PPG Industries, Inc. (NYSE:PPG) , based in Pennsylvania, has a diversified business and a leading position in several paints and coatings end markets.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Original post

Zacks Investment Research

Earnings

PPG Industries’ adjusted earnings were $1.19 per share for the fourth quarter. It beat the Zacks Consensus Estimate of $1.18.

Revenues

PPG Industries posted fourth-quarter revenues of $3,682 million, up 7.8% year over year. It surpassed the Zacks Consensus Estimate of $3,605 million. Favorable currency swings improved net sales by more than 3%.

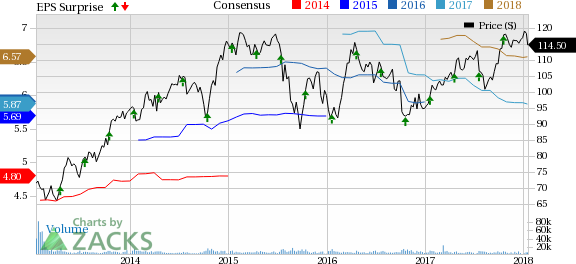

Estimate Trend & Surprise History

Investors should note that the earnings estimate for PPG Industries for the fourth quarter has been going down over the last month. PPG Industries has beaten the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of 1.3%.

Key Stats/Developments to Note

PPG Industries anticipates additional selling price increases this year. The company is committed to deploy at least $2.4 billion of cash in 2018 on acquisitions and share repurchases as part of its earlier communicated goal to deploy $3.5 billion in 2017 and 2018 combined. The company expects its effective tax rate to be in the range of 23-24% for 2018.

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. Price, Consensus and EPS Surprise

Zacks Rank

PPG Industries currently has a Zacks Rank #3 (Hold), but that could change following its earnings report which has just released. Meanwhile, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Market Reaction

PPG Industries’ shares were inactive following the release. It would be interesting to see how the market reacts to the results during the trading session today.

Check back later for our full write up on PPG Industries’ earnings report!

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Original post

Zacks Investment Research