PPG Industries (NYSE:PPG) inaugurated a 300 square meter training center for automotive refinish professionals in Pillar, Argentina. The latest facility is an addition to the automotive refinish training center it currently operates in Sumaré, Brazil, thus expanding PPG Industries’ training resources in southern Latin America.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post

At the new state-of-the-art facility, PPG Industries’ experts will train technicians from Argentina, Chile and Uruguay on all automotive refinish product lines and color modules, as well as application techniques of the company. Also, the center will ensure adherence to the company’s stringent quality standards in Latin America and enable the installation of the three pillars that guide the company’s automotive refinish business globally – innovative technology pipeline, increased technical know-how and excellent brand experience.

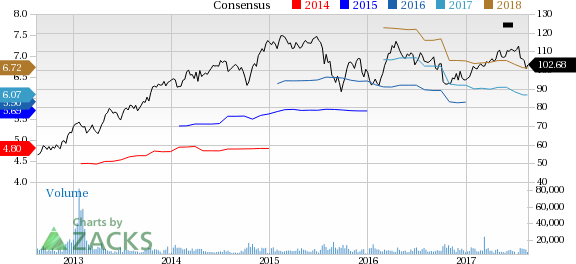

PPG Industries has underperformed the industry over the last six months. The company’s shares have moved up around 0.3% over this period, compared with roughly 5.2% gain recorded by the industry.

PPG Industries reported adjusted earnings of $1.83 per share for the second quarter of 2017, up 5.8% from the year-ago earnings of $1.73. The result beat the Zacks Consensus Estimate of $1.81. Net sales in the quarter edged up 1% year over year to $3,806 million. Sales missed the Zacks Consensus Estimate of $3,898.6 million.

PPG Industries expects modest overall global economic growth. PPG Industries is taking steps for growing organically and also remains committed to deploy cash on acquisitions. The company also announced plans to resume share repurchases from the third quarter. It plans to deploy $2.5 billion to $3.5 billion of cash on acquisitions and share repurchases in 2017 and 2018 combined and is now targeting the top end of that range at a minimum.

PPG Industries is reeling under currency headwinds and macroeconomic challenges. Some of its end-markets including marine still remain sluggish. It is also exposed to volatility in raw materials and energy costs.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Original post