PPG Industries, Inc. (NYSE:PPG) announced that its Aerocron electrocoat (e-coat) has qualified at Dassault Aviation for application to structural aircraft parts for corrosion resistance. This qualification enables the Dassault subcontractors to produce parts for the aircraft manufacturer utilizing the chrome-free PPG e-coat primer.

Dassault has been an industry leader in Aviation and qualifying Aerocron primer demonstrates its persistent commitment to technological advancements as well as the environment. Aerocron primer is chrome-free and water-based, and it lowers emissions along with waste-treatment requirements.

Metal parts are immersed into the electrically-charged Aerocron primer bath in the e-coat process. PPG’s e-coat process provides better protection from corrosion, more uniform application, less coating weight for cost savings and improved aircraft fuel economy compared with the conventional spray primer application. Using the product with Aerocron primer leads to lesser spray and eases worker exposure while resulting in almost zero waste.

The primer achieves a uniform thickness even on hidden and recessed areas of a part, which is a remarkable advantage important within the aerospace industry. The complex-shaped parts can have savings in weight by about 30% for flat parts and up to 75% on complex-shaped parts.

The e-coat line can be fully automated, and parts can be coated and cured in just two hours, compared with days to achieve full cure for traditional primers. The users will also decrease product waste and other operational costs with about 95% transfer ratio. Aerocron primer is also qualified to SAE International’s Aerospace Material Specification 3144 for anodic electrode position primer for aircraft applications.

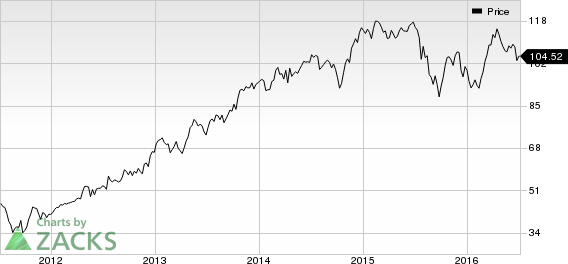

Shares of PPG Industries rose around 1.9% to close at $100.56 last Tuesday.

PPG Industries’ adjusted earnings per share for first-quarter 2016 rose 11% year over year, marking the thirteenth consecutive quarter of double-digit growth in earnings. The bottom line also beat the Zacks Consensus Estimate by a penny. Results were aided by higher sales volume, cost management and acquisition-related gains. However, sales of $3.7 billion lagged the Zacks Consensus Estimate.

The company is working on developing as well as commercializing new consumer-driven technology. It is also improvising branding strategies. Management is focused on reducing costs and completing the previously announced restructuring program. PPG Industries has also reaffirmed its plans to deploy $2–$2.5 billion cash in the 2015–2016 period toward acquisitions and share repurchases.

PPG Industries currently holds a Zacks Rank #2 (Buy).

Some other favorably ranked stocks in the chemical space include Albemarle Corporation (NYSE:ALB) , Asahi Kasei Corporation (OTC:AHKSY) and Axiall Corporation (NYSE:AXLL) , all sporting a Zacks Rank #1 (Strong Buy).

PPG INDS INC (PPG): Free Stock Analysis Report

ALBEMARLE CORP (ALB): Free Stock Analysis Report

ASAHI KASEI CP (AHKSY): Free Stock Analysis Report

AXIALL CORP (AXLL): Free Stock Analysis Report

Original post