PPG Industries Inc (NYSE:PPG) went though a rough period from July through to today. A strong drop lower followed by a bounce and then another pullback to a higher low. Since then it moved straight up before a pullback on Thursday following its earnings report. Friday saw buyers come in, making this an interesting stock.

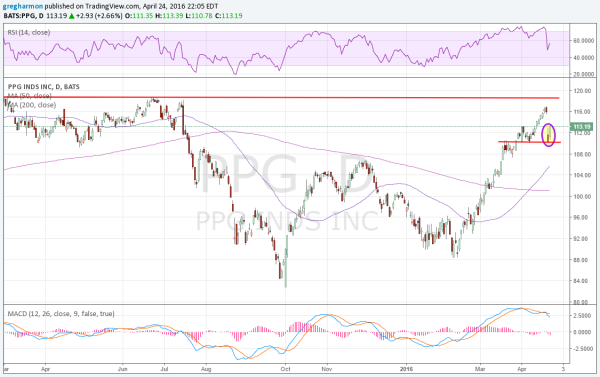

The chart below shows this price action. The 50 day SMA ha pushed above the 200 day SMA, a golden cross, and the price has now retested the last breakout area and held. The move higher Friday confirms the reversal off the minor pullback and looks for at least a gap fill to 115.55.

The rest of the chart shows that this is a great reset to a strong chart. The RSI is moving back higher in the bullish zone while the MACD is crossed down. A reversal higher would be welcome. There is resistance higher at 118.50 and then the prior uptrend continues. With 110 as a stop loss, the bounce level, this is good reward to risk if it does not break resistance, and incredible if it does.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.