The stock market has had a very strong run higher since the Christmas Eve low. But one sector that has done well is of particular interest. It is the Utilities Sector. Utilities are supposed to be defensive stocks, a place to hide when markets are in turmoil. That is because their regulated rates give them a buffer against economic downturns.

If you look at the Utilities sector last fall, it was lagging the broad market by about 6 weeks, peaking in mid-December as investors had been selling other stocks for some time already. But there has been no lag on the latest move higher.

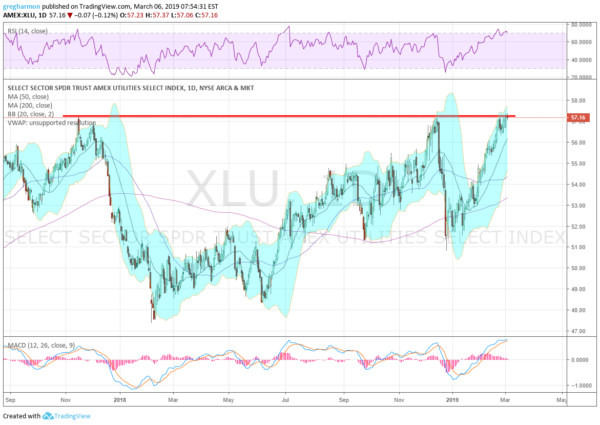

This is a signal that the entire market was being bought, not just select sectors. Almost like the collective of investors realized everything was too low at the same time. Now with the Utilities sector is back at all-time highs, the first sector to get there, can it lead the broader markets higher? History would suggest that it needs to rest and let other sectors take the lead. And with the RSI entering the overbought territory and the MACD leveling at prior highs, that may be happening now.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.