Powell sees a stronger US economy

- In his debut testimony before Congress yesterday, Fed’s new governor Jerome Powell, supported the argument for a stronger economy. Specifically, he cited possible increased budget spending and increased wages from a possible increase of productivity as main factors for a stronger economy. There were also hints for an increased number of rate hikes as well as an unwinding of the Feds balance sheet. Having said that, we would like to add that the new governor made a good impression in his debut appearance, as some analysts noted. The USD reacted positively to the testimony and we see the case for the positive effect to continue in the next few days. Please be advised that there will be another hearing of Powell tomorrow.

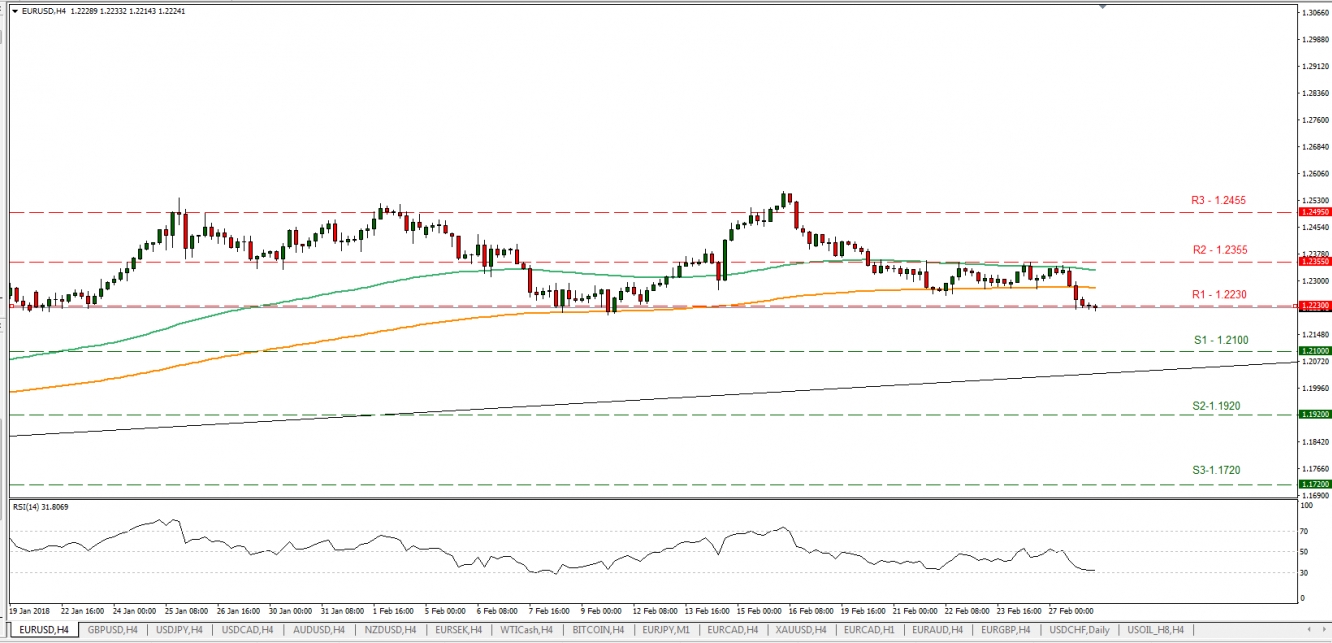

- EUR/USD dropped yesterday, breaking the 1.2230 (R1) support level (now turned to resistance). We see the case for the pair to trade in a sideways manner with some bearish tones based on the before mentioned fundamental news and financial data which are to be released during the day. Should the bears take the driver’s seat, we could see the pair aiming and even breaching the 1.2100(S1) support line. Should the bulls take the reins, we could see the pair breaking the 1.2230(R1) resistance level and aim for the 1.2355 (R2) resistance zone.

EU: Brexit time running out

- Media reports suggested that EU chief Brexit negotiator stated that Britain is running out of time if it wants to avoid a hard Brexit. The EU seems to aim the end of October as a deadline for an agreement with the UK for their post-Brexit relationships. On other news, Theresa May seems to deliver a preemptive strike to the EU draft deal which is set to be published on Wednesday. Also, pressure seems to be piling for May, as 8 Tory parliament members rebel as they prefer to remain in the customs union. Negative headlines are expected to continue to appear and could weaken the pound.

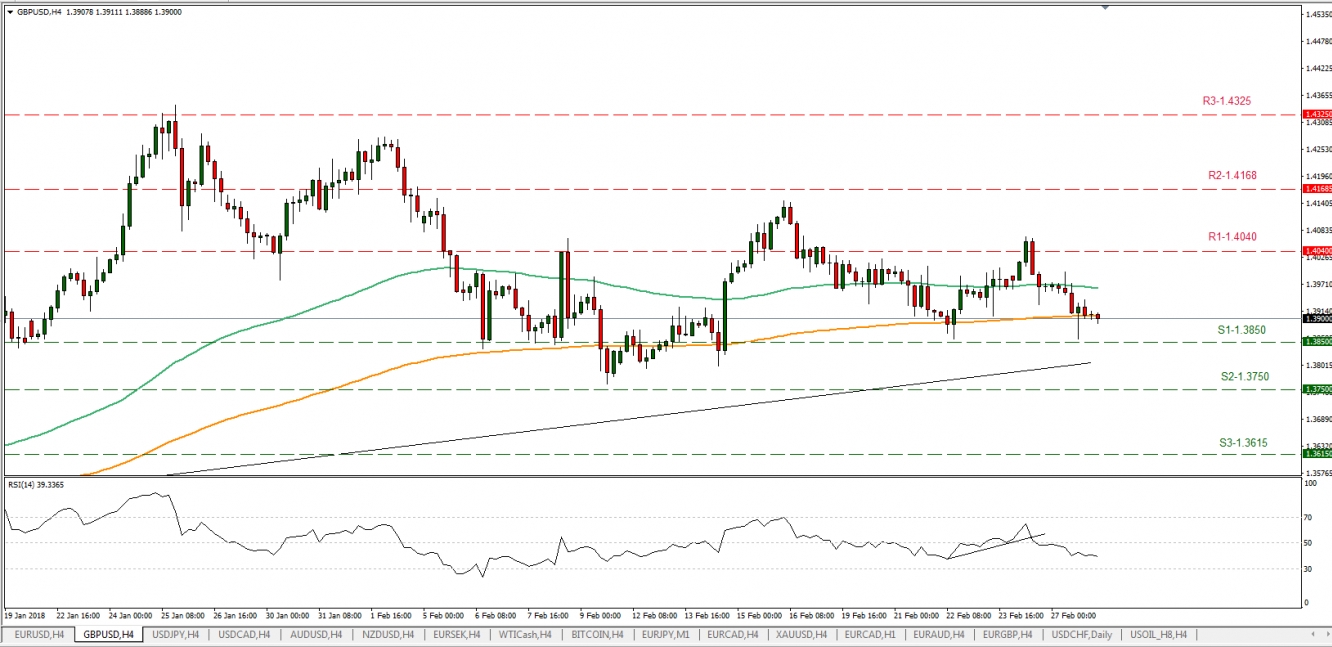

- Cable traded in a sideways manner yesterday, testing the 1.3850 (S1) support line, during Powell’s testimony. We see the case for the pair to continue to trade in a sideways manner for the next couple of days, with some bearish mood as positive USD sentiment may continue. However, it should be noted that the pair is approaching the upward trend line incepted since the 13th of January. Should the pair find fresh buying orders, it could break the 1.4040 (R1) resistance level. Should it come under selling interest, we could see the pair breaking the 1.3850(S1) support level and aim for the 1.3750(S2) support barrier.

Today’s other economic highlights:

- From France, we get the preliminary CPI (EU Norm.) rate for February as well as the final GDP growth rate for Q4. From Sweden, we get the GDP growth rate for Q4, which could support the SEK. Also, Germany’s Unemployment data are due out for February, while in the eurozone we get the inflation rate for February which could weaken the EUR. In the North American session, we get the 2nd release of the US GDP Growth rate for Q4, the US Preliminary Core PCE prices rate for Q4, the US pending home sales for January and last but not least we get the US Crude Oil inventories which are expected to influence oil prices.

·Support: 1.3850(S1), 1.3750(S2), 1.3615(S3)

·Resistance: 1.4040(R1), 1.4168(R2), 1.4325(R3)

EUR/USD

·Support: 1.2230(S1), 1.2355(S2), 1.2455(S3)

·Resistance: 1.2100(R1), 1.1920(R2), 1.1720(R3)