PPG Industries (NYSE:PPG) will exhibit its Teslin label stock during Labelexpo Europe 2017 at the Brussels Expo Center from Sep 25-28 for packaging specialists and label converters.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research

Teslin label stock is durable, secure and easy to print. It enables printed data to remain on labels through demanding use and extreme environmental exposure.

The label stock is used extensively in security, medical, food and beverage applications owing to its reliability. Also, it is used in the chemicals industry for labels that are compliant with the Globally Harmonized System (GHS) of Classification and Labeling of Chemicals and British Standard 5609.

The label stock is available in both standard label configurations and custom-designed options. It offers bubble-free application and is widely compatible with print technologies, such as inkjet, laser, thermal transfer, flexographic and offset. Along with this, it reduces the potential for static discharge when label liners are peeled from label stock — a process known to ignite chemical vapors in some manufacturing environments. The static-dissipative nature of Teslin label stock also helps minimize static buildup during digital printing, thereby improving throughput and print quality.

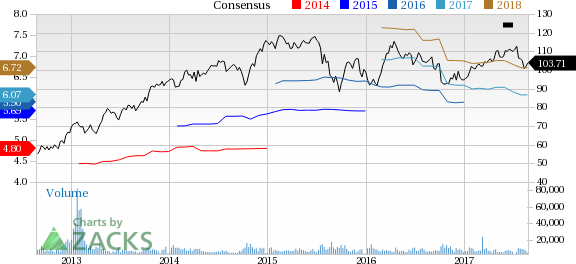

PPG Industries has underperformed the industry for over the last six months. The company’s shares have moved up around 1.2% over this period, compared with roughly 4.8% gain recorded by the industry.

PPG Industries reported adjusted earnings of $1.83 per share for the second quarter of 2017, up 5.8% from the year-ago earnings of $1.73. The figure beat the Zacks Consensus Estimate of $1.81. Net sales in the quarter edged up 1% year over year to $3,806 million. Sales missed the Zacks Consensus Estimate of $3,898.6 million.

PPG Industries expects modest overall global economic growth. Also, the company anticipates a higher level of earnings-accretive cash deployment in the second half of 2017 including acquisitions and share repurchases. The company announced that it will resume share repurchases from the third quarter.

PPG Industries is taking steps for growing organically as well as cutting costs. The company also remains committed to deploy cash on acquisitions and share repurchases. It plans to deploy $2.5 billion to $3.5 billion of cash on acquisitions and share repurchases in 2017 and 2018 combined and is now targeting the top end of that range at a minimum.

However, PPG Industries faces currency headwinds and macroeconomic challenges. Some of its end-markets including marine still remain sluggish. It is also exposed to volatility in raw materials and energy costs.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research