PPG Industries Inc. (NYSE:PPG) reported net earnings from continuing operations of $184 million or 72 cents per share for fourth-quarter 2017, a roughly two-fold increase from the year ago figure of $91 million or 34 cents. However, adjusted earnings were $1.19 per share that surpassed the Zacks Consensus Estimate of $1.18.

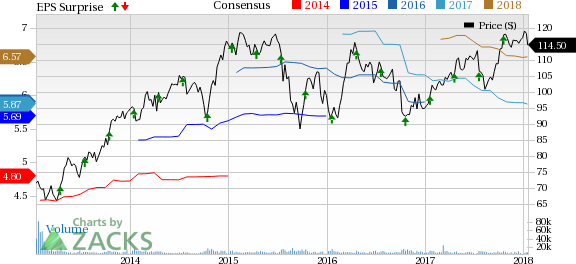

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post

Net sales increased 7.8% year over year to $3,682 million, beating the Zacks Consensus Estimate of $3,605 million. Favorable currency swings positively impacted net sales by more than 3%.

FY17 Results

For full-year 2017, the company posted profits from continuing operations of $1.4 billion, or $5.46 per share, up from $547 million, or $2.05 per share, reported in 2016. Adjusted earnings for the year came in at $5.87 per share, up 3.5% from $5.67 reported a year ago.

PPG Industries reported revenues of $14.8 billion in 2017, up around 3.4% from $14.3 billion reported in 2016. While favorable foreign currency translation positively impacted sales by less than 1% and acquisitions related sales improved more than 1%.

PPG Industries, Inc. Price, Consensus and EPS Surprise

Zacks Rank & Stocks to Consider

PPG Industries carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:KRO) , Methanex Corporation (NASDAQ:MEOH) and Huntsman Corporation (NYSE:HUN) all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has an expected long-term earnings growth of 5%. Its shares skyrocketed 123.8% over a year.

Methanex has an expected long-term earnings growth of 15%. Shares of the company rallied 32% in a year.

Huntsman has an expected long-term earnings growth of 8%. Its shares soared 73.8% over a year.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post