Are Any Negotiations Actually Going Well?

European markets are paring losses on Wednesday, as comments from Jerome Powell offer hope that the central bank will do more to fend off recessionary pressures.

In his appearance on Tuesday, his second of three this week ahead of the release of the minutes later today, Powell discussed the likelihood of increasing the Fed’s balance sheet as a means of adding to reserves in the financial system, following the hiccup in the repo market a few weeks ago.

The Fed Chair was keen to stress that this is not QE, although that didn’t stop investors getting excited at the prospect of a reversal in the direction of the central bank’s balance sheet. He did also leave the door open to further rate cuts in order to maintain the expansion, although this is the same language we’ve heard over and over again.

While investors are demanding more easing from the Fed in order to fend off the risk of recession, the central bank will be pleased with the progress made and continues to stress further calls will be made meeting by meeting, with monetary policy not on a set path. In other words, it is still reluctant to accept that this is an easing cycle, rather than a mid-cycle adjustment.

Team Boris steps up PR offensive

The Brexit show is as erratic and confusing as ever, with leaks on Tuesday giving the impression that any hope of a deal is doomed due to the inflexibility of the EU side. Naturally, any leak of this nature is going to be largely posturing with a sprinkle of truth, with the rest of us left to decipher which is which.

Traders were initially reluctant to be drawn in but eventually conceded, with the pound reluctantly heading south before finding support around 1.22. The fact is we’ve seen negotiations like this repeatedly and while everyone is taking no-deal much more seriously than in the past, there still seems to be a belief that it will be avoided, either via an eleventh hour deal or an extension. That won’t stop the next few weeks being a wild ride though.

GBP/USD Daily Chart

Gold briefly buoyed by Fed easing hopes

Gold was buoyed on Tuesday by the prospect of more stimulus but this has quickly run its course, with the yellow metal once again running into resistance before trading lower today. Despite last week’s surge, gold continues to look vulnerable although the bulls are putting up quite a fight.

Gold Daily Chart

Oil languishes near summer lows

Oil prices remain sensitive to market sentiment and trade talks later this week. Brent continues to trade around its summer lows despite the rebound late last week as hopes ahead of the negotiations in Washington fade before they even begin. Trump’s decision to add 28 Chinese companies to its entity list ahead of the talks doesn’t exactly fill anyone with optimism, which means a prolonged trade war, lower growth and greater risks of recession. Not ideal at a time when demand growth fears are dragging oil prices lower.

Brent Daily Chart

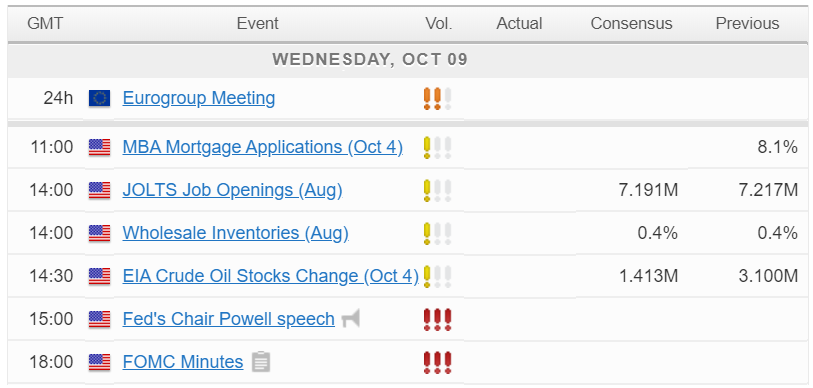

Economic Calendar