Yesterday’s best performer was undisputed the British pound which was headed towards 1.33 on the back of stronger U.K. inflation. The U.K. CPI accelerated more than forecast and sterling bulls took the opportunity to push the currency up to fresh highs. Whether the pound can hold onto its gains will depend on tomorrow’s Bank of England meeting. There is speculation that the BoE has no choice but to take a more hawkish stance in response to the rising inflation which is well beyond the central bank’s 2 percent target.

Yesterday’s strong CPI print pushed higher market expectations that the BoE will have to raise interest rates before year-end. In other words, BoE Governor Mark Carney will have to deal with higher inflation at tomorrow’s meeting and should the central bank retain their dovish stance and thus disappoint the market‘s expectations, the pound could quickly fall back towards 1.31. Tomorrow we will know more and until then we may see continued sterling strength going into the BoE decision.

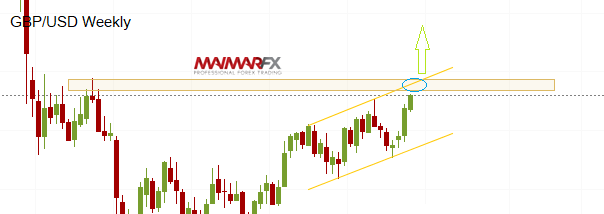

GBP/USD

The pound broke above 1.3225 and took out the August high near 1.3270. The next bullish target is the resistance area around 1.34. But traders should be careful: If the BoE disappoints in terms of future rate hike expectations, the pound could experience a sharp drop from its highs. The U.K. Jobs report is scheduled for release today at 8:30 UTC and a strong report should support the pound’s bullish bias.

EUR/USD: The euro tested the rising support line near 1.1925 before it recovered its losses towards 1.20. The uptrend in the EUR/USD is still active and if the pair breaks significantly above 1.20, we focus on higher targets at 1.2050, 1.21 and 1.2160. A break below 1.1925, however, could increase bearish momentum towards 1.1850.

From the U.S., we have the Producer Price Index scheduled for release at 12:30 UTC today which could have an impact on the greenback before U.S. inflation data is due tomorrow.

Here are our daily signal alerts:

EUR/USD

Long at 1.2015 SL 25 TP 20, 40

Short at 1.1925 SL 25 TP 20, 40

GBP/USD

Long at 1.3320 SL 25 TP 20, 55

Short at 1.3275 SL 25 TP 20, 40

We wish you good trades and many pips.

Disclaimer: Any and all liability of the author is excluded.