PPG Industries’ (NYSE:PPG) Teslin label stock received British Maritime Standard 5609 (BS 5609) Section 3 certification for use along with the Konica Minolta bizhub Press C1070 printing system. This enables Teslin-based labels, printed with this system, to remain intact and legible when used on chemical drums and other packaging for hazardous materials shipped by sea.

Teslin-based label products were previously granted BS 5609 Section 2 certification in which a base label is tested for adhesive performance and dimensional stability after being immersed for three months in salt water. Section 3 testing examines print permanence of a base label and legibility printed with a specific print system. The tests assess a finished label’s durability post weathering, ultraviolet radiation exposure, temperature cycling and abrasion.

Teslin BS 5609-certified label stock is resistant to water, chemicals and abrasion and offers bubble-free application. It is known for providing on-demand printing thus ensuring printed data is secure from wearing caused by handling and extreme environmental conditions. Also, it is compatible with print technologies such as inkjet, laser, thermal transfer, flexographic and offset.

Additionally, it reduces the potential for static discharge when liners are peeled from label stock. The static-dissipative nature of Teslin label stock helps in improving print quality and throughput by minimizing static buildup during digital printing.

Further, the company plans to pursue certification of the label stock in combination with more printing systems based on customer and market needs.

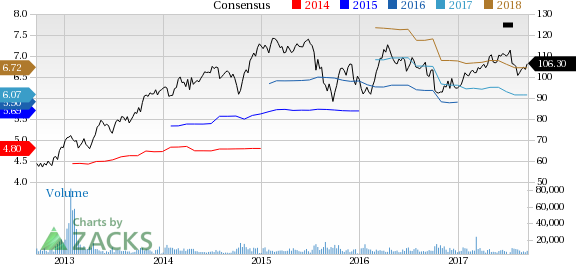

PPG Industries has underperformed the industry over a year. The company’s shares have moved up around 5.2% over this period, compared with roughly 27% gain recorded by the industry.

PPG Industries expects modest global economic growth. Also, the company anticipates a higher level of earnings-accretive cash deployment in the second half of 2017 including acquisitions and share repurchases. The company announced that it will resume share repurchases from the third quarter.

PPG Industries is taking steps for growing organically. The company is also taking measures to lower costs. The company also remains committed to deploy cash on acquisitions and share repurchases. It plans to deploy $2.5-$3.5 billion cash for acquisitions and share repurchases in 2017 and 2018 combined and is now targeting the top end of that range at a minimum.

However, PPG Industries faces currency headwinds and macroeconomic challenges. Some of its end markets including marine still remain sluggish. It is also exposed to volatility in raw materials and energy costs.

PPG Industries, Inc. Price and Consensus

PPG Industries currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the chemical space are Arkema S.A. (OTC:ARKAY) , Kronos Worldwide (NYSE:KRO) and Akzo Nobel N.V. (OTC:AKZOY) .

Arkema has an expected long-term earnings growth of 12.8% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has an expected long-term earnings growth of 5% and flaunts a Zacks Rank #1.

Akzo Nobel has an expected long-term earnings growth of 11.1% and carries a Zacks Rank #2 (Buy).

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now>>

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Akzo Nobel NV (AKZOY): Free Stock Analysis Report

Original post