PPL Corporation (NYSE:PPL) reported second-quarter 2017 adjusted earnings of 52 cents per share, beating the Zacks Consensus Estimate of 50 cents by 4%. Earnings, however, declined 7.1% year over year, primarily due to lower foreign currency exchange rates.

On a GAAP basis, the company reported earnings per share of 43 cents in the quarter compared with 71 cents a year ago. The difference between GAAP and operating earnings in the reported quarter was due to a loss of 9 cents from foreign currency-related economic hedges.

Total Revenues

PPL Corp’s total revenue of $1,725 million in the second quarter, down 2.9% compared with Zacks Consensus Estimate of $1,776 million. Revenues also decreased 3.4% year over year.

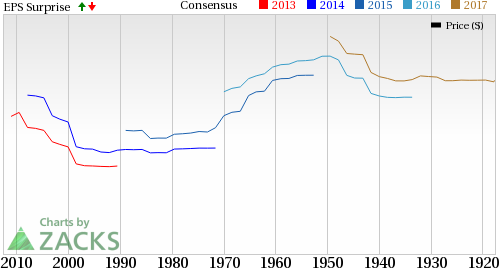

PPL Corporation Price, Consensus and EPS Surprise

Segment Results

UK Regulated: Adjusted earnings decreased 13.4% on a year-over-year to 31 cents per share.

Kentucky Regulated: Adjusted earnings increased 9.1% on a year-over-year to 12 cents per share. This was primarily because of lower sales volumes due to unfavorable weather.

Pennsylvania Regulated: Adjusted earnings in the reported quarter were 11 cents in-line with the year ago quarter.

Corporate and Other: It includes unallocated corporate-level financing and other costs. The segment reported a loss of 2 cents for the quarter compared with the loss of 2 cents for the quarter ended Jun 2016.

Operational Highlights

PPL Corp.’s total operating expenses decreased 3.5% year over year to $ 1,023 million in the reported quarter.

The company reported an operating income of $702 million, down 3.2% from $725 million a year ago.

Interest expenses slid 0.9% to $222 million from $224 million a year ago.

Financial Position

As of Jun 30, 2017, PPL Corp. had cash and cash equivalents of $467 million compared with $341 million as of Dec 31, 2016.

Long-term debt (excluding debts due within one year) was $18,387 million as of Jun 30, 2017, compared with $17,808 million at the end of 2016.

In the first half of 2017, net cash flow from operating activities was $790 million compared with $1,170 million in the prior-year period.

Guidance

PPL Corp. reaffirmed its 2017 adjusted earnings guidance in the range of $2.05–$2.25 per share, with the midpoint at $2.15.

The midpoints of the 2017 adjusted earnings guidance for UK Regulated, Kentucky Regulated and Pennsylvania Regulated are $1.20, 56 cents and 50 cents, respectively. For the Corporate & Other segment, the midpoint of the full-year projection is at a loss of 11 cents per share.

The company expects 5–6% compound annual earnings growth per share from 2017 through 2020, measured against the 2017 earnings midpoint of $2.15 per share.

Zacks Rank

PPL Corp. holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 adjusted earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.7%.

Eversource Energy (NYSE:ES) reported second-quarter 2017 operating earnings of 72 cents per share, beating the Zacks Consensus Estimate of 68 cents by 5.8%.

FirstEnergy Corp. (NYSE:FE) reported second-quarter 2017 operating earnings of 61 cents per share, in line with the Zacks Consensus Estimate.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

PPL Corporation (PPL): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Original post

Zacks Investment Research