PPG Industries (NYSE:PPG) has wrapped up its acquisition of Lima, OH-based industrial coatings services provider, MetoKote Corporation and its affiliates from Platinum Equity.

MetoKote generated sales worth roughly $200 million in 2015. The financial terms of the deal, which was announced in Jun 2016, were not divulged.

MetoKote is a leading player in the protective coating applications space. It was acquired by Platinum Equity in Oct 2013. Since then the mergers, acquisitions and operating firm has boosted MetoKote’s business, diversifying its customer base, strengthening its key customer relationships and positioning it for long-term growth.

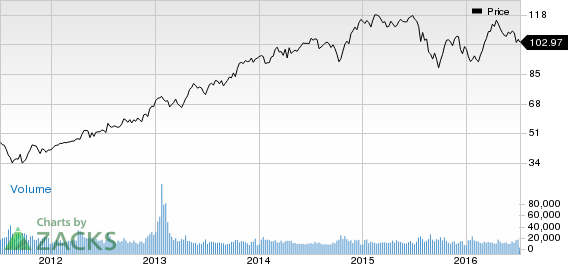

PPG Industries’ shares ticked up around 0.3% to close at $102.97 yesterday.

MetoKote will provide PPG Industries with a platform to meet different customers’ critical coatings requirements. MetoKote, employing over 1,500 workers, provides on-site coatings services to numerous manufacturing facilities as well as regional service centers in the U.S., Canada, Mexico, the U.K., Germany, Hungary and the Czech Republic.

MetoKote’s size, capabilities and geographic reach when combined with PPG Industries’ technology, will provide customers with efficient and innovative coatings operations.

PPG Industries looks to acknowledge and provide a solution for customers' need to streamline the purchasing, delivery and application of coatings with this acquisition.

PPG Industries is taking steps to grow its business inorganically by making a number of acquisitions. The company plans to deploy $2–$2.5 billion cash in the 2015–2016 period toward acquisitions and share repurchases.

PPG Industries currently holds a Zacks Rank #2 (Buy).

Some other favorably ranked companies in the chemical space include Albemarle Corporation (NYSE:ALB) , Asahi Kasei Corporation (OTC:AHKSY) and Axiall Corporation (NYSE:AXLL) , all sporting a Zacks Rank #1 (Strong Buy).

PPG INDS INC (PPG): Free Stock Analysis Report

ALBEMARLE CORP (ALB): Free Stock Analysis Report

ASAHI KASEI CP (AHKSY): Free Stock Analysis Report

AXIALL CORP (AXLL): Free Stock Analysis Report

Original post

Zacks Investment Research