total revenue.

Revenues from South America increased 4.2% to $373 million. It represented 13.2% of total revenue.

Margins

In the quarter, Praxair’s margin profile suffered from higher costs of sales, increasing 8.9% year over year. It represented 56.4% of total revenue compared with 55.1% in the year-ago quarter. Gross margin decreased 130 basis points (bps) to 43.6%. Selling, general and administrative expenses were flat at $308 million. Research and development expenses were $23 million.

Adjusted operating profit in the quarter increased 5.3% year over year to $619 million. However, operating margin slipped 30 bps to 21.8%.

Balance Sheet & Cash Flow

Exiting the second quarter, Praxair had cash and cash equivalents of $535 million, increasing 3.1% from $519 million in the preceding quarter. Long-term debt declined 8.6% sequentially to $8,177 million.

Net cash generated from operating activities slipped 0.7% year over year to $701 million. Capital spent on purchase of property, plant and equipment totaled $325 million, down from $357 million spent in the year-ago quarter.

During the quarter, Praxair paid dividends of $225 million.

Concurrent with the earnings release, Praxair announced that its board of directors has approved payment of a quarterly dividend of 78.75 cents per share to shareholders on record as of Sep 8. The dividend will be paid on Sep 15.

Outlook

For 2017, Praxair anticipates benefitting from a talented workforce, sound product portfolio and new project wins. Also, the company is working on its business combination deal with Linde AG (DE:LING).

Businesses in the U.S. will be unsatisfactory while that in the South America will be weak. Moderate growth is anticipated in Asia while Europe will likely remain stable.

The company raised its earnings guidance to $5.63–$5.75 from the previous projection of $5.55–$5.80. Excluding foreign currency translation impact, earnings are predicted to grow 3–5% year over year. Capital spending is expected to be nearly $1.4 billion.

For the third quarter of 2017, Praxair expects earnings in the range of $1.40–$1.46 per share.

Zacks Rank & Key Picks

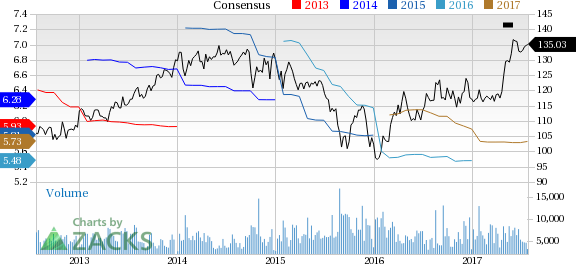

With a market capitalization of $38.3 billion, Praxair currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the industry include Air Liquide (OTC:AIQUY) , Asahi Kasei Corporation (OTC:AHKSY) and Arkema SA (OTC:ARKAY) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Air Liquide’s earnings estimates for 2017 and 2018 improved over the past 60 days. Its earnings are anticipated to grow 8.10% in the next three to five years.

Asahi Kasei’s earnings estimates for fiscal 2017 and fiscal 2018 were revised upward over the last 60 days.

Arkema SA witnessed positive revisions in earnings estimates for 2017 and 2018, over the past 60 days. Its earnings are anticipated to grow 12.40% in the next three to five years.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Praxair, Inc. (PX): Free Stock Analysis Report

Air Liquide (AIQUY): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Asahi Kasei Corp. (AHKSY): Free Stock Analysis Report

Original post

Zacks Investment Research